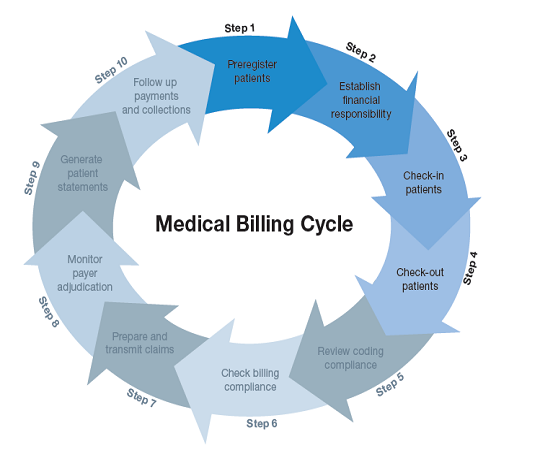

In the realm of healthcare administration, understanding the intricacies of the medical billing process is crucial. With the ever-increasing complexity of medical billing codes and regulations, it is essential to have a clear grasp of the sequential steps involved. This article aims to provide a concise overview of the 10 fundamental steps in the medical billing process, allowing you to navigate this intricate terrain with confidence and proficiency.

Pre-Registration

Gathering patient information

The first step in the medical billing process is pre-registration, which involves gathering important patient information. This information includes the patient’s name, date of birth, contact details, and insurance information. It is crucial to collect accurate and up-to-date information to ensure smooth billing and claims processing.

Verifying insurance eligibility

After collecting patient information, the next step is to verify insurance eligibility. This involves contacting the insurance company to check if the patient’s policy is active and to determine the coverage and benefits. Verifying insurance eligibility enables healthcare providers to understand the patient’s insurance coverage and make informed decisions regarding treatment and billing.

Scheduling appointments

The final step in the pre-registration process is scheduling appointments for patients. This ensures that patients have a designated time to visit the healthcare facility for their medical services. Scheduling appointments aids in managing patient flow and ensures that medical professionals can provide timely and efficient care.

Check-in

Updating patient information

During the check-in process, patients are required to update their personal and insurance information. This step is crucial to ensure that the information on file is accurate and up to date. Patients may have changed their address, contact details, or insurance providers, and updating this information ensures that the billing process is accurate and efficient.

Collecting co-payments

The check-in process also involves collecting co-payments from patients. Co-payments are a portion of the medical costs that the patient is responsible for. Collecting co-payments upfront ensures that the patient has made their financial contribution towards their medical services and also helps in managing revenue for the healthcare facility.

Verifying insurance information

Verifying insurance information during check-in allows the healthcare facility to ensure that the insurance details provided by the patient are accurate and up to date. This step is important to avoid any potential issues with claims submission or denials due to incorrect insurance information. Verifying insurance information helps to streamline the billing process and ensure accurate reimbursement.

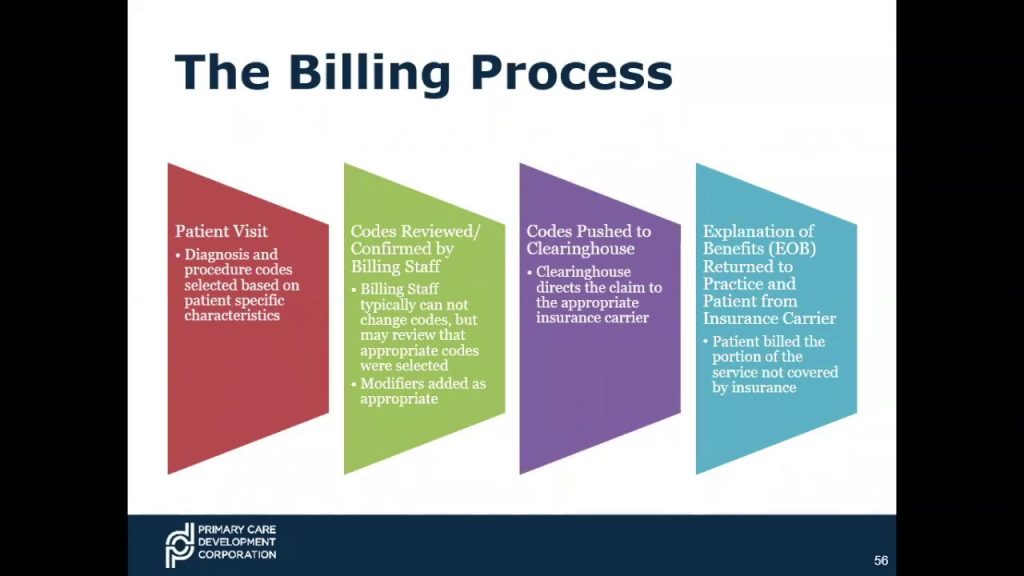

Coding

Assigning appropriate medical codes

Coding is a fundamental step in the medical billing process, where healthcare professionals assign specific medical codes to diagnoses, procedures, and services provided during a patient’s visit. These codes help in accurately describing the patient’s medical condition and the services rendered. Assigning appropriate medical codes ensures proper reimbursement and adherence to coding guidelines.

Using diagnosis codes

Diagnosis codes, also known as International Classification of Diseases (ICD) codes, are used to describe the patient’s medical condition or illness. These codes provide detailed information about the diagnosis, which helps in proper billing and claims submission. Using accurate diagnosis codes ensures that claims are processed smoothly and reflects the patient’s medical needs accurately.

Using procedure codes

Procedure codes, also known as Current Procedural Terminology (CPT) codes, are used to describe the specific medical procedures or services provided to the patient. These codes provide information about the type of service, the complexity, and the resources involved in delivering the care. Using procedure codes assists in accurate billing and enables appropriate reimbursement for the healthcare services provided.

Charge Entry

Medical cost concept with stethoscope and medical bill

Recording charges for services rendered

Charge entry involves recording the charges for the services rendered to patients. This step includes documenting the specific procedures, tests, or treatments provided during the patient’s visit. Accurate charge entry is vital as it ensures that the healthcare facility is appropriately reimbursed for the services provided and reflects the value of the care delivered.

Verifying charges for accuracy

Before entering charges into the billing system, it is essential to verify their accuracy. This involves reviewing the documentation, medical codes, and the fee schedule to ensure that the charges align with the services provided. Verifying charges for accuracy minimizes errors, reduces potential billing disputes, and ensures that the billing process is transparent and compliant.

Entering charges into the billing system

After verifying the charges, the next step is to enter them into the billing system. This involves inputting the relevant information, such as the medical codes, patient details, and any required modifiers, into the billing software or electronic health record system. Entering charges into the billing system paves the way for claims submission and further processing.

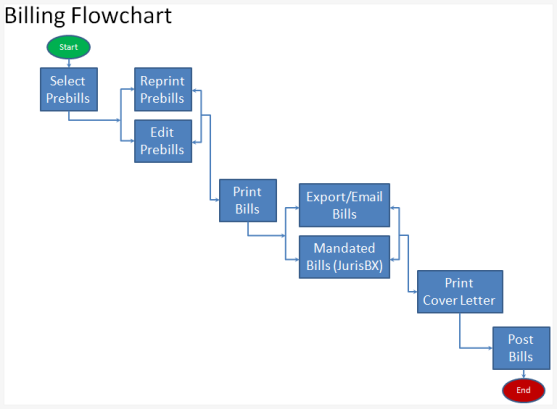

Claim Submission

Generating and reviewing claim forms

Claim submission is a critical step in the medical billing process, where healthcare providers generate and review claim forms. These forms contain all the necessary information, including the patient’s demographics, insurance details, medical codes, and any supporting documentation. Generating and reviewing claim forms ensures completeness and accuracy before submission to the insurance company.

Attaching necessary documentation

Along with claim forms, it may be necessary to attach additional documentation that supports the services provided or justifies medical necessity. This can include progress notes, test results, or referral documents from other healthcare providers. Attaching necessary documentation provides comprehensive information to the insurance company, increasing the chances of successful claim processing.

Submitting claims to insurance companies

Once the claim forms and supporting documentation are prepared, they are submitted to the appropriate insurance companies for processing. This step involves sending the claims electronically or via mail, depending on the insurance provider’s requirements. Submitting claims in a timely manner ensures prompt reimbursement and minimizes delays in the billing process.

Insurance Verification

Verifying insurance coverage and benefits

Insurance verification is a crucial step in the medical billing process, where healthcare providers confirm the patient’s insurance coverage and benefits. This involves contacting the insurance company to verify the policy details, including deductibles, co-insurance, and coverage limits. Verifying insurance coverage and benefits helps in estimating the patient’s financial responsibility and aids in accurate billing.

Confirming patient and provider information

In addition to insurance coverage, it is essential to confirm the accuracy of patient and provider information during insurance verification. This ensures that the correct patient and provider details are included in the claim submission. Confirming patient and provider information avoids potential claim rejections or delays due to incorrect or mismatched information.

Determining pre-authorization requirements

Certain healthcare services or procedures may require pre-authorization from the insurance company before they can be performed. Insurance verification helps in determining these pre-authorization requirements. This involves checking if medical services require prior approval and following the necessary steps to obtain the authorization. Understanding pre-authorization requirements helps in avoiding claim denials and ensuring reimbursement.

Claim Processing

Reviewing claims for completeness and accuracy

After the insurance company receives the claims, they are reviewed for completeness and accuracy. This involves checking if all the necessary information, including medical codes, documentation, and patient details, is present. Reviewing claims for completeness and accuracy helps in minimizing claim rejections and ensures that the claims are processed effectively.

Adjudicating claims based on insurance policies

Claim adjudication is the process where the insurance company reviews the submitted claims and makes decisions regarding coverage and payment. This step involves comparing the services provided with the policy’s benefits and coverage limitations. Adjudicating claims based on insurance policies determines the amount that will be reimbursed to the healthcare provider.

Applying payment adjustments or denials

During claim processing, the insurance company may apply payment adjustments or denials based on their policies and coverage limitations. Payment adjustments can include deductibles, co-pays, or contractual obligations with the healthcare provider. Denials occur when the insurance company determines that the services provided are not covered or do not meet medical necessity. Applying payment adjustments or denials concludes the claim processing stage.

Payment Posting

Recording payments received from insurance companies

Payment posting involves recording the payments received from insurance companies for the services rendered. This step includes updating the patient’s account and reflecting the insurance company’s reimbursement in the financial records. Recording payments received from insurance companies ensures accurate tracking of payments and helps in managing accounts receivable.

Applying payments to patient accounts

Once the payments are recorded, they are then applied to the respective patient accounts. This involves reconciling the payment with the outstanding balances and adjusting the account accordingly. Applying payments to patient accounts ensures that the correct balance is reflected and facilitates accurate financial reporting.

Notifying patients of outstanding balances

In cases where the insurance company’s payment does not cover the full amount due, there may be an outstanding balance remaining for the patient to pay. Notifying patients of outstanding balances is essential to prompt them to settle their financial responsibility. This step involves generating patient statements and providing detailed explanations of the charges and payments received.

Denial Management

Identifying and resolving claim denials

Denial management is an important aspect of the medical billing process. It involves identifying the reasons for claim denials and taking appropriate action to resolve them. This may include reviewing the denial reason, correcting coding or documentation errors, and resubmitting the claim for reconsideration. Identifying and resolving claim denials ensures maximum reimbursement for the services provided.

Appealing denied claims if necessary

If claim denials cannot be resolved through regular channels, healthcare providers have the option to appeal the decision. Appealing denied claims involves presenting additional documentation, evidence, or justification for the medical necessity of the services provided. Appealing denied claims allows healthcare providers to advocate for proper reimbursement and challenge unfavorable decisions.

Updating coding or documentation as needed

As part of denial management, updating coding or documentation may be necessary to address the reasons for claim denials. This can involve reviewing the medical codes used, modifying the diagnosis or procedure codes, or improving the supporting documentation. Updating coding or documentation addresses any deficiencies and helps in successfully resubmitting the claim for reimbursement.

Patient Billing and Follow-up

Generating patient statements

Patient billing is the final step in the medical billing process, where healthcare providers generate and send statements to patients for their outstanding balances. Generating patient statements includes consolidating all the charges, payments, and adjustments into a single document that clearly outlines the financial responsibility. Patient statements provide transparency and facilitate prompt payment collection.

Providing detailed explanation of charges

Along with patient statements, it is important to provide patients with a detailed explanation of the charges incurred. This may involve itemizing the services provided, showcasing the corresponding medical codes, and offering a breakdown of any insurance adjustments or payments. Providing a detailed explanation of charges ensures that patients understand the billing process and can address any questions or concerns.

Following up on unpaid balances

Following up on unpaid balances is crucial for efficient revenue management. This involves contacting patients who have outstanding balances, sending reminders, and working with them to arrange payment plans or resolve any billing discrepancies. Following up on unpaid balances ensures timely collection of payments and helps maintain positive patient-provider relationships.

In conclusion, the medical billing process consists of various interconnected steps that require attention to detail, accurate information gathering, and adherence to coding and insurance guidelines. From pre-registration to patient billing and follow-up, each step plays a vital role in ensuring smooth and accurate billing, appropriate reimbursement, and maintaining financial stability for healthcare providers. By following these ten steps diligently, healthcare facilities can streamline their billing processes and provide optimal patient care.