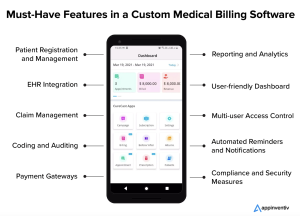

In order to effectively manage the financial aspects of a medical practice, selecting the right medical billing software is crucial. There are various types of medical billing software available in the market, each catering to the specific needs and requirements of healthcare professionals. This article provides an overview of the different types of medical billing software, highlighting their key features and benefits. By understanding the unique functionalities of each type, you will be equipped to make an informed decision and choose the software that best suits your practice’s needs.

Cloud-Based Medical Billing Software

Advantages of Cloud-Based Medical Billing Software

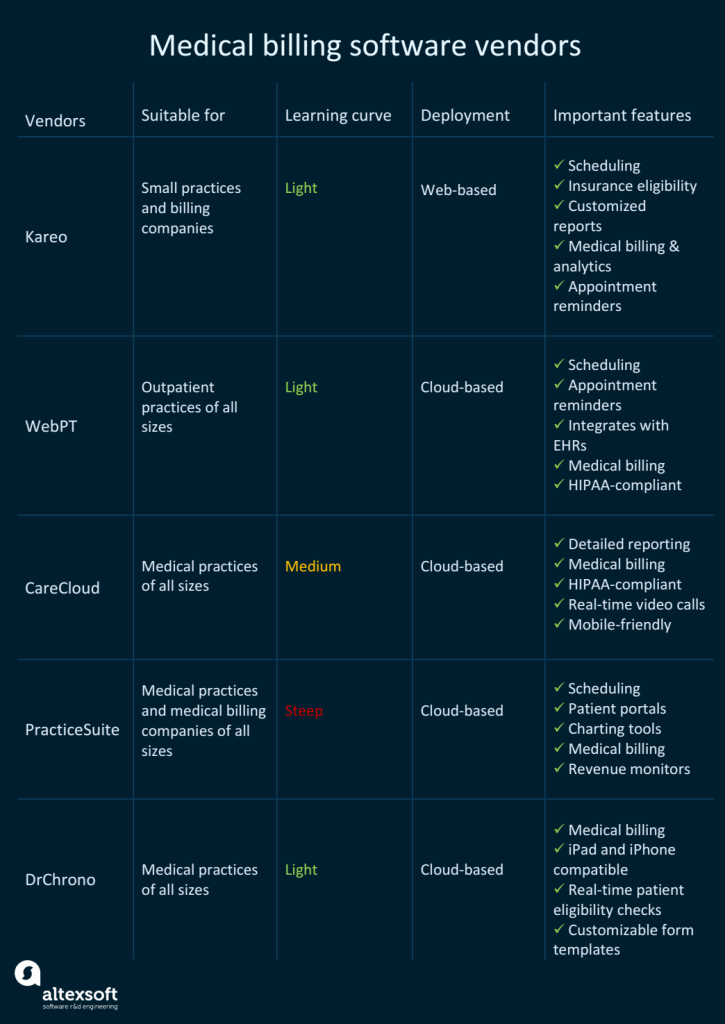

Cloud-based medical billing software offers numerous advantages for healthcare providers and medical billing professionals. One of the key benefits is the ability to access the software and patient data from anywhere with an internet connection. This flexibility eliminates the need for physical servers and allows for seamless collaboration between multiple users across different locations. Additionally, cloud-based software often comes with automatic updates, ensuring that users always have access to the latest features and security patches without the hassle of manual installations.

Another advantage of cloud-based medical billing software is the cost-saving potential. By moving away from traditional on-premises infrastructure, healthcare organizations can reduce hardware and maintenance costs. Cloud-based solutions typically operate on a subscription model, where users pay a regular fee based on their usage. This eliminates the need for large upfront investments and allows organizations to scale their usage according to their needs. Furthermore, cloud-based software eliminates the need for dedicated IT staff to manage servers and perform maintenance, freeing up resources that can be allocated elsewhere.

The scalability of cloud-based medical billing software is another significant advantage. As healthcare organizations grow or experience fluctuations in patient volumes, cloud-based solutions can easily accommodate the changing needs. With the ability to scale up or down resources quickly, providers can handle increased workloads during peak times without experiencing performance issues. This scalability feature ensures that the software remains reliable and efficient, supporting the smooth operation of medical billing processes.

Disadvantages of Cloud-Based Medical Billing Software

While cloud-based medical billing software offers many benefits, it is important to consider the potential disadvantages as well. One potential concern is the reliance on internet connectivity. Since cloud-based software requires a stable and reliable internet connection, any disruptions or network outages can temporarily hinder access to patient data and software functionality. However, with the increasing availability of internet services, this issue is becoming less of a concern for most healthcare practices.

Another potential disadvantage of cloud-based medical billing software is data security and privacy concerns. Storing patient information in the cloud introduces the risk of unauthorized access or data breaches. However, reputable cloud service providers implement stringent security measures, such as encryption and regular backups, to protect sensitive data. It is crucial for healthcare organizations to carefully assess the security protocols and compliance standards of any cloud-based software they consider using to ensure the safety of patient information.

Additionally, some healthcare providers may have concerns about the potential loss of control over their data when using a cloud-based solution. With an on-premises system, healthcare organizations have direct control over the physical servers and data storage. In contrast, cloud-based software involves entrusting the management and maintenance of data to the service provider. However, this trade-off is often balanced by the enhanced security, backup capabilities, and expertise of the cloud service provider.

On-Premises Medical Billing Software

On-premises medical billing software, which is installed and operated directly on a healthcare organization’s own servers and infrastructure, offers several advantages and disadvantages:

Advantages of On-Premises Medical Billing Software

On-premises medical billing software refers to software that is installed and operated directly on a healthcare organization’s own servers and infrastructure. This type of software offers several advantages that make it a preferred choice for certain healthcare providers. One of the primary benefits is the level of control it provides over the entire system. By keeping the software and data within the organization’s premises, healthcare providers have full control over data security, access, and customization. This control can be particularly important for organizations with strict compliance requirements or those who prefer to have complete ownership over their infrastructure.

Another advantage of on-premises medical billing software is the potential for faster processing speeds. Since the software and data are stored locally, there is typically less latency in retrieving and processing information compared to cloud-based solutions that rely on remote servers. This faster processing can result in improved overall efficiency and productivity for medical billing teams, allowing them to handle billing tasks more quickly.

Additionally, some healthcare organizations may prefer on-premises software due to data privacy concerns. With on-premises solutions, sensitive patient information remains within the organization’s own servers, reducing the potential risks associated with storing data in external locations. This can provide peace of mind for healthcare providers who prioritize data privacy and control.

Disadvantages of On-Premises Medical Billing Software

Despite the advantages, on-premises medical billing software comes with its own set of challenges and limitations. One significant disadvantage is the high initial investment required for setting up and maintaining the necessary infrastructure. Healthcare organizations must purchase and maintain servers, networking equipment, backups, and employ dedicated IT staff to manage the system. These upfront costs can be a significant barrier for smaller practices or those with limited financial resources.

Another drawback is the potential lack of flexibility and scalability compared to cloud-based solutions. On-premises software often requires substantial effort and time to upgrade or scale up as the organization grows or experiences changes in its billing requirements. This can result in delays and disruptions when expanding the system or adapting it to new industry regulations.

Furthermore, on-premises medical billing software may face challenges when it comes to remote access and collaboration. With the increasing trend towards remote work and telecommuting, the ability to access the software and patient data from anywhere becomes essential. On-premises solutions often require complex and potentially less secure remote access setups, which can hinder the convenience and efficiency of remote work practices.

Free/Open-Source Medical Billing Software

Free/open-source medical billing software offers several advantages and disadvantages:

Advantages of Free/Open-Source Medical Billing Software

Free/open-source medical billing software provides healthcare organizations and medical billing professionals with an alternative to commercial software solutions. One of the significant advantages of using free/open-source software is the cost savings it offers. As the name suggests, this type of software does not require any upfront licensing fees, allowing healthcare organizations to save on software expenses. Moreover, the open-source nature of the software means that it can be freely customized and tailored to fit the specific needs of the organization without incurring additional fees.

Another advantage is the potential for community-driven support and development. Free/open-source software often has a vibrant community of developers and users who actively contribute to its improvement and provide support through forums, discussion groups, and documentation. This collaborative environment can provide valuable resources for healthcare organizations, ensuring that they have access to technical expertise and guidance when using the software.

The transparency and auditability of free/open-source medical billing software is another significant advantage. With the source code openly available, healthcare organizations can review and inspect the software for security vulnerabilities or potential issues. This level of transparency allows independent audits and ensures accountability, especially when handling sensitive patient data.

Disadvantages of Free/Open-Source Medical Billing Software

While free/open-source medical billing software offers numerous advantages, there are also potential disadvantages to consider. One major challenge is the technical expertise required to properly install, configure, and maintain the software. Unlike commercial software solutions that often come with dedicated customer support, free/open-source software may require in-house IT staff or external consultants with the necessary technical skills to ensure a smooth implementation and ongoing maintenance. This requirement can be a barrier for smaller healthcare organizations or those with limited technical resources.

Another potential disadvantage is the lack of vendor-provided updates and support. Free/open-source software relies on the community for updates and bug fixes, which may not always be as timely or comprehensive as commercial software solutions backed by dedicated vendors. Without reliable support, healthcare organizations may face challenges in resolving technical issues or receiving timely updates to address industry changes or new compliance requirements.

Furthermore, customization of free/open-source medical billing software can be more complex and time-consuming compared to commercial solutions that offer pre-built features and modules. Organizations with unique billing requirements may need to invest additional resources into custom development or modification to ensure that the software meets their specific needs effectively.

Integrated Medical Billing Software

Integrated medical billing software offers numerous advantages and some potential disadvantages:

Advantages of Integrated Medical Billing Software

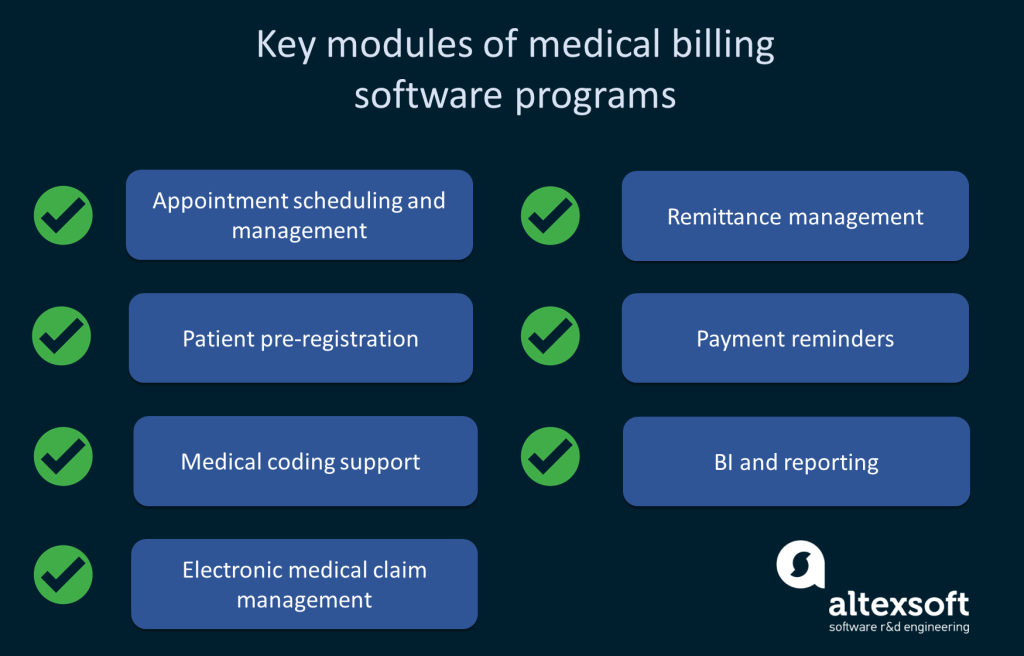

integrated medical billing software refers to a comprehensive solution that incorporates multiple functionalities to streamline various aspects of the billing process. The primary advantage of integrated software is the seamless flow of information between different modules, eliminating the need for manual data entry or transferring data between separate applications. With integrated software, patient information, appointments, billing codes, and insurance claims can all be managed within a single system. This integration improves accuracy, reduces errors, and enhances overall efficiency in the billing workflow.

Another advantage of integrated medical billing software is the reduction of duplicate data entry. With separate systems, healthcare professionals often need to enter patient information multiple times in different applications, increasing the risk of errors and consuming valuable time. Integrated software eliminates or minimizes these duplicate entries by syncing data across modules, ensuring that information entered once is automatically available throughout the system. This streamlines the workflow and allows billing teams to focus on higher-value tasks instead of tedious data entry.

In addition, integrated medical billing software can provide real-time visibility into the billing process. With all the necessary information consolidated in a single system, healthcare organizations can generate comprehensive reports and track key metrics, such as claim rejections, reimbursement rates, and outstanding balances. This real-time visibility enables timely analysis and informed decision-making, helping organizations identify areas for improvement and optimize their billing operations.

Disadvantages of Integrated Medical Billing Software

While integrated medical billing software offers significant advantages, there are also potential disadvantages to consider. One potential challenge is the complexity of implementation and customization. Integrated software often requires thorough planning, configuration, and training to ensure that all modules are seamlessly integrated and aligned with the organization’s specific needs. This implementation process can be time-consuming and may result in temporary disruptions in the billing workflow.

Another potential disadvantage is the potential lack of flexibility and customization compared to standalone applications. Integrated software aims to provide a comprehensive solution for multiple functionalities, which may limit the ability to customize individual modules according to specific preferences or unique requirements. Organizations with highly specialized or specific billing practices may find that certain aspects of the integrated software do not fully meet their needs, requiring additional workarounds or customization efforts.

Furthermore, the cost of integrated medical billing software may be higher compared to standalone applications that focus on specific functionalities. While integrated software offers the advantage of bundling multiple features into a single solution, organizations may need to consider whether the additional functionalities justify the potentially higher upfront and ongoing costs. Careful evaluation of the specific needs and priorities of the healthcare organization is necessary to determine whether the benefits of integrated software outweigh the associated expenses.

Stand-Alone Medical Billing Software

Stand-alone medical billing software offers specific advantages and potential disadvantages:

Advantages of Stand-Alone Medical Billing Software

Stand-alone medical billing software refers to software applications that focus solely on the billing aspects of healthcare practices. This type of software offers several advantages that make it a preferred choice for healthcare organizations that prioritize billing efficiency and simplicity. One of the primary advantages is the ease of use and streamlined user interface focused specifically on billing tasks. Stand-alone software often eliminates unnecessary features, allowing users to navigate and complete billing tasks more efficiently without being overwhelmed by unrelated functionalities.

Another advantage of stand-alone medical billing software is the potential for faster implementation and learning curve. With a narrower scope of features, stand-alone applications can be installed and configured relatively quickly compared to more complex integrated solutions. This efficient implementation process can minimize disruptions and allow healthcare organizations to start using the software and fulfilling billing requirements promptly. Furthermore, the focused nature of stand-alone software reduces the learning curve for users, enabling them to become proficient in handling billing tasks more rapidly.

Stand-alone medical billing software also offers the advantage of cost savings for organizations with limited budgets or specific billing requirements. Since stand-alone applications specialize in billing functionalities, they often come at a lower price point compared to comprehensive integrated software. This pricing model allows healthcare organizations to access the necessary billing features without investing in functionalities that may not be relevant to their specific needs.

Disadvantages of Stand-Alone Medical Billing Software

While stand-alone medical billing software offers several benefits, there are also potential disadvantages to consider. One potential challenge is the lack of integration with other systems or modules. Stand-alone software focuses solely on billing and may not have built-in capabilities for integrating with electronic health records (EHR) systems or other practice management solutions. This lack of integration can result in manual data entry or the need for additional workarounds to transfer information between different applications, potentially introducing errors and inefficiencies.

Another disadvantage is the potential lack of scalability compared to integrated solutions. Stand-alone software is designed to handle billing tasks and may not be capable of accommodating the changing needs of growing healthcare organizations. As practices expand, they may require additional functionalities or the ability to handle larger volumes of billing data. Stand-alone software may not offer the flexibility or scalability necessary to effectively support this growth, potentially requiring organizations to switch to integrated solutions in the future.

Furthermore, stand-alone medical billing software may lack certain advanced features or capabilities available in integrated software solutions. Integrated software often incorporates additional functionalities, such as practice management, appointment scheduling, or reporting modules, which can provide comprehensive insights and streamline various aspects of the healthcare organization’s operations. Organizations that prioritize these additional functionalities may find that stand-alone software does not meet their requirements fully.

Web-Based Medical Billing Software

Advantages of Web-Based Medical Billing Software

Web-based medical billing software, also known as cloud-based or Software-as-a-Service (SaaS) software, offers several advantages over traditional on-premises software. One of the primary benefits is the accessibility and convenience provided by web-based solutions. With web-based software, healthcare professionals can access the application and patient data from any device with an internet connection. This flexibility allows for efficient remote work, collaboration, and the ability to access real-time information anytime, anywhere, ensuring continuity in the billing process.

Another advantage of web-based medical billing software is the automatic updates and maintenance performed by the software provider. With traditional on-premises software, organizations often need to allocate resources and time to install updates and patches manually. Web-based software eliminates this burden by automatically deploying updates, ensuring that healthcare organizations have access to the latest features and security enhancements without disruption. This regular and seamless updating process helps improve system performance, reliability, and compliance with changing industry standards.

Web-based software also offers the advantage of reduced hardware and infrastructure costs. Since the software runs on remote servers maintained by the software provider, healthcare organizations do not need to invest in expensive servers or networking equipment. This saves upfront costs and eliminates the need for dedicated IT staff to manage and maintain hardware. Furthermore, the scalability of web-based software allows organizations to adjust resources and storage capacity according to their needs, ensuring that the software efficiently supports growing volumes of billing data without major infrastructure changes.

Disadvantages of Web-Based Medical Billing Software

While web-based medical billing software offers numerous advantages, there are also potential disadvantages to consider. One significant concern is the reliance on internet connectivity. Since web-based software requires a stable and reliable internet connection, any disruptions or network outages can temporarily hinder access to the software and patient data. However, with the increasing availability of internet services and redundant network setups, this disadvantage is becoming less of a concern for most healthcare practices.

Another potential disadvantage is the security and privacy of patient data. With web-based software, sensitive patient information is stored on remote servers managed by the software provider. This introduces the risk of unauthorized access or data breaches. However, reputable web-based software providers implement stringent security measures, such as encryption, firewalls, and regular backups, to protect sensitive data. It is crucial for healthcare organizations to carefully assess the security protocols and compliance standards of any web-based software they consider using to ensure the safety of patient information.

Additionally, some healthcare providers may have concerns regarding the potential loss of control over their data with web-based solutions. With on-premises software, organizations have direct control over the physical servers and data storage. Web-based software involves entrusting the management and maintenance of data to the service provider. However, this trade-off is often balanced by the enhanced security measures, backup capabilities, and expertise of reputable web-based software providers.

Mobile Medical Billing Software

Advantages of Mobile Medical Billing Software

Mobile medical billing software provides healthcare professionals with the convenience and flexibility to manage billing tasks on the go, using their smartphones or tablets. One of the key advantages of mobile software is the ability to access patient data and complete billing tasks from any location. This flexibility allows healthcare providers to work efficiently while attending conferences, visiting patients, or traveling, ensuring timely and accurate billing information. This enhanced mobility improves overall productivity and responsiveness in the billing workflow.

Another advantage of mobile medical billing software is the time-saving potential. With mobile applications, healthcare professionals can immediately document and submit billing information at the point of care, eliminating the need for manual data entry later. This real-time documentation reduces the risk of errors and delays, improving billing accuracy and accelerating the reimbursement process. Additionally, mobile software often integrates with existing systems, allowing for seamless synchronization of data between different devices and platforms.

Mobile software also offers the advantage of simplicity and user-friendly interfaces. With the smaller screens of mobile devices, developers often prioritize clean and intuitive designs that focus on essential functionalities. This simplicity allows healthcare professionals to navigate the software comfortably and quickly complete billing tasks without unnecessary complexities. Moreover, mobile software often incorporates features like voice recognition or barcode scanning, further enhancing the user experience and efficiency.

Disadvantages of Mobile Medical Billing Software

Despite the advantages, mobile medical billing software does have potential disadvantages that healthcare organizations should consider. One significant concern is the potential security risks associated with mobile devices. Smartphones and tablets are highly portable and can be susceptible to loss, theft, or unauthorized access. Healthcare organizations must implement stringent security measures, such as mobile device management systems, strong encryption, and password policies, to protect patient data and comply with privacy regulations.

Another potential disadvantage is the limited screen size and reduced functionality compared to desktop applications. While mobile software prioritizes simplicity, it may not offer the same level of functionality or detailed reporting capabilities as its desktop counterparts. Organizations that rely heavily on complex reporting or in-depth analysis of billing data may find that mobile software does not fully meet their requirements in this regard.

Additionally, mobile medical billing software may have compatibility limitations with certain operating systems or device types. Healthcare organizations need to ensure that the software they choose is compatible with the devices used by their providers. Furthermore, some mobile software may require reliable internet connectivity to fully access features or synchronize data, which can be challenging in areas with poor network coverage.

Specialized Medical Billing Software

Specialized medical billing software offers unique advantages and potential disadvantages:

Advantages of Specialized Medical Billing Software

Specialized medical billing software focuses on catering to the unique billing requirements of specific healthcare specialties. This type of software offers several advantages for healthcare organizations that choose to adopt it. One key advantage is the ability to tailor the software to the specific needs of the specialty. Since specialized software is designed with a deep understanding of the intricacies and nuances of a particular specialty’s billing practices, it can offer features, templates, and workflows specific to the specialty. This customization streamlines the billing process and ensures accurate and compliant coding and billing practices.

Another advantage of specialized medical billing software is the potential for improved efficiency and productivity. Specialty-specific software often automates repetitive tasks and supports specialized reporting and documentation requirements. This automation reduces manual errors, improves the accuracy of billing claims, and frees up time for healthcare providers and billing teams to focus on higher-value activities. Additionally, specialized software may integrate with other specialty-specific systems or databases, further enhancing workflow efficiency.

Specialized medical billing software can also provide comprehensive industry-specific reporting and analytics capabilities. With a deep understanding of the specialty’s billing practices, specialized software can generate detailed reports and analyses that offer valuable insights into financial performance, reimbursement rates, and compliance metrics. This information enables healthcare organizations to identify trends, optimize billing processes, and make informed decisions regarding financial management and resource allocation.

Disadvantages of Specialized Medical Billing Software

Although specialized medical billing software offers numerous advantages, there are potential disadvantages to consider. One significant concern is the potential lack of interoperability with other systems or standard coding practices. Specialized software may prioritize the needs of a specific specialty to the extent that it becomes challenging to integrate with other practice management systems or exchange data with external stakeholders. This lack of interoperability can elevate the risk of manual errors, hinder collaboration, and introduce inefficiencies in cross-specialty billing processes.

Another potential disadvantage is the limited availability or support for certain specialties. While specialized software exists for various healthcare specialties, not all specialties may have a wide range of software options to choose from. Additionally, the smaller user base for specific specialties may result in limited ongoing support, updates, or training resources compared to more widely adopted medical billing software.

Furthermore, healthcare organizations that provide services across multiple specialties may face challenges when adopting and managing multiple specialized software systems. Juggling different software applications can complicate the overall billing workflow and require separate training and support for each system. In such cases, healthcare organizations may need to consider solutions that provide comprehensive functionality for multiple specialties or explore the integration capabilities of different specialized software systems.

Open-Source Medical Billing Software

Open-source medical billing software offers unique advantages and potential disadvantages:

Advantages of Open-Source Medical Billing Software

Open-source medical billing software provides healthcare organizations with a unique alternative to proprietary, commercial software. One of the primary advantages of open-source software is the freedom and flexibility it offers. The source code of open-source software is openly available, allowing healthcare organizations to customize and adapt the software to their specific needs without legal restrictions. This level of customization ensures that the software aligns perfectly with the organization’s billing practices, resulting in more efficient and tailored billing workflows.

Another advantage is the cost-saving potential of open-source software. Since open-source software is freely available, healthcare organizations can save on licensing fees and allocate their resources towards customizations, training, or other critical areas. Additionally, the community-driven nature of open-source software often results in a wide range of plugins, extensions, and other complementary tools developed by the community, further enhancing the functionality and flexibility of the software without requiring additional investment.

The transparency and security of open-source medical billing software are significant advantages. Since the source code is openly available, healthcare organizations can review and audit the software for security vulnerabilities or potential issues. This transparency ensures that organizations have full visibility into the software they use, allowing them to assess and improve security measures as necessary. Furthermore, the open-source community often actively contributes to improving the software’s security, ensuring that vulnerabilities are detected and addressed promptly.

Disadvantages of Open-Source Medical Billing Software

Despite the advantages, open-source medical billing software also has potential disadvantages that healthcare organizations should consider. One primary concern is the technical expertise required to effectively implement and maintain open-source software. Customizing and configuring open-source software often requires in-house IT staff or external consultants with the necessary technical skills to ensure a smooth implementation and ongoing maintenance. This requirement can be a barrier for smaller healthcare organizations or those with limited technical resources.

Another potential disadvantage is the lack of dedicated customer support compared to proprietary software. While open-source communities offer support through forums, mailing lists, or chat platforms, the level of support may not always match that of commercial software vendors. Healthcare organizations must be prepared to rely on community-driven support or allocate resources to ensure timely assistance and guidance when facing technical issues or implementing new functionalities.

Additionally, the availability of open-source medical billing software for specific specialties may be limited compared to proprietary software solutions. Not all specialties may have open-source software options that cater specifically to their billing requirements. Healthcare organizations with specialized billing needs or complex regulatory compliance may find that the available open-source solutions do not adequately meet their unique requirements, necessitating customizations or additional software integration efforts.

Proprietary Medical Billing Software

Proprietary medical billing software, developed and provided by commercial software vendors, offers healthcare organizations a range of advantages and capabilities. These advantages include professional support, compliance with industry standards, and robust security measures.

Advantages of Proprietary Medical Billing Software

Proprietary medical billing software, developed and sold by commercial software vendors, offers several advantages for healthcare organizations. One primary advantage is the professional support and customer service provided by the software vendor. Proprietary software vendors typically offer dedicated customer support teams that can assist healthcare organizations with implementation, training, and ongoing technical support. This professional support ensures that healthcare organizations have access to timely assistance when facing issues or require guidance during software implementation.

Another advantage of proprietary medical billing software is the availability of industry-standard features and compliance with regulatory requirements. Commercial software vendors often prioritize developing features and functionalities that align with industry best practices and standards. This adherence to established norms ensures that the software can handle common billing tasks efficiently and comply with regulatory requirements. Moreover, proprietary software vendors are typically responsible for regularly updating and maintaining the software, ensuring that healthcare organizations have access to the latest features and regulatory enhancements without the burden of manual updates.

Security is another significant advantage of proprietary medical billing software. Commercial software vendors invest substantial resources in developing robust security measures to protect patient data and ensure compliance with privacy regulations. These measures often include data encryption, regular security audits, and adherence to industry-specific security frameworks. The focus on security helps healthcare organizations mitigate the risks associated with data breaches and unauthorized access, providing peace of mind when it comes to sensitive patient information.

Disadvantages of Proprietary Medical Billing Software

While proprietary medical billing software offers numerous advantages, there are potential disadvantages to consider. One disadvantage is the cost associated with proprietary software. Commercial software vendors typically charge licensing fees, often based on the number of users or features required. This upfront cost can be a significant consideration for healthcare organizations, especially those with limited budgets or smaller practices. Additionally, ongoing maintenance fees or subscription costs may apply for software updates and technical support, further impacting the total cost of ownership.

Another potential disadvantage is the lack of customizability compared to open-source or specialized software solutions. Proprietary software often provides a standard set of features and functionalities, which may not meet the specific needs or unique billing requirements of all healthcare organizations. Organizations with highly specialized or complex billing practices may find that proprietary software solutions do not offer the necessary flexibility for customization or detailed tailoring of workflows.

Additionally, the reliance on a single vendor for proprietary software introduces potential vendor lock-in risks. With proprietary software, healthcare organizations become dependent on the vendor for ongoing support, updates, and future development. If the vendor discontinues the software or weakens its support, healthcare organizations may face challenges in transitioning to alternative software or receiving adequate updates to address industry changes or compliance requirements. Therefore, careful evaluation of the reputation, stability, and long-term commitment of the proprietary software vendor is crucial before making a significant investment.

In conclusion, the diverse landscape of medical billing software offers various options for healthcare organizations and medical billing professionals. Choosing the right software depends on factors such as the organization’s specific needs, budget, compliance requirements, and preferences. Cloud-based software provides flexibility and cost-saving potential, while on-premises software offers control and faster processing speeds. Free/open-source software and specialized software provide customization options, whereas integrated software streamlines workflows. Web-based and mobile software enable remote access and convenience, while proprietary software offers professional support and industry-standard features.

When evaluating different software options, healthcare organizations should carefully consider the advantages and disadvantages of each type to make an informed decision. Thorough research, consultation with peers or industry experts, and effective vendor evaluation processes can help ensure that the chosen medical billing software aligns with the organization’s goals and requirements, optimizing billing efficiency, accuracy, and compliance.