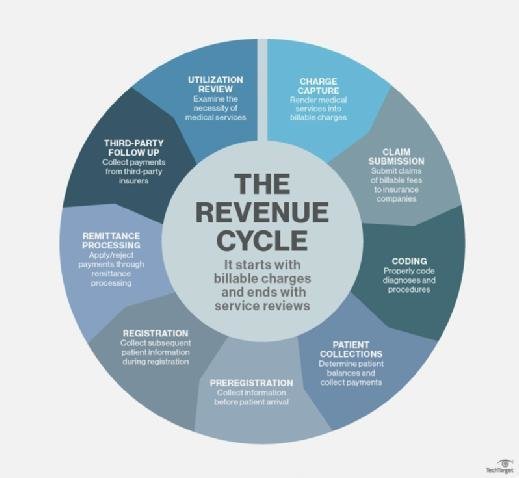

The revenue cycle in medical billing refers to the entire process of financial management in healthcare organizations, from the initial patient registration to the final payment collection. It encompasses various steps such as insurance verification, claims submission, coding, and reimbursement. Ensuring an effective revenue cycle is crucial for healthcare providers to optimize revenue, reduce claim denials, and maintain financial stability. This article provides a comprehensive overview of the revenue cycle in medical billing, its significance, and key components involved in the process.

Overview of Revenue Cycle in Medical Billing

Definition of Revenue Cycle in Medical Billing

The revenue cycle in medical billing refers to the process of managing and optimizing the financial aspects of healthcare services provided to patients. It encompasses all the activities from the initial patient registration and scheduling to the final payment collection for services rendered. The ultimate goal of the revenue cycle is to ensure that healthcare organizations receive timely and accurate payments for the services they provide.

Importance of Revenue Cycle in Medical Billing

The revenue cycle plays a vital role in the financial stability and success of healthcare organizations. By efficiently managing the revenue cycle, healthcare organizations can optimize their financial performance, improve cash flow, reduce costs, and enhance overall operational efficiency. Effective revenue cycle management also ensures compliance with regulations and helps healthcare organizations make informed decisions about resource allocation and strategic planning.

Key Components of Revenue Cycle

The revenue cycle in healthcare involves a series of critical components that are essential for the financial sustainability of healthcare organizations. Each component plays a specific role in the process of capturing revenue for services provided to patients.

Patient Registration and Scheduling

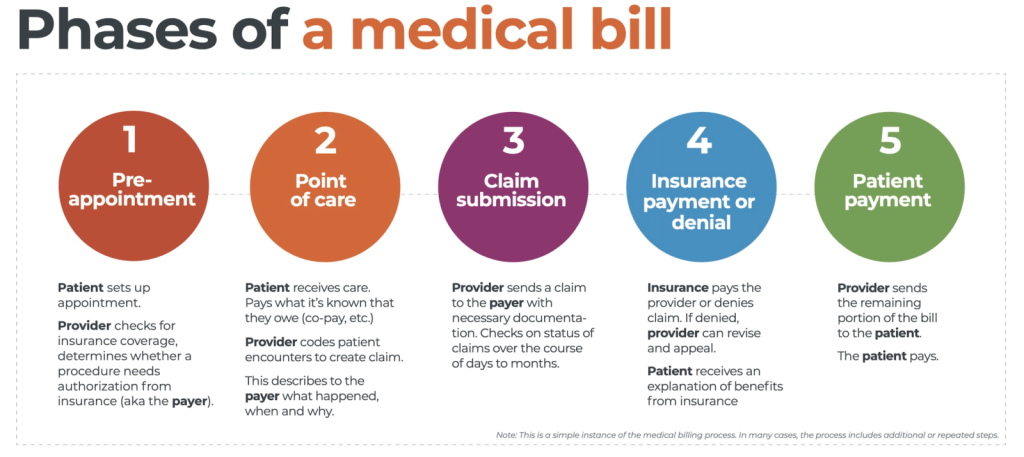

The first step in the revenue cycle is the patient registration and scheduling process. This involves capturing and verifying patient demographics, insurance information, and medical history. Accurate and complete patient registration ensures that the necessary information is available for claims submission and billing.

Eligibility Verification and Insurance Authorization

Once the patient is registered, the next important component of the revenue cycle is verifying their insurance eligibility and obtaining authorization for the anticipated services. This helps prevent claim denials and rejections due to insufficient coverage or lack of pre-authorization.

Charge Capture

Charge capture involves accurately capturing and documenting the services provided to patients during their visit. This includes capturing the CPT codes, diagnosis codes, and any additional charges for procedures, tests, or medications. Accurate charge capture is essential for correct coding and billing, which directly impacts reimbursement.

Claims Submission

After charge capture, the claims submission process begins. This involves preparing and submitting claims to insurance payers for reimbursement. Claims must adhere to specific coding and billing guidelines and be submitted within the designated time frame. Timely and accurate claims submission is crucial for receiving prompt payment and reducing the risk of claim denials.

Claims Adjudication

Once the insurance payer receives the claims, they undergo a process called claims adjudication. During this process, the payer reviews the claims for accuracy, completeness, and compliance with their policies. The payer determines the amount of reimbursement based on the contracted rates and any applicable patient deductibles or co-pays.

Payment Posting

Once the claims are adjudicated and payments are received, they need to be posted accurately to the patient’s account. This involves recording the payment details, including the amount paid by the payer and any patient responsibility. Payment posting ensures the receivables are properly accounted for and reconciled with the submitted claims.

Denial Management

Sometimes, claims may be denied or rejected by insurance payers due to various reasons such as incorrect coding, missing documentation, or lack of medical necessity. denial management involves identifying and resolving these denials by appealing or resubmitting the claims with the necessary corrections. Effective denial management is crucial to minimize revenue loss and maximize reimbursement.

Accounts Receivable Follow-up

following up on outstanding accounts receivable is an essential component of revenue cycle management. Healthcare organizations need to proactively communicate with payers and patients to ensure timely payment collection. This includes sending regular statements, making phone calls, and negotiating payment plans if necessary.

Patient Collections

In cases where the patient is responsible for a portion of the payment, effective patient collections are crucial. This involves educating and assisting patients with understanding their financial responsibility, setting up payment arrangements, and collecting outstanding balances. Proper patient collections not only contribute to revenue but also enhance patient satisfaction.

Reporting and Analytics

To monitor and measure the efficiency and effectiveness of the revenue cycle, reporting and analytics play a significant role. By analyzing key performance indicators, such as days in accounts receivable, denial rates, and collection rates, healthcare organizations can identify areas for improvement and make informed decisions to optimize revenue cycle management.

Revenue Cycle Process Flow

This image is property of www.waystar.com.

Patient Registration and Scheduling

The revenue cycle begins with the patient registration and scheduling process. During this stage, accurate and complete patient information is collected, including demographics, insurance details, and medical history. This information lays the foundation for the rest of the revenue cycle and ensures a seamless workflow.

Eligibility Verification and Insurance Authorization

Once the patient is registered, the next step is to verify their insurance eligibility and obtain authorization for the anticipated services. This involves checking the patient’s insurance coverage, confirming the benefits and limitations, and ensuring that the services are medically necessary and covered by the insurance plan.

Charge Capture

After eligibility verification and insurance authorization, the charge capture process takes place. This involves documenting the services provided to the patient, including any tests, procedures, or medications administered. Accurate charge capture is essential for proper coding and billing, which significantly impacts reimbursement.

Claims Submission

Once the charges are captured, the claims submission process begins. Claims are prepared and electronically submitted to the appropriate insurance payer, following the specific coding and billing guidelines. Claims should be submitted within the designated time frame to ensure timely payment and reduce the risk of denials.

Claims Adjudication

After the claims are submitted, they undergo a process called claims adjudication by the insurance payer. This involves reviewing the claims for accuracy, completeness, and compliance with the payer’s policies. The payer determines the reimbursement amount based on the contracted rates and any patient responsibilities, such as deductibles or co-pays.

Payment Posting

Once the claims are adjudicated, the payments received from the insurance payer need to be accurately posted to the patient’s account. This involves recording the payment details, including the amount paid by the payer and any patient responsibility. Payment posting ensures that the payment is properly allocated and reconciled with the submitted claims.

Denial Management

In cases where claims are denied or rejected, denial management comes into play. This involves identifying the reasons for denials, appealing or resubmitting the claims with the necessary corrections, and following up with the insurance payer to ensure prompt resolution. Effective denial management is crucial for minimizing revenue loss and maximizing reimbursement.

Accounts Receivable Follow-up

Following up on outstanding accounts receivable is an ongoing process in the revenue cycle. This includes regularly communicating with insurance payers and patients to ensure timely payment collection. Healthcare organizations engage in various activities such as sending statements, making phone calls, and negotiating payment plans to ensure prompt payment.

Patient Collections

Patient collections are an integral part of the revenue cycle. In cases where patients are responsible for a portion of the payment, healthcare organizations need to effectively communicate with patients and collect outstanding balances. This involves educating patients about their financial responsibility, setting up payment arrangements, and offering different payment options.

Reporting and Analytics

To evaluate the performance of the revenue cycle and identify areas for improvement, reporting and analytics play a vital role. Healthcare organizations analyze key performance indicators such as denial rates, collection rates, and days in accounts receivable. This data helps in monitoring the revenue cycle’s efficiency and making informed decisions to optimize revenue management.

Challenges in Revenue Cycle Management

Coding and Documentation Errors

One of the significant challenges in revenue cycle management is coding and documentation errors. Inaccurate or incomplete documentation can lead to incorrect coding and billing, resulting in claim denials or underpayment. Adequate training and oversight are essential to ensure accurate and compliant coding and documentation practices.

Claim Denials and Rejections

Claim denials and rejections pose a significant challenge in revenue cycle management. Denials occur when claims are rejected by insurance payers due to various reasons such as coding errors, missing information, or lack of medical necessity. Healthcare organizations need to have robust denial management processes in place to address these denials promptly and minimize revenue loss.

Delayed Payments

Delayed payments from insurance payers can significantly impact the revenue cycle. Healthcare organizations rely on timely payments to maintain their financial stability and meet their operational needs. Delays in payment can disrupt cash flow, increase days in accounts receivable, and lead to financial challenges.

Lack of Automation

The absence of automation in revenue cycle management can hinder efficiency and productivity. Manual processes are time-consuming, prone to errors, and can result in delays in claims processing and payment posting. Implementing technology solutions, such as electronic health records (EHR) and revenue cycle management software, can streamline processes, improve accuracy, and accelerate revenue collection.

Inadequate Training and Staffing

The lack of proper training and staffing can significantly impact revenue cycle management. Inadequately trained staff may not be familiar with coding and billing guidelines, leading to errors and claim denials. Additionally, a shortage of staff can result in delays in claims processing and follow-up, leading to increased days in accounts receivable and potential revenue loss.

Compliance Issues

Compliance with regulations and payer requirements is critical in revenue cycle management. Failure to comply with coding and billing guidelines, privacy rules, and other regulatory requirements can result in penalties, audits, and reputational damage. Healthcare organizations need to establish robust compliance programs and stay updated with changing regulations to mitigate compliance risks.

Unresolved Patient Balances

Outstanding patient balances can pose a significant challenge in revenue cycle management. Patients may have difficulty understanding their financial responsibility, face affordability issues, or simply neglect to pay their bills. Implementing effective patient collection strategies, such as clear communication, convenient payment options, and financial counseling, can help address this challenge.

Inefficient Verification and Eligibility Process

An inefficient verification and eligibility process can lead to delays in claims processing and payment posting. Insurance verification delays and inaccurate eligibility determination can result in claim denials and delays in reimbursement. Streamlining and automating the verification and eligibility process can help minimize these challenges and improve revenue cycle efficiency.

Inaccurate Charge Capture

Accurate charge capture is critical for correct coding, billing, and reimbursement. Failure to capture charges correctly can lead to undercoding or overcoding, resulting in claims denials or overpayment recovery. Effective charge capture processes, such as regular audits, staff training, and technology utilization, are essential to minimize this challenge and optimize revenue cycle management.

Limited Access to Real-time Data

The lack of access to real-time data can hinder decision-making and revenue cycle performance. Healthcare organizations need timely and accurate data to monitor key performance indicators, identify trends, and make informed decisions. Implementing advanced reporting and analytics tools can provide real-time insights and enable proactive revenue cycle management.

Key Strategies for Effective Revenue Cycle Management

Implementing Efficient Processes

To optimize revenue cycle management, healthcare organizations need to implement efficient processes across the revenue cycle. This includes streamlining workflows, eliminating redundant tasks, and ensuring standardized procedures. Efficient processes reduce costs, accelerate revenue collection, and improve overall operational efficiency.

Optimizing Billing and Coding

Proper billing and coding are crucial for accurate claims submission and reimbursement. Healthcare organizations should focus on optimizing billing and coding practices by providing regular training and education to staff, implementing coding guidelines, and conducting regular audits to identify and address coding errors.

Streamlining Claims Submission

Streamlining the claims submission process is essential for timely reimbursement. Healthcare organizations should leverage technology solutions, such as electronic claim submission platforms, to automate and streamline the claims submission process. This reduces manual errors, accelerates claims processing, and facilitates faster payment collection.

Investing in Technology and Automation

Investing in technology and automation can significantly enhance revenue cycle management. Healthcare organizations should adopt electronic health record (EHR) systems, revenue cycle management software, and other advanced tools to automate and streamline various revenue cycle processes. Technology solutions improve accuracy, reduce administrative burden, and expedite revenue collection.

Improving Staff Training and Education

Proper training and education of staff are essential for effective revenue cycle management. Healthcare organizations should provide comprehensive training programs to ensure that staff is well-versed in coding and billing guidelines, regulations, and best practices. Continuous education and skill development help staff stay updated in this dynamic field.

Enhancing Denial Management

Denial management is a critical aspect of revenue cycle management. Healthcare organizations should establish robust denial management processes, including timely denial identification, root cause analysis, appeal preparation, and proactive communication with payers. Well-designed denial management processes minimize revenue loss and improve overall financial performance.

Implementing Effective Collection Practices

Effective patient collection practices are vital for revenue cycle management. Healthcare organizations should implement patient-friendly billing practices, such as clear and concise statements, easy-to-understand explanations of charges, and convenient payment options. Establishing effective collection policies and providing financial counseling can also help patients understand their financial responsibility and facilitate prompt payment.

Strengthening Communication with Payers

Strong communication with insurance payers is crucial for successful revenue cycle management. Healthcare organizations should proactively communicate with payers to clarify policy expectations, understand payer requirements, and resolve any issues or disputes promptly. Building positive relationships with payers improves claims processing and facilitates smoother reimbursement.

Regular Monitoring and Reporting

Regular monitoring and reporting are essential for revenue cycle management. Healthcare organizations should track key performance indicators, such as denial rates, days in accounts receivable, and collection rates, to identify areas for improvement. The data obtained from monitoring and reporting helps in making data-driven decisions and implementing effective revenue cycle strategies.

Building Strong Patient Relationships

Developing strong patient relationships is crucial for revenue cycle management. Healthcare organizations should prioritize patient satisfaction, provide clear and transparent communication about billing, educate patients about their financial responsibility, and offer support for payment options. Strong patient relationships improve collection rates and enhance overall patient experience.

Benefits of Effective Revenue Cycle Management

Increased Cash Flow

Efficient revenue cycle management leads to increased cash flow for healthcare organizations. Timely submission and processing of claims, prompt payment collection, and effective denial management all contribute to improved cash flow, supporting the financial stability and growth of the organization.

Reduced Denials and Rejections

Effective revenue cycle management minimizes claim denials and rejections. By ensuring accurate coding, complete documentation, and thorough eligibility verification, healthcare organizations can reduce the risk of denials and rejections, resulting in faster and higher reimbursement.

Improved Efficiency and Productivity

Efficient revenue cycle management improves overall efficiency and productivity. By streamlining processes, leveraging technology, and implementing best practices, healthcare organizations can reduce administrative burden, eliminate manual errors, and enhance staff productivity.

Enhanced Patient Satisfaction

Effective revenue cycle management positively impacts patient satisfaction. Clear communication about billing and financial responsibility, convenient payment options, and efficient collection practices contribute to a positive patient experience and satisfaction with the healthcare organization.

Accurate Financial Reporting

An effective revenue cycle management ensures accurate financial reporting. By implementing standardized processes, leveraging technology for data capture and analysis, and monitoring key performance indicators, healthcare organizations can generate accurate financial reports for decision-making and compliance purposes.

Compliance with Regulations

Compliance with regulatory requirements is a crucial benefit of effective revenue cycle management. By adhering to coding and billing guidelines, privacy rules, and other regulatory frameworks, healthcare organizations mitigate compliance risks and avoid penalties or reputational damage.

Optimized Revenue and Profitability

Optimizing revenue and profitability is a key outcome of effective revenue cycle management. By maximizing reimbursement, reducing denials, improving cash flow, and minimizing operational costs, healthcare organizations can achieve financial success and sustainability.

Streamlined Operations

Efficient revenue cycle management streamlines operations within the healthcare organization. By eliminating redundancies, automating processes, and implementing best practices, healthcare organizations achieve operational efficiency, reduce costs, and improve overall performance.

Better Decision-Making

Effective revenue cycle management provides healthcare organizations with accurate and timely data for better decision-making. By monitoring key performance indicators, analyzing trends, and conducting regular reporting and analytics, healthcare organizations can make informed decisions to optimize revenue cycle management and drive overall success.

Conclusion

Efficient revenue cycle management in medical billing is essential for the financial stability and success of healthcare organizations. By implementing best practices, leveraging technology, optimizing processes, and prioritizing patient satisfaction, healthcare organizations can achieve improved cash flow, reduced denials, enhanced efficiency, and optimized revenue and profitability. Effective revenue cycle management benefits healthcare organizations by facilitating accurate financial reporting, ensuring compliance with regulations, streamlining operations, and enabling data-driven decision-making. By continuously reviewing and improving revenue cycle management strategies, healthcare organizations can achieve long-term financial health and enhance the overall patient experience.