In the world of medical billing, efficiency and accuracy are paramount. To ensure streamlined financial processes in healthcare organizations, the Revenue Cycle Management (RCM) cycle plays a pivotal role. RCM encompasses a series of steps that begin with the registration of a patient and concludes with payment collection. By seamlessly integrating various administrative, clinical, and financial tasks, RCM ensures healthcare providers receive appropriate reimbursement for services rendered. This article will shed light on the essential components of the RCM cycle in medical billing, providing a comprehensive overview of its significance and benefits.

Overview of RCM Cycle

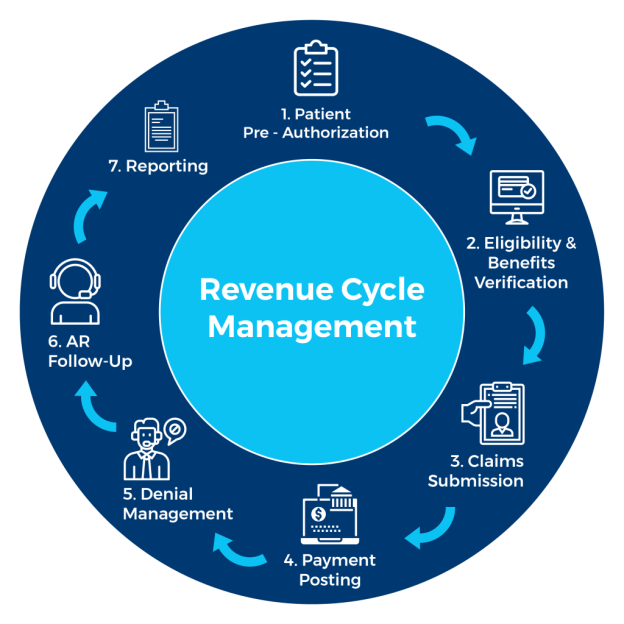

RCM involves various stages, including patient registration, insurance verification, claims submission, payment processing, and revenue optimization. The RCM cycle ensures that healthcare organizations can efficiently and accurately capture revenue for the services they provide while maintaining compliance with regulatory requirements. In this overview, we will delve into the key stages and components of the RCM cycle, highlighting its significance in the financial stability of healthcare providers.

Definition of RCM Cycle

The Revenue Cycle Management (RCM) Cycle in medical billing refers to the process by which healthcare providers manage the financial aspects of their practice, from the initial registration and check-in of patients to the collection of payments and reconciliation of accounts. It encompasses all the necessary steps to ensure that healthcare services are billed accurately and timely, and that the payments are received promptly.

Importance of RCM Cycle

An efficient RCM Cycle is crucial for the financial success of healthcare practices. It helps optimize revenue by ensuring accurate coding and billing, reducing claim denials, and improving the overall efficiency of the revenue cycle. Effective management of the RCM Cycle ensures that healthcare providers can focus on patient care, while maximizing their financial performance.

Key Components of RCM Cycle

The RCM Cycle can be divided into several key components, each playing a vital role in the overall revenue management process.

Patient Registration and Check-In

Gathering Patient Information

The first step in the RCM Cycle is gathering relevant patient information during the registration and check-in process. This includes basic demographic details such as name, address, contact information, insurance details, and any other relevant data required for accurate billing and claims submission.

Verification of Insurance Eligibility

Once patient information is collected, it is essential to verify the patient’s insurance eligibility. This involves validating the insurance coverage, confirming the plan benefits, and determining any deductible, copayment, or coinsurance amounts that may need to be collected at the time of service.

Collecting Patient Demographics

Accurate collection of patient demographics is essential for billing and claim submission. This includes capturing details such as date of birth, gender, social security number, and any other information required by insurance companies for claims processing.

Coding and Charge Entry

Medical Coding

Medical coding is a critical component of the RCM Cycle, as it involves translating the healthcare services provided into standardized codes. These codes, such as CPT (Current Procedural Terminology) and ICD-10 (International Classification of Diseases), ensure accurate billing and claims submission.

Diagnosis and Procedure Codes

Using the appropriate diagnosis and procedure codes is essential for proper reimbursement. The diagnosis codes capture the patient’s condition or reason for the healthcare visit, while the procedure codes describe the specific services or treatments performed by healthcare providers.

Code Verification and Validation

Once the codes are assigned, it is crucial to verify and validate their accuracy before submitting the claims. This includes ensuring that the codes align with the documented medical records, guidelines, and payer-specific requirements to avoid claim denials or delays in reimbursement.

Claim Submission

Preparation of Claim

After coding and charge entry, the next step in the RCM Cycle is the preparation of the claim. This involves compiling all the necessary information, including patient details, services provided, diagnosis, and procedure codes, into a standardized claim format acceptable by insurance companies.

Claims Scrubbing for Errors

Before submitting the claim, it is essential to scrub it for any errors or inconsistencies that may lead to claim denials. Claims scrubbing involves using specialized software or systems to identify and correct any coding, billing, or data-related errors to increase the chances of successful claim processing.

Electronic and Paper Claim Submission

Once the claim is error-free, it can be submitted electronically or in paper format, depending on the requirements of the insurance payer. Electronic claim submission offers numerous benefits, including faster processing, reduced errors, and improved tracking capabilities. However, some insurance payers still accept paper claims, requiring healthcare providers to follow their specific submission guidelines.

Claims Adjudication

Verification of Claims

After the claim is submitted, it undergoes a process called claims adjudication. This refers to the review and evaluation of the claims by insurance companies to determine their validity and accuracy. During this process, the claims are checked against various criteria, including covered services, medical necessity, and policy guidelines, to ensure appropriate reimbursement.

Coordination with Insurance Companies

During the claims adjudication process, healthcare providers may need to coordinate with insurance companies for additional information, clarification, or documentation related to the submitted claims. This communication is crucial to resolve any discrepancies or requests for additional details to facilitate accurate and timely claims processing.

Reviewing for Medical Necessity

One of the key aspects of claims adjudication is reviewing the medical necessity of the services provided. Insurance companies assess whether the services were medically necessary based on established criteria and guidelines. Healthcare providers must ensure that the documentation and supporting medical records justify the medical necessity of the billed services to avoid claim denials.

Payment Collection

Billing and Invoicing Patients

Once the claims are approved and reimbursed by insurance companies, the healthcare providers engage in billing and invoicing the patients for their portion of the fees, such as copayments, deductibles, or coinsurance. Accurate and timely billing is essential to ensure prompt payment collection and minimize any outstanding balances.

Payment Options and Plans

Offering various payment options and plans can enhance the payment collection process. Healthcare providers may provide options such as credit card payments, online payment portals, installment plans, or financial assistance programs to accommodate patients’ financial situations and increase the likelihood of collecting payments in a timely manner.

Follow-Up on Outstanding Balances

Even with diligent billing practices, there may still be outstanding balances that require follow-up. This includes tracking and monitoring unpaid or partially paid claims, sending reminders to patients for outstanding balances, and utilizing collection agencies or legal actions if necessary to recover unpaid amounts.

Denial Management and Appeals

Analysis of Denied Claims

Despite best efforts, claims may still be denied by insurance companies for various reasons. Effective denial management involves analyzing the denied claims to identify common patterns or trends that may help prevent future denials. It also includes categorizing denials based on the reasons provided by insurance companies and developing strategies to address those specific issues.

Identification of Patterns

By closely examining denied claims, healthcare providers can identify patterns or recurring issues that lead to claim denials. These patterns may include coding errors, lack of medical necessity documentation, or non-compliance with payer-specific policies or guidelines. Understanding these patterns helps in implementing appropriate measures to reduce future denials and improve cash flow.

Appeals and Resubmission

When claims are denied, healthcare providers have the option to appeal the decision by providing additional information or documentation to support the medical necessity of the billed services. The appeals process involves submitting the necessary paperwork, following the specific guidelines set by insurance companies, and requesting a reevaluation of the denied claims. Successful appeals result in claims being resubmitted for payment consideration.

Account Follow-Up

Tracking Outstanding Claims

In the RCM Cycle, it is vital to track outstanding claims to ensure timely reimbursement. This involves monitoring the progress of each claim, identifying any delays or issues, and taking appropriate actions to resolve the outstanding accounts. Regular follow-up ensures that claims do not fall through the cracks and helps maximize revenue collection.

Resolving Billing Discrepancies

During account follow-up, healthcare providers may encounter billing discrepancies that need to be addressed. This includes resolving any coding errors, coordinating with insurance companies for missing or misprocessed claims, and rectifying any outstanding issues related to claim submission or reimbursement.

Monitoring Payment Delays

Payment delays can impact the cash flow of healthcare practices. To minimize the impact, it is crucial to closely monitor payment delays and take proactive measures to address them. This may involve contacting insurance companies, identifying reasons for delayed payments, and engaging in appropriate follow-up actions to expedite the reimbursement process.

Revenue Posting and Reconciliation

Receiving and Posting Payments

Upon receiving payments from insurance companies or patients, healthcare providers need to accurately post the received amounts to the appropriate patient accounts. This involves entering payment details into the practice management system, allocating the payments to specific claims or invoices, and updating the accounts receivable records accordingly.

Reconciliation with Accounting Systems

To ensure the accuracy of financial records, it is essential to reconcile the revenue postings with the accounting systems. This involves comparing the records in the practice management system with the financial records in the accounting software. Any discrepancies or variances must be identified and resolved promptly to maintain accurate financial reporting.

Identifying Discrepancies

During the reconciliation process, any discrepancies in the revenue postings or accounting records must be thoroughly examined. These discrepancies may arise due to various reasons, such as data-entry errors, payment misallocations, or billing inaccuracies. Identifying and addressing these discrepancies ensures the integrity of financial reporting and minimizes the risk of financial misstatements.

Reporting and Analytics

Generating Financial Reports

Reporting and analytics play a crucial role in evaluating the performance of the RCM Cycle. By generating financial reports, healthcare providers can assess key metrics such as revenue, denials, collection rates, and accounts receivable aging. These reports provide valuable insights into the financial health of the practice and identify areas for improvement.

Analyzing Key Metrics

Analyzing key metrics derived from financial reports helps healthcare providers understand the strengths and weaknesses of their revenue management processes. By evaluating metrics such as denial rates, average reimbursement times, or collection rates, they can identify bottlenecks or inefficiencies in the RCM Cycle and take appropriate actions to enhance revenue performance.

Identifying Areas of Improvement

The RCM Cycle is a dynamic process that requires continuous improvement and adjustments. By analyzing financial reports and key metrics, healthcare providers can identify areas of improvement and implement corrective measures. These improvements may involve enhancing coding practices, streamlining claim submission processes, or implementing technology solutions to automate revenue management tasks.

In conclusion, the Revenue Cycle Management (RCM) Cycle in medical billing is a comprehensive process that encompasses various stages, from patient registration to financial reporting. Each step in the RCM Cycle plays a crucial role in optimizing revenue, ensuring accurate billing and claims submission, and maximizing financial performance for healthcare providers. By implementing efficient practices and leveraging technology solutions, healthcare practices can enhance their RCM process and improve their overall revenue management.