In the realm of healthcare services, an important aspect that often goes unnoticed is the billing process. Proper management of billing methods ensures that healthcare providers receive timely and accurate payments for the services they render. Understanding the intricacies of healthcare services billing methods is crucial to optimize revenue generation and maintain fiscal responsibility. In this article, we will explore the three main types of billing methods utilized in the healthcare industry, shedding light on how they function and their potential impact on healthcare providers and patients alike.

Traditional Fee-for-Service

Traditional fee-for-service is a healthcare billing method in which providers are reimbursed for individual services rendered to patients. Under this system, healthcare professionals bill patients or insurance companies separately for each service provided. The charges are typically based on a fee schedule determined by the healthcare provider. This method has been the traditional approach to healthcare reimbursement for many years.

Characteristics

In a fee-for-service arrangement, healthcare providers are paid for each specific service or procedure they perform. This includes examinations, tests, surgeries, medications, and any other interventions provided to the patient. The charges are usually based on the provider’s standard rates or a predetermined fee schedule. Each service is billed separately, and the reimbursement is determined by the allowed amount agreed upon by the provider and the payer.

Pros and Cons

One of the advantages of the fee-for-service model is that it allows for more flexibility in terms of patient care. Providers are incentivized to perform more services as they are reimbursed for each one, promoting a high volume of procedures. This can be advantageous in cases where patients require multiple interventions.

However, the fee-for-service model has faced criticisms due to potential overutilization of services and rising healthcare costs. Critics argue that the system may incentivize unnecessary tests or procedures as providers are financially motivated to provide more services. Additionally, the fee-for-service model may not focus on patient outcomes, leading to fragmented care and lack of coordination among providers.

Capitation

Capitation is a healthcare reimbursement method in which providers are paid a fixed amount per patient, regardless of the services provided. Under this model, healthcare providers receive a predetermined monthly payment for each patient enrolled in their care. This payment is meant to cover all necessary healthcare services the patient may require.

Characteristics

In a capitation payment system, providers assume both the financial risk and responsibility for the healthcare needs of the enrolled population. The payment is typically adjusted for factors such as the patient’s age, health status, and demographic characteristics. Providers must manage the allocated funds efficiently to ensure the provision of necessary healthcare services within the set budget.

Pros and Cons

One of the advantages of capitation is that it promotes a focus on preventive care and overall population health. Providers have an incentive to keep their patients healthy and minimize the need for costly interventions. This model can lead to better care coordination and the implementation of preventive measures to reduce healthcare costs in the long term.

However, capitation also has potential drawbacks. Providers may be financially discouraged from delivering expensive or specialty services as the fixed payment may not adequately cover the costs. This can lead to limited access to certain treatments or specialty care for patients. Care coordination among different providers can also be challenging under a capitation system, potentially resulting in fragmented care.

Bundled Payments

Bundled payments, also known as episode-based payments, are a healthcare reimbursement model in which providers receive a single payment to cover all services and treatments associated with a specific episode of care or condition. The payment is usually predetermined and includes the costs of all related services provided by different healthcare professionals involved in the patient’s care.

Characteristics

Under bundled payments, all healthcare services within a defined episode of care are bundled together into a single payment. This can include hospital stays, procedures, follow-up visits, and post-acute care. Providers are responsible for managing the costs and quality of care for the entire episode, encouraging collaboration and care coordination among different healthcare professionals.

Pros and Cons

One of the main advantages of bundled payments is the potential for cost savings and improved care quality. By having a fixed payment for a bundle of services, providers have an incentive to streamline care, reduce unnecessary interventions, and improve care coordination. This can lead to better patient outcomes and reduced healthcare costs.

However, implementing bundled payments can be complex, requiring cooperation and coordination among various providers and healthcare organizations. It can also pose challenges in determining the appropriate payment amount for each episode of care. Additionally, providers may face financial risks if the fixed payment does not adequately cover the costs associated with the episode of care.

Global Payments

Global payments, also known as global budgets, are a healthcare reimbursement method in which providers receive a fixed amount of money to cover all healthcare services provided to a specific population or region. This payment model is often used in systems such as government-funded healthcare or accountable care organizations (ACOs).

Characteristics

Under global payments, providers are given a fixed budget to cover the healthcare needs of a defined population. This budget may be based on factors such as the population size, demographics, and expected healthcare utilization. Providers are responsible for managing the allocated funds to ensure the provision of necessary and cost-effective healthcare services within the given budget.

Pros and Cons

One of the advantages of global payments is that it promotes a focus on population health and efficient resource allocation. Providers have the flexibility to allocate funds based on the specific healthcare needs of the population they serve. This can lead to better coordination of care and the implementation of preventive measures to improve population health outcomes.

However, global payments may present challenges in terms of managing limited resources and ensuring equitable access to healthcare services. Providers may face financial constraints if the allocated budget is not sufficient to cover the population’s healthcare needs. Additionally, global payments require effective governance and monitoring systems to ensure appropriate resource allocation and prevent potential misuse of funds.

Value-Based Reimbursement

Value-based reimbursement is a healthcare payment model that focuses on rewarding providers based on the value and quality of care they deliver to patients. In this model, reimbursement is tied to achieving specific quality and outcome measures, rather than the volume of services provided.

Characteristics

Value-based reimbursement emphasizes the delivery of high-quality, patient-centered care. Providers are incentivized to meet certain quality metrics, such as patient satisfaction, improved health outcomes, and reduced healthcare costs. Payments may be adjusted based on the provider’s ability to meet these measures, fostering a focus on value and efficiency in healthcare delivery.

Pros and Cons

One of the key advantages of value-based reimbursement is its potential to improve the overall quality and outcomes of healthcare. By linking payment to outcomes, providers are encouraged to deliver effective and patient-centered care. This can lead to better care coordination, reduced healthcare costs, and improved patient satisfaction.

However, transitioning to value-based reimbursement can be complex and challenging. Implementation requires robust data collection and analysis systems to measure and evaluate outcomes effectively. Providers may also face financial risks and uncertainties during the initial transition period, as the payment model may affect their revenue streams differently. Additionally, there is a need for standardization and consensus on outcome measures to ensure fairness and comparability among different providers.

Episode of Care

An episode of care refers to a specific period during which a patient receives healthcare services related to a particular condition or treatment. It encompasses all the services provided, starting from the initial diagnosis or procedure to post-treatment care and follow-up visits.

Characteristics

An episode of care may involve various healthcare professionals and settings, depending on the complexity and duration of the condition or treatment. It typically includes diagnosis, treatment or surgery, medication prescriptions, rehabilitation, and any necessary follow-up care. The coordination and continuity of care are crucial during an episode of care to ensure effective and efficient treatment.

Pros and Cons

One of the advantages of an episode of care model is improved care coordination and continuity. By focusing on the entire healthcare journey of the patient, providers can work together to ensure consistent care delivery. This can result in better patient outcomes and reduced healthcare costs, as unnecessary duplication of services can be avoided.

However, implementing episode of care reimbursement can be challenging due to varying complexity and duration of different conditions or treatments. Determining the appropriate payment for each episode can be complex and requires accurate assessments of resource utilization and treatment effectiveness. Additionally, care coordination among different providers and organizations is essential to ensure a seamless episode of care for the patient.

Pay for Performance

Pay for performance is a reimbursement model in which providers are paid based on their ability to meet certain predetermined performance measures or quality indicators. This model aims to incentivize providers to deliver high-quality care and achieve specific outcome goals.

Characteristics

Under pay for performance, providers receive financial incentives or penalties based on their performance in meeting predefined metrics. These metrics can include various aspects of care, such as patient satisfaction, adherence to clinical guidelines, health outcomes, or cost efficiency. The payment is adjusted based on the provider’s ability to meet or exceed these performance measures.

Pros and Cons

The main advantage of pay for performance is its potential to improve the overall quality of healthcare delivery. Providers are encouraged to prioritize patient outcomes, adhere to evidence-based guidelines, and deliver efficient care. This model can result in better patient experiences, reduced complications, and improved healthcare system performance.

However, pay for performance can also face challenges. Implementation requires robust data collection and monitoring systems to accurately measure and evaluate performance. Overemphasizing specific metrics may lead to a narrow focus on those measures, potentially overlooking other essential aspects of care. Additionally, designing fair and meaningful performance measures can be complex and require thorough evaluation and consensus among relevant stakeholders.

Retrospective Payment

Retrospective payment is a reimbursement method in which providers are paid after the healthcare services have been delivered. Under this model, providers submit claims to insurance companies or payers, detailing the services provided, and the reimbursement is then determined based on the allowed amount or fee schedule.

Characteristics

In a retrospective payment system, providers deliver healthcare services first and then bill for reimbursement later. The reimbursement amount is typically determined through negotiation or based on predetermined fee schedules. This model allows providers to receive payment for the services provided, but there may be delays in receiving the reimbursements, depending on the insurance or payer’s processing timeline.

Pros and Cons

One advantage of retrospective payment is that providers are assured of receiving payment for the services provided, regardless of patient outcomes or treatment success. This can provide financial stability for healthcare organizations and incentivize the delivery of necessary care. Additionally, this payment model allows providers to assess the actual costs incurred for each service or procedure.

However, there may be potential drawbacks to retrospective payment. Providers may face administrative burdens associated with submitting claims and waiting for reimbursements. Delays in reimbursement can affect the cash flow of healthcare organizations and may impact their ability to provide timely care. Additionally, this payment model may not incentivize a focus on cost efficiency or quality improvement, as reimbursement is not tied to specific performance measures.

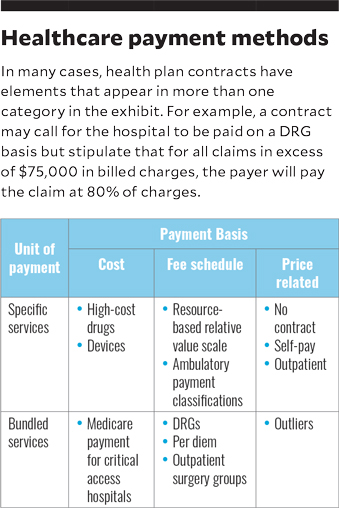

This image is property of www.hfma.org.

Prospective Payment

Prospective payment is a reimbursement method in which providers receive a predetermined payment based on a fixed rate or set of criteria before delivering healthcare services. This payment model is often used in various healthcare settings, such as hospitals or outpatient clinics.

Characteristics

In a prospective payment system, providers receive a predetermined amount based on factors such as the diagnosis, procedure, or service provided. This amount is determined in advance and may be based on standardized rates or a fee schedule. Providers deliver the necessary care within the set payment amount, assuming the financial risk for any additional costs.

Pros and Cons

One of the advantages of prospective payment is that it provides predictability and financial stability for healthcare organizations. Providers have a clear understanding of the payment they will receive for each service or procedure before delivering care. This can help in budgeting and resource allocation, especially for hospitals and other healthcare facilities.

However, prospective payment may pose challenges in situations where costs exceed the predetermined payment amount. Providers have the responsibility to manage costs efficiently within the fixed payment, potentially leading to constraints on resource utilization. Additionally, the accuracy and appropriateness of the predetermined rates or fee schedules are crucial to ensure fair reimbursement for providers and sustainability of healthcare services.

Out-of-Pocket Payment

Out-of-pocket payment is a healthcare billing method in which patients are required to pay for healthcare services directly, without involving insurance companies or third-party payers. Under this model, individuals are responsible for the full cost of the services received.

Characteristics

In an out-of-pocket payment system, patients bear the financial responsibility for their healthcare services. This can include payments for consultations, medications, tests, procedures, and any other healthcare interventions. The costs are determined by the healthcare provider or institution and are typically communicated to the patient before the services are rendered.

Pros and Cons

One of the advantages of out-of-pocket payment is the transparency and control it offers to patients. Individuals have a clear understanding of the costs involved and can make informed decisions based on their financial situation. Additionally, out-of-pocket payment can reduce administrative complexities and potentially lower healthcare costs by eliminating intermediaries.

However, out-of-pocket payment can have significant financial implications for individuals, particularly in cases where expensive or long-term treatments are required. It can create barriers to accessing necessary healthcare services for those with limited financial resources. Additionally, the absence of insurance coverage may limit individuals’ ability to afford preventive or non-urgent care, potentially impacting overall health outcomes.