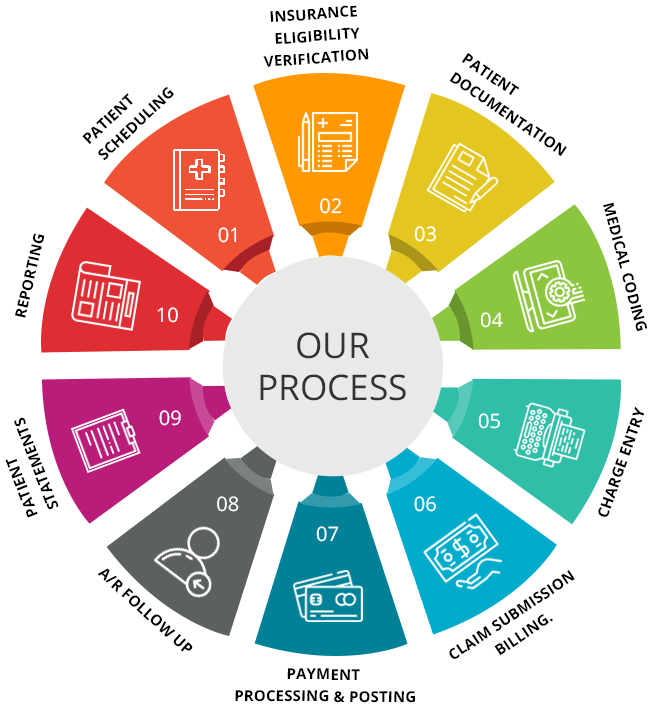

In the realm of healthcare, medical billing plays a vital role in ensuring that healthcare providers are compensated for the services they provide. The medical billing revenue cycle encompasses a series of interconnected steps that facilitate the billing process, ultimately leading to the generation of revenue. This article will guide you through the ten essential steps of the medical billing revenue cycle, offering a comprehensive overview of each stage and highlighting their significance in the healthcare industry. By understanding these steps, you will gain valuable insights into the complexities of medical billing and the crucial role it plays in maintaining the financial stability of healthcare organizations.

Patient Registration

Patient registration is the critical first step in The medical billing revenue cycle. During this process, the healthcare facility collects essential information from the patient, such as their name, address, contact details, and insurance information. This data is crucial for ensuring accurate billing and claim submission. By registering patients properly, healthcare providers ensure that all subsequent steps in the revenue cycle are carried out smoothly and efficiently.

Collecting Patient Information

Effective collection of patient information is key to proper medical billing. The registration process involves gathering demographic details, including the patient’s full name, date of birth, gender, and contact information. Additionally, it is important to collect insurance information, such as the policy number, insurance company name, and any relevant authorization or referral forms. Collecting comprehensive patient information is vital to ensure that claims are submitted accurately and payments are processed smoothly.

Verifying Insurance Coverage

Verifying insurance coverage is an essential step in the medical billing revenue cycle. Healthcare facilities must confirm the patient’s insurance details with the insurance company to ensure that the patient’s treatment is covered by their plan. This involves checking if the patient’s policy is active, the coverage limits, and any specific requirements or restrictions. Proper insurance verification helps prevent claim denials and ensures that patients receive the appropriate benefits according to their insurance coverage.

Obtaining Consent Forms

Consent forms are crucial to protect both the healthcare provider and the patient. These forms provide legal authorization for medical procedures, the release of medical records, and the billing of insurance companies. Obtaining signed consent forms from patients is an important part of the medical billing revenue cycle as it ensures that the healthcare facility has the necessary consent to bill for services rendered. These forms also serve as an agreement between the patient and the provider, outlining the patient’s rights and responsibilities.

Charge Entry

Charge entry involves assigning the appropriate codes to the services and procedures provided to the patient. This step ensures that accurate and detailed information is recorded to facilitate proper billing and claim submission. The coding process involves translating the services rendered into standardized codes using systems such as Current Procedural Terminology (CPT) and International Classification of Diseases (ICD) codes. Assigning the correct codes is crucial for accurate reimbursement and minimizing claim denials.

Assigning Appropriate Codes

Assigning appropriate codes is a critical aspect of the charge entry process. Healthcare professionals responsible for coding must review the medical documentation thoroughly to accurately determine the most appropriate codes. Diagnostic and procedural codes are used to document the patient’s conditions and the services provided during their visit. Proper coding ensures that the healthcare facility is reimbursed correctly for the services rendered and ensures accurate documentation for medical record keeping.

This image is property of www.medphine.com.

Entering Charges into the Billing System

Once the appropriate codes have been assigned, the charges for the services rendered are entered into the billing system. This step involves recording the details of the procedures, treatments, and any additional services provided to the patient. Accurate and timely entry of charges is vital to ensure that claims are submitted promptly and accurately. This step sets the stage for the subsequent stages in the medical billing revenue cycle.

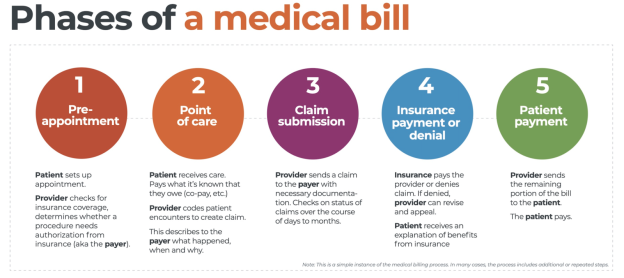

Claim Submission

The claim submission process involves preparing and submitting claims to insurance companies. This step requires meticulous attention to detail to ensure that claims are complete and accurate. Claims include detailed information about the services provided, the corresponding codes, and supporting documentation. Properly submitting claims facilitates timely reimbursement and minimizes the chances of claim denials, delays, or rejections.

Preparing and Submitting Claims to Insurance Companies

Preparing and submitting claims to insurance companies is a complex and detail-oriented process. Healthcare providers must carefully prepare claims with accurate and complete information, including patient demographics, service details, and supporting documentation. Claims are then submitted to the appropriate insurance companies electronically or through traditional mail. Proper preparation and submission of claims is crucial to ensuring timely reimbursement and preventing claim rejection.

Ensuring Accuracy and Completeness of Claims

Before submitting claims to insurance companies, it is essential to ensure their accuracy and completeness. Healthcare providers must verify that all required information, including patient demographics, insurance details, and service documentation, is accurate and complete. This step helps minimize the risk of claim denials due to missing or inaccurate information. Thoroughly reviewing and double-checking claims before submission is crucial to the success of the medical billing revenue cycle.

Claim Processing

Once claims are submitted, they undergo the claim processing stage. During this stage, insurance companies adjudicate the claims by reviewing the submitted information and determining the amount of coverage and reimbursement to be provided. The claim processing stage involves verification of coverage and eligibility, including confirming the patient’s policy details, pre-authorization requirements, and any limitations or exclusions. Accurate and timely claim processing is essential for healthcare providers to receive payment for the services rendered.

Adjudication of Claims by Insurance Companies

The adjudication of claims refers to the process by which insurance companies review and evaluate the submitted claims. This involves determining the level of coverage applicable to each claim, verifying the accuracy of the billed services, and calculating the reimbursement amount. Insurance companies analyze the codes, documentation, and policy details to assess the validity of the claim. Upon completion of the adjudication process, insurance companies communicate the reimbursement decision to the healthcare provider.

Verification of Coverage and Eligibility

Insurance companies verify coverage and eligibility during the claim processing stage. This involves confirming the patient’s insurance policy details, such as coverage limits, deductible amount, and any pre-authorization requirements. Verification of coverage and eligibility helps ensure that claims are processed accurately and that healthcare providers receive the appropriate reimbursement for the services provided. Thorough verification is crucial to avoid claim denials and delays in payment.

Payment Posting

Payment posting is a critical step in the medical billing revenue cycle as it involves recording and depositing payments received from insurance companies and patients. This step ensures accurate and up-to-date records of financial transactions. Healthcare providers record the received payments, allocate them to the corresponding patient accounts, and update the billing system accordingly. Accurate payment posting helps track revenue and maintain financial records.

Recording and Depositing Payments

Recording and depositing payments received from insurance companies and patients is a vital aspect of the payment posting process. Payments can be received in various forms, including checks, electronic transfers, or credit card payments. Healthcare providers must accurately record the received payments, including the payment amount, the payer’s information, and the date received. Depositing the funds in a timely manner ensures that revenue is properly managed and accounted for.

Posting Payments to Patient Accounts

Once payments are recorded, they are posted to the respective patient accounts. This step involves allocating the received payments to the outstanding balance of the patient. Accurate posting of payments is crucial for maintaining updated patient accounts, accounting for the services rendered, and ensuring prompt and accurate billing. Healthcare providers must reconcile the posted payments with the corresponding claims and maintain accurate and organized payment records.

Insurance Follow-Up

Insurance follow-up is an important step in the medical billing revenue cycle that involves identifying and resolving claim denials. In this stage, healthcare providers review claim statuses and communicate with insurance companies to address any issues or discrepancies. By following up on denied claims, healthcare providers can provide additional information, correct errors, or appeal the decision if necessary. Effective insurance follow-up helps maximize reimbursement and minimize the impact of claim denials on financial performance.

Identifying and Resolving Claim Denials

During the insurance follow-up stage, healthcare providers identify and resolve claim denials. This involves reviewing claim statuses and identifying the reasons for denial, such as coding errors, lack of documentation, or policy exclusions. Healthcare providers must work proactively with insurance companies to address these issues by providing additional information, appealing the denial decision, or correcting any errors. Resolving claim denials is essential to ensure accurate reimbursement and minimize revenue loss.

Appealing Denied Claims if Necessary

In some cases, healthcare providers may need to appeal denied claims to advocate for proper reimbursement. Appeals involve providing additional documentation, justifying the medical necessity of the services provided, or addressing any administrative errors. Timely and accurate appeals can help overturn claim denials and ensure fair reimbursement for services rendered. Effective appeals management is crucial for maximizing revenue and minimizing the financial impact of denied claims.

Patient Follow-Up

Patient follow-up is an important step in the medical billing revenue cycle where healthcare providers communicate with patients regarding their financial obligations. This stage involves informing patients of their balances, collecting payments, and discussing payment plans or financial assistance options if necessary. By proactively addressing patient balances, healthcare providers can ensure timely payment and maintain positive patient-provider relationships.

Informing and Collecting Balances from Patients

To facilitate timely payment, healthcare providers must inform patients of their outstanding balances. Communication with patients about their financial obligations is essential for transparency and customer service. By providing clear and detailed information regarding the billed services and the corresponding charges, patients are more likely to understand their financial responsibility. Professionally collecting outstanding balances from patients helps optimize revenue and maintain financial stability.

Setting Up Payment Plans or Financial Assistance

In instances where patients may face financial challenges, healthcare providers can offer payment plans or financial assistance options to facilitate payment. Setting up payment plans allows patients to pay their balances in installments over an agreed-upon period, making it more manageable for them. Financial assistance programs may also be available for patients who meet specific criteria, providing them with reduced costs or care at no cost. Offering these options helps ensure that patients receive the necessary healthcare while preventing the accumulation of uncollectible debts.

Accounts Receivable Management

Accounts receivable management is a critical aspect of the medical billing revenue cycle. This stage involves tracking and managing outstanding claims and unpaid balances. Healthcare providers must monitor accounts receivable regularly, identify overdue payments, and implement strategies to collect outstanding balances. Effective accounts receivable management helps optimize revenue, improve cash flow, and minimize the financial impact of unpaid claims.

Tracking and Managing Outstanding Claims

Tracking and managing outstanding claims is a vital part of accounts receivable management. Healthcare providers must closely monitor the status of submitted claims, identify any delays or denials, and take appropriate action to resolve issues. Tracking outstanding claims ensures timely payment and prevents revenue leakage due to unprocessed or unresolved claims. By managing outstanding claims efficiently, healthcare providers can enhance financial performance and maintain a healthy revenue cycle.

Following Up on Unpaid Balances

Unpaid balances can have a significant impact on the financial stability of healthcare providers. Following up on unpaid balances involves contacting patients, sending reminders, and implementing collection strategies to recover outstanding payments. Healthcare providers may utilize various methods such as phone calls, letters, or electronic communications to communicate with patients about their unpaid balances. Proactive follow-up on unpaid balances helps optimize revenue and ensure financial sustainability.

Reporting and Analysis

Reporting and analysis play a crucial role in the medical billing revenue cycle. This stage involves generating financial reports and analyzing revenue and performance metrics. By analyzing key performance indicators (KPIs) and financial data, healthcare providers can gain insights into the effectiveness of their billing processes, identify areas for improvement, and make informed decisions to optimize revenue. Reporting and analysis help healthcare organizations monitor financial performance, identify trends, and implement strategies to enhance revenue cycle management.

Generating Financial Reports

Generating financial reports is vital for healthcare providers to gain a comprehensive understanding of their revenue cycle. These reports provide insights into key metrics such as total billed charges, net collections, accounts receivable aging, and denial rates. By generating financial reports, healthcare providers can evaluate their financial performance, track trends, and compare results against industry benchmarks. Regular financial reporting helps healthcare organizations make informed decisions and implement strategies for improved revenue cycle management.

Analyzing Revenue and Performance Metrics

Analyzing revenue and performance metrics is a critical step in optimizing the medical billing revenue cycle. Healthcare providers must review key metrics, such as accounts receivable days, clean claim rate, and reimbursement rates, to identify areas for improvement and efficiency. By analyzing revenue and performance metrics, healthcare organizations can identify bottlenecks, implement process improvements, and enhance financial performance. Effective analysis of revenue and performance metrics is crucial for maintaining a smooth and efficient revenue cycle.