In this article, you will learn about the basic billing process and how it works. We will discuss the different steps involved, such as verifying insurance, collecting information, generating invoices, and sending them to the appropriate parties. Understanding this process is crucial for businesses and individuals who need to ensure timely and accurate payments. By the end of this article, you will have a clear understanding of the basic billing process and its importance in ensuring a smooth financial flow.

Definition of Billing Process

Understanding the Concept of Billing

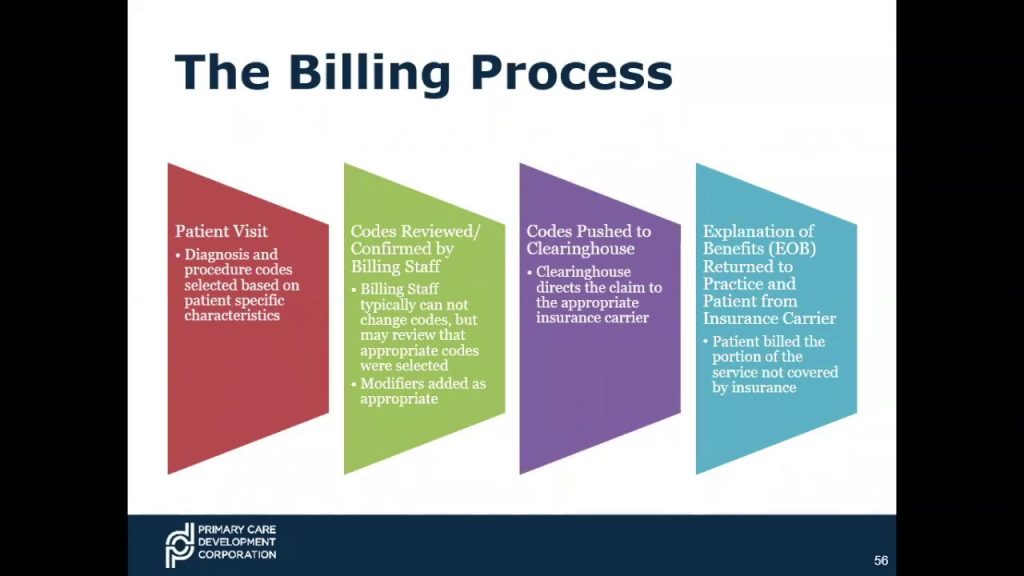

The billing process refers to the series of steps and procedures involved in generating and delivering invoices to customers for the products or services they have purchased. It is an essential part of any business operation as it ensures timely payment collection, accurate record-keeping, and effective financial management. The billing process encompasses various activities such as gathering customer information, generating invoices, collecting payments, and reconciling accounts.

Importance of Billing Process

The billing process plays a crucial role in the overall functioning of a business. It serves as a means to communicate with customers regarding their financial obligations and ensures that the business receives timely payment for its goods or services. Additionally, an efficient billing process helps in maintaining accurate financial records, analyzing revenue patterns, and making informed decisions about business operations and strategies.

Types of Billing Processes

Overview of Different Billing Methods

There are several billing methods that businesses can choose from, depending on their specific needs and requirements. Some of the commonly used billing methods include:

- Traditional Paper Billing: This method involves printing and mailing physical invoices to customers. While it may seem outdated, many customers still prefer this method.

- Online Billing: Online billing, also known as e-billing or electronic billing, utilizes digital platforms to send invoices to customers. This method offers convenience, speed, and cost-effectiveness.

- Recurring Billing: Recurring billing is commonly used for subscription-based services or products with regular installments. It automatically charges customers at predetermined intervals, eliminating the need for manual invoicing.

- Prepaid Billing: Prepaid billing requires customers to pay in advance for products or services. It is often used for prepaid mobile plans, gift cards, or prepaid service contracts.

Choosing the Right Billing Process

The choice of billing process depends on factors such as the nature of the business, customer preferences, cost considerations, and technological capabilities. Businesses need to evaluate the advantages and disadvantages of each billing method and select the one that best aligns with their requirements.

Key Components of a Billing Process

Customer Information and Database Management

One of the key components of a billing process is the management of customer information and databases. This involves collecting and maintaining accurate customer data, including contact details, billing addresses, and payment preferences. An effective database management system helps in streamlining the invoicing process and ensures that invoices are sent to the correct recipients.

Invoicing and Billing Statements

The generation of invoices and billing statements is another crucial component of the billing process. Invoices provide a detailed breakdown of the products or services purchased, along with the corresponding prices and any applicable taxes or discounts. Billing statements, on the other hand, summarize the total amount owed by the customer, including any outstanding balances from previous invoices.

Payment Collection and Processing

The collection and processing of payments form an integral part of the billing process. This involves offering multiple payment options, such as credit card payments, bank transfers, or online payment gateways. It is essential to have secure and reliable payment systems in place to ensure the smooth and efficient processing of customer payments.

Account Reconciliation

Account reconciliation is the process of comparing and matching the payments received with the corresponding invoices. It helps in identifying any discrepancies or errors and ensures that all transactions are accurately recorded. Account reconciliation is essential for maintaining accurate financial records and tracking the overall financial health of the business.

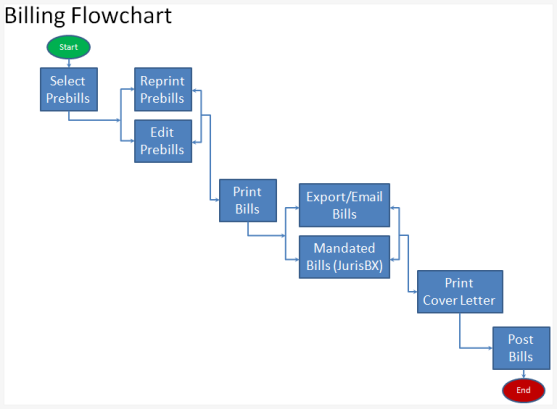

Step-by-Step Guide to the Billing Process

Gathering Customer Details and Generating Bills

The first step in the billing process is to gather customer details, including their contact information, billing addresses, and preferred payment methods. This information can be obtained during the customer onboarding process or through regular customer updates. Once the customer details are collected, bills or invoices are generated using billing software or templates.

Issuing Invoices and Billing Statements

Once the invoices are generated, they are sent to the customers via their preferred method of communication, such as email, postal mail, or online portals. Invoices contain all the relevant details, including the description of the products or services, unit prices, quantities, and any applicable taxes or discounts. Similarly, billing statements are sent periodically to summarize the total outstanding balance and provide an overview of all the invoices.

Sending Notifications and Reminders

It is important to send timely notifications and reminders to customers regarding their outstanding invoices or upcoming due dates. Automated systems can be used to send email notifications or text messages to customers, reminding them to make the payment. These notifications help in ensuring prompt payment and minimizing the chances of late payments or disputes.

Processing Payments

When customers make a payment, the payment needs to be processed and recorded accurately. Depending on the chosen payment method, the payment can be processed manually or through automated systems. Online payment gateways or merchant services can be integrated into the billing process to facilitate secure and convenient payment processing.

Recording and Updating Payments

Once the payments are processed, it is crucial to record and update the payment information in the accounting system or billing software. This helps in maintaining accurate financial records and tracking the status of each invoice. The payment details should include the date, amount, payment method, and any reference numbers or notes provided by the customer.

Reconciling Accounts

Account reconciliation is the final step in the billing process. It involves comparing the recorded payments with the corresponding invoices and identifying any discrepancies or outstanding balances. Reconciling accounts helps in ensuring the accuracy of financial records and provides a clear picture of the overall financial health of the business.

Common Challenges in Billing Process

Late Payments and Outstanding Balances

One of the common challenges in the billing process is dealing with late payments and outstanding balances. This can cause cash flow issues and affect the overall financial stability of the business. To address this challenge, businesses can implement effective reminder systems, offer flexible payment options, and establish clear payment terms and penalties for late payments.

Disputes and Inaccurate Invoices

Another challenge in the billing process is handling disputes and dealing with inaccurate invoices. Disputes may arise due to pricing discrepancies, incorrect product or service descriptions, or billing errors. To minimize disputes, businesses should ensure that invoices are accurate, clear, and detailed and provide a clear system for customers to raise any concerns or disputes.

Technical Issues and System Errors

Technical issues and system errors can also pose challenges in the billing process. These can include software glitches, network outages, or errors in data entry. To address these challenges, businesses should have backup systems in place, regularly update and maintain their software and hardware, and provide training and support to employees to minimize errors.

Payment Fraud and Security Concerns

Payment fraud and security concerns are significant challenges in the billing process. With the increasing reliance on digital payments, businesses need to implement robust security measures to protect customer information and prevent fraudulent activities. This can include using secure payment gateways, implementing encryption protocols, and regularly monitoring and updating security systems.

Tips for Effective Billing and Revenue Management

Maintaining Accurate Customer Data

One of the most important tips for effective billing and revenue management is to maintain accurate customer data. This includes regularly updating customer information, verifying contact details, and monitoring changes in payment preferences. Accurate customer data ensures that invoices are sent to the correct recipients and helps in addressing any payment issues or discrepancies promptly.

Streamlining Invoicing and Payment Processes

Streamlining the invoicing and payment processes can significantly improve the efficiency and effectiveness of the billing process. This can be achieved by implementing automated systems, using billing software or platforms, and integrating payment gateways for quick and secure payment processing. Streamlining the processes saves time, reduces errors, and improves overall customer satisfaction.

Implementing Efficient Billing Systems

The choice of billing system can greatly impact the effectiveness of the billing process. Implementing efficient billing systems, such as cloud-based software or customer relationship management (CRM) solutions integrated with billing functionalities, can streamline the entire billing process. These systems offer features such as automated invoicing, payment reminders, and real-time reporting to enhance efficiency and accuracy.

Regularly Monitoring and Analyzing Performance

Regular monitoring and analysis of the billing process is essential for identifying areas of improvement and ensuring optimal performance. This can include tracking metrics such as average days sales outstanding (DSO), customer payment trends, and invoice accuracy rates. By analyzing the data, businesses can identify bottlenecks, implement process improvements, and enhance overall revenue management.

Ensuring Compliance with Regulations

Compliance with regulations and legal requirements is critical in the billing process. Businesses must ensure that their billing practices align with relevant laws, including tax regulations, consumer protection laws, and data privacy regulations. Compliance not only prevents legal issues but also helps in building trust and credibility with customers.

Impact of Billing Process on Business

Improving Cash Flow and Financial Management

A well-functioning billing process improves cash flow by ensuring timely payment collection and reducing outstanding balances. It provides businesses with a steady stream of revenue and enables effective financial management. Accurate record-keeping and reconciliation help in monitoring and analyzing cash flow patterns, facilitating better financial decision-making.

Enhancing Customer Satisfaction and Trust

An efficient billing process contributes to enhanced customer satisfaction and trust. Clear and detailed invoices, prompt payment processing, and effective communication about payment expectations create a positive customer experience. Customer satisfaction with the billing process can result in increased loyalty, repeat business, and positive word-of-mouth referrals.

Enabling Efficient Business Operations

A smooth billing process enables efficient business operations by reducing administrative tasks and minimizing manual efforts. With automated systems and streamlined processes, employees can focus on other core business activities, such as sales and customer service. This leads to improved productivity and overall operational efficiency.

Facilitating Business Growth and Expansion

A well-executed billing process is crucial for business growth and expansion. It ensures that the business is able to effectively manage its finances, meet financial obligations, and invest in growth opportunities. A solid billing process also provides valuable insights into revenue patterns and customer behavior, enabling businesses to identify potential areas for growth and expansion.

Best Practices for Billing Process

Automating Billing and Payment Procedures

One of the best practices for a billing process is to automate billing and payment procedures as much as possible. This can include using billing software, integrating payment gateways, and setting up recurring billing systems. Automation reduces manual errors, saves time, and ensures consistency in the billing process.

Providing Clear and Detailed Invoices

Clear and detailed invoices are crucial for effective billing. Invoices should clearly state the products or services provided, along with their descriptions, prices, and any applicable taxes or discounts. Including payment due dates, payment methods, and contact information for inquiries or disputes also helps in reducing confusion and improving payment processing.

Offering Flexible Payment Options and Plans

Providing customers with flexible payment options and plans can greatly improve the billing process. Offering multiple payment methods, such as credit card payments, bank transfers, or online payment gateways, ensures convenience for the customers. Similarly, providing installment or payment plans can help in managing large or recurring payments, reducing the chances of late or missed payments.

Implementing Robust Security Measures

To address security concerns and prevent payment fraud, implementing robust security measures is essential. This includes using secure and encrypted payment gateways, regularly updating security systems, and educating employees about best practices for data protection. A secure billing process instills customer confidence and safeguards against potential security breaches.

Recent Developments in Billing Process

Advancements in Billing Software and Systems

Recent advancements in billing software and systems have significantly improved the efficiency and effectiveness of the billing process. Cloud-based software solutions offer scalability, flexibility, and real-time access to billing information. AI-powered billing systems can automate tasks such as invoice generation, payment reminders, and even revenue forecasting, further enhancing the billing process.

Integration of Billing and CRM Solutions

The integration of billing and customer relationship management (CRM) solutions has gained significant momentum in recent years. By combining these two systems, businesses can streamline the entire customer lifecycle, from lead generation and sales to billing and customer support. This integration improves coordination between sales and billing teams, enhances customer experience, and simplifies revenue management.

Digital Transformation in Billing and Payments

Digital transformation has had a profound impact on the billing process and payment methods. With the increasing shift towards online transactions and electronic payments, businesses are embracing digital billing and payment solutions. This includes e-billing, mobile payment apps, and contactless payment options. Digital transformation in billing ensures faster payment processing, improved customer convenience, and reduced administrative costs.

Conclusion

The billing process is a critical component of any business, ensuring timely payment collection, accurate record-keeping, and effective financial management. By understanding the concept of billing, exploring the different billing methods, and implementing efficient billing systems, businesses can optimize their revenue management and enhance customer satisfaction. By addressing common challenges, adopting best practices, and staying updated with recent developments, businesses can adapt their billing process to the changing needs of their customers and leverage it as a strategic tool for growth and success.