In the healthcare industry, effectively preparing patients for the billing process is essential for both their understanding and satisfaction. Understanding the intricacies of medical billing can be overwhelming for patients, often leading to confusion, frustration, and potential financial burden. To address these concerns, the product “How Do You Prepare A Patient For Billing?” offers a comprehensive guide to help healthcare professionals navigate this complex process and empower patients with valuable knowledge. By providing step-by-step instructions and clear explanations, this product aims to improve patient experiences, enhance transparency, and promote better financial outcomes for all parties involved.

Gathering Patient Information

Collecting Demographic Information

When preparing a patient for the billing process, it is essential to collect accurate demographic information. This includes the patient’s full name, date of birth, address, and contact details. Gathering these details ensures that the billing statements are correctly addressed and delivered to the right individual. Additionally, demographic information allows healthcare providers to maintain an organized system for patient records and communication.

Verifying Patient Identification

To ensure accurate billing, it is crucial to verify the patient’s identification. This step helps prevent any potential errors and protects both the patient and the healthcare provider. Verifying patient identification involves confirming the patient’s identity through various means, such as checking their photo identification or comparing their information with documents on file. By establishing a reliable identification process, healthcare providers can minimize the risk of fraudulent activities and protect patient confidentiality.

Updating Patient Insurance Details

Another crucial component of preparing a patient for billing is updating their insurance details. Insurance information is subject to change, including policy numbers, coverage plans, and provider networks. By regularly updating a patient’s insurance details, healthcare providers can ensure accurate billing and prevent claim denials. It is essential to communicate with the patient to obtain updated insurance information, including any changes in coverage or primary care physicians.

Obtaining Consent for Billing

Before proceeding with the billing process, it is important to obtain the patient’s consent for billing. This ensures that the patient is aware of the financial responsibilities involved and agrees to the medical services provided. Consent for billing can be obtained through a variety of methods, such as having the patient sign a consent form or verbally confirming their agreement. Obtaining consent not only protects the healthcare provider but also promotes transparency and clarity in the billing process.

Explaining Billing Process

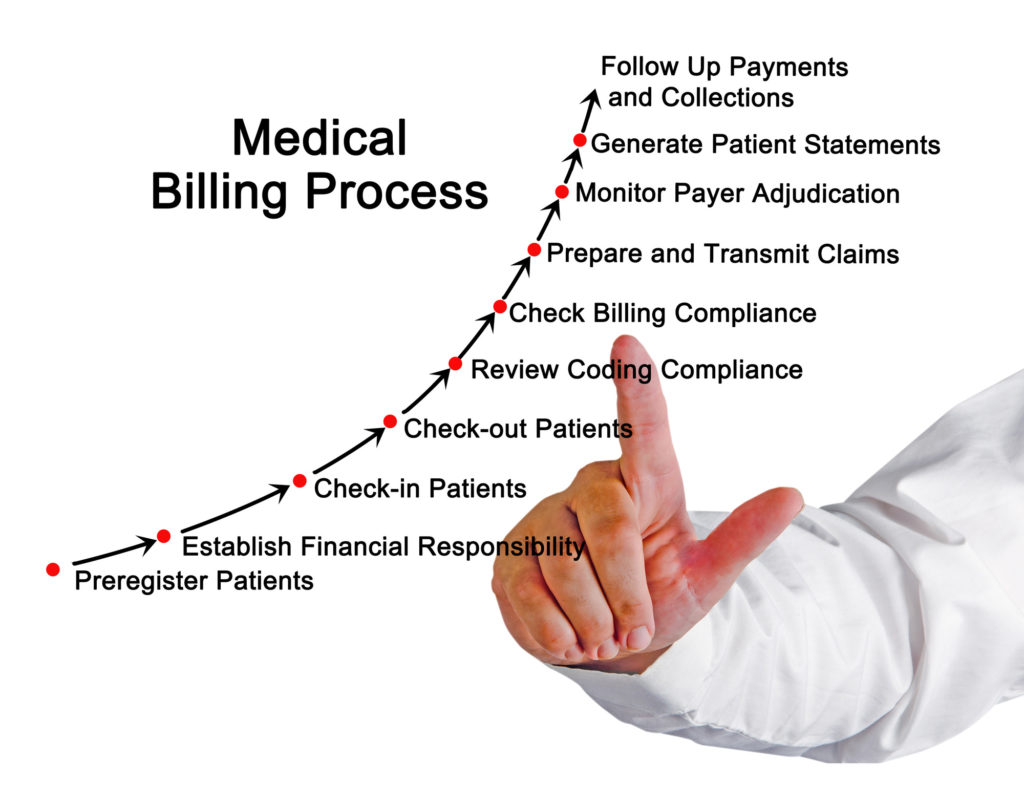

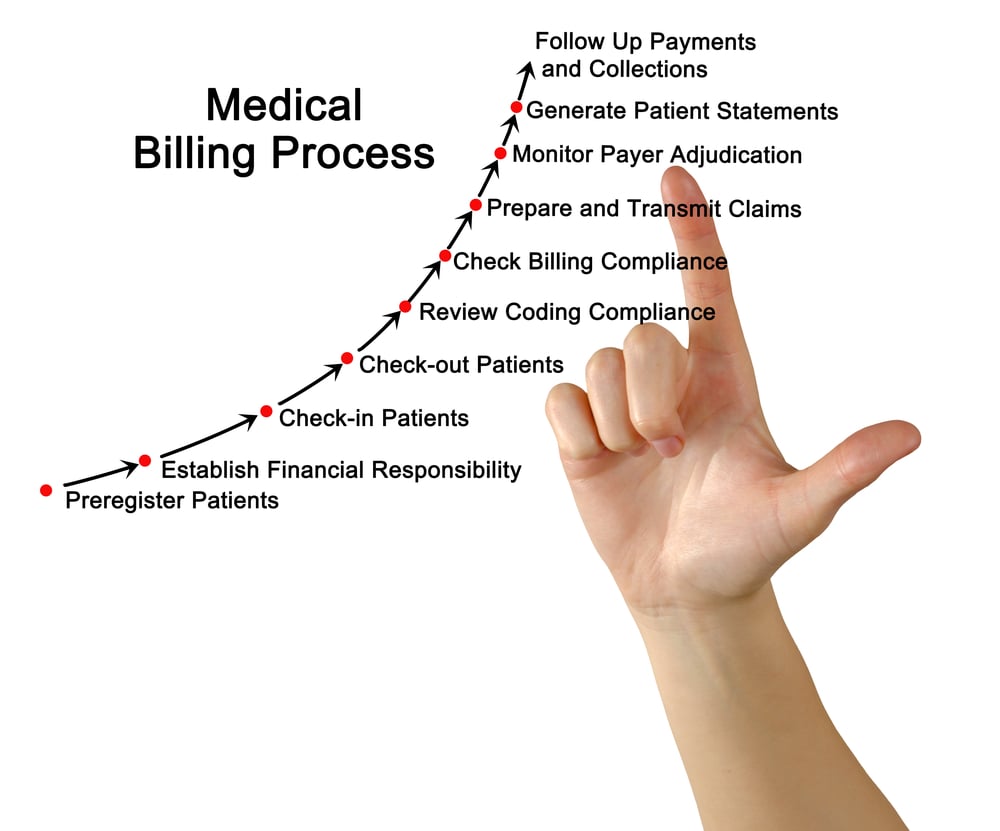

Educating Patients on Billing Procedures

To prepare patients for the billing process, it is vital to educate them on the overall billing procedures. This includes providing a general overview of how medical charges are generated, how insurance claims are processed, and what to expect in terms of statements and payments. By explaining the billing process to patients, healthcare providers can promote understanding and reduce any confusion or anxiety related to financial matters.

Clarifying Insurance Coverage and Benefits

One essential aspect of preparing patients for billing is clarifying their insurance coverage and benefits. This involves explaining what services are covered by their insurance and what portion of the costs they may be responsible for. By clarifying insurance coverage, healthcare providers can help patients understand their financial obligations and make informed decisions regarding their healthcare options. Additionally, this information aids patients in anticipating potential out-of-pocket expenses.

Discussing Out-of-Pocket Expenses

Discussing out-of-pocket expenses is an integral part of preparing patients for billing. Out-of-pocket expenses refer to the costs that patients are responsible for paying directly to the healthcare provider. These expenses may include deductibles, co-pays, and services not covered by insurance. By discussing out-of-pocket expenses with patients upfront, healthcare providers can ensure transparency and allow patients to plan for these costs accordingly.

Informing Patients about Co-pays and Deductibles

Patient education regarding co-pays and deductibles is crucial for their preparedness in the billing process. A co-pay is a predetermined flat fee that patients must pay for specific medical services, while deductibles are the amounts patients must pay out of pocket before their insurance coverage kicks in. By informing patients about co-pays and deductibles, healthcare providers enable them to budget for these costs and avoid any surprises or confusion when receiving their bills.

Providing Cost Estimates

Estimating Costs for Different Procedures

To further prepare patients for the billing process, it is essential to provide accurate cost estimates for different procedures. Cost estimates help patients understand the financial implications of their medical services and can assist them in making informed decisions. Healthcare providers should have a transparent and standardized system for estimating costs, taking into account procedure fees, equipment usage, and any related additional costs, such as medications or post-operative care.

Explaining Calculation Methods

When providing cost estimates, it is crucial to explain the calculation methods used to arrive at the estimated costs. This promotes transparency and helps patients understand the factors considered in determining the expenses associated with their care. Healthcare providers should be able to explain the basis for the cost calculations, including the specific procedure codes utilized, any reimbursement rates set by insurance companies, and any negotiated rates with third-party payers.

Discussing Potential Variances in Costs

While providing cost estimates, healthcare providers should also discuss potential variances in costs that may occur. Factors such as variations in necessary procedures, individual patient needs, and unforeseen complications can impact the final billed amount. By discussing these potential variances upfront, patients can be prepared for any unexpected costs and minimize the risk of financial surprises.

Providing Payment Options

To ensure patients are fully prepared for the billing process, healthcare providers should provide various payment options. Payment options can include options for paying upfront, setting up payment plans, or exploring financial assistance programs. By providing a range of payment options, healthcare providers can accommodate different financial situations and help patients manage their healthcare expenses more effectively.

Offering Financial Assistance

Understanding Patient’s Financial Situation

Offering financial assistance to patients requires a comprehensive understanding of their financial situation. Healthcare providers should have processes in place to assess a patient’s income, assets, and financial obligations. By understanding a patient’s financial circumstances, providers can identify eligibility for assistance programs and tailor financial solutions that are appropriate for each individual’s needs.

Assessing Eligibility for Assistance Programs

To support patients with their billing, healthcare providers should assess their eligibility for assistance programs. These programs may include government-funded healthcare assistance, charity care, or financial aid programs offered by the healthcare facility. By assessing eligibility, healthcare providers can provide patients with information on available resources and guide them through the application process.

Guiding Patients through Application Processes

Assisting patients in navigating the application process for financial assistance programs is crucial. Healthcare providers should provide clear instructions and guidance on completing the necessary paperwork and submitting required documentation. By offering support and streamlining the application process, providers can alleviate some of the stress and complexity associated with seeking financial assistance.

Explaining Payment Plans

When offering financial assistance, healthcare providers should also explain payment plan options to patients. Payment plans allow patients to divide their healthcare expenses into manageable monthly payments. Providers should clearly outline the terms and conditions of payment plans, including interest rates (if applicable), the duration of the plan, and any penalties or fees for late payments. This helps patients understand their obligations and make informed decisions regarding their financial commitments.

Discussing Insurance Coverage

Verifying Insurance Eligibility

To prepare patients for billing, healthcare providers must verify their insurance eligibility. Verifying insurance eligibility involves confirming the patient’s coverage details, including the insurance company, policy number, and effective dates. By verifying insurance eligibility, healthcare providers can ensure that services rendered will be covered by the patient’s insurance and prevent potential claim denials.

Explaining In-Network and Out-of-Network Providers

When discussing insurance coverage, healthcare providers should explain the concepts of in-network and out-of-network providers. In-network providers are healthcare professionals and facilities that have a contract with a patient’s insurance company and have agreed upon discounted rates. Out-of-network providers, on the other hand, do not have agreements with the patient’s insurance company and may result in higher out-of-pocket expenses for the patient. By explaining the importance of in-network providers, patients can make informed choices that minimize their financial obligations.

Reviewing Coverage Limitations and Exclusions

Reviewing coverage limitations and exclusions is crucial to help patients understand the scope of their insurance coverage. Insurance policies often have specific limitations or exclusions, such as certain treatments or procedures not being covered. By reviewing these limitations and exclusions with patients, healthcare providers can ensure that patients are aware of what services may not be covered and can plan accordingly for potential out-of-pocket expenses.

Addressing Pre-Authorization Requirements

Preparing patients for the billing process involves addressing pre-authorization requirements. Pre-authorization refers to the process of obtaining approval from the insurance company before certain procedures or treatments can be performed. Healthcare providers should inform patients about any pre-authorization requirements and guide them through the process of obtaining the necessary approvals. This helps prevent claim denials and ensures that patients receive the maximum insurance coverage for their care.

Preparing for Pre-Authorizations

Identifying Services Requiring Pre-Authorization

To prepare patients for pre-authorizations, healthcare providers should identify the services that require this approval process. Certain procedures, testing, or specialty consultations may require pre-authorization before they can be performed. By identifying these services in advance, providers can inform patients about the importance of obtaining pre-authorization and any potential consequences if pre-authorization is not obtained.

Confirming Referrals and Specialist Visits

Alongside pre-authorizations, healthcare providers should also confirm referrals and specialist visits. Some insurance plans require a referral from a primary care physician before seeing a specialist. Providers should verify the necessity of such referrals and inform patients about the requirements. This ensures that patients have the appropriate documentation in place to maximize their insurance coverage and minimize any potential out-of-pocket costs.

Assisting Patients with Pre-Authorization Process

Assisting patients with the pre-authorization process is crucial to their preparedness for billing. Healthcare providers should guide patients through the necessary paperwork and support them in obtaining all the required documentation and information for pre-authorization. Efficiently assisting patients with the pre-authorization process ensures that the necessary approvals are obtained promptly, minimizing any delays or potential complications in the billing process.

Communicating with Insurance Companies

To facilitate the pre-authorization process, healthcare providers must effectively communicate with insurance companies. This involves submitting the required documentation, following up on approval statuses, and addressing any additional queries or requests from the insurance company. By maintaining clear lines of communication with insurance companies, healthcare providers can ensure a smooth pre-authorization process and avoid unnecessary billing complications.

Confirming Medical Necessity

Ensuring Proper Documentation

Confirming medical necessity requires healthcare providers to ensure that proper documentation is in place. This involves reviewing medical records, test results, and other relevant documents to support the medical necessity of the services provided. Proper documentation not only supports accurate billing but also protects the patient and the healthcare provider by demonstrating that the services rendered were appropriate and necessary.

Reviewing Diagnosis and Treatment Codes

To confirm medical necessity, healthcare providers should review the diagnosis and treatment codes assigned to the patient. These codes outline the specific medical condition, symptoms, procedures, and treatments involved. By reviewing these codes, providers can ensure that the services provided align with the documented medical conditions, further supporting the claim’s legitimacy.

Coordinating with Healthcare Providers

Confirming medical necessity often requires coordination with other healthcare providers involved in the patient’s care. This includes collaborating with primary care physicians, specialists, and other healthcare professionals to ensure that the provided services are well-documented and medically necessary. Coordinating with healthcare providers ensures comprehensive and accurate billing, minimizing the risk of claim denials or delays.

Submitting Relevant Medical Records

To reinforce medical necessity, healthcare providers should submit relevant medical records to insurance companies when required. These records may include test results, imaging reports, surgical notes, or treatment plans. By submitting these records, providers provide the evidence necessary to support the medical necessity of the services rendered, increasing the chances of successful reimbursement.

Addressing Prior Balances

Informing Patients about Outstanding Balances

When preparing patients for billing, it is essential to address any prior balances they may have. Prior balances refer to outstanding amounts owed for previous services rendered. Healthcare providers should inform patients about any existing balances before proceeding with new services. This helps patients understand their current financial obligations and allows them to plan accordingly for any additional costs.

Explaining Payment Options for Past Bills

To assist patients in addressing prior balances, healthcare providers should explain payment options available for past bills. This may include setting up installment plans, offering discounted settlement amounts, or providing information on financial assistance programs. By explaining these options, providers empower patients to address their outstanding balances while still ensuring access to necessary healthcare services.

Discussing the Impact on Future Services

Addressing prior balances involves discussing the potential impact on future services. Depending on the healthcare provider’s policy, patients with outstanding balances may face limitations in scheduling or accessing additional services until the prior balances are resolved. It is crucial to communicate these potential impacts to patients and help them understand the importance of addressing outstanding balances promptly.

Negotiating Settlements or Payment Plans

To facilitate the resolution of prior balances, healthcare providers may engage in negotiations with patients regarding settlements or payment plans. Settlements involve agreeing on a reduced amount to clear the outstanding balance, while payment plans allow patients to divide their payments into manageable installments. Providers should assess the patient’s financial situation and work towards finding mutually beneficial solutions to address prior balances effectively.

Creating Accurate Charge Records

Reviewing Documentation for Accurate Billing

Creating accurate charge records requires healthcare providers to review the documentation thoroughly. This involves verifying that all services provided are well-documented, including any supporting medical records, test results, and treatment plans. By reviewing the documentation, providers ensure that the billed charges accurately represent the services rendered.

Confirming CPT and ICD-10 Codes

Healthcare providers should confirm that the correct Current Procedural Terminology (CPT) and International Classification of Diseases, Tenth Revision (ICD-10) codes are used when creating charge records. CPT codes outline the specific procedures or services provided, while ICD-10 codes indicate the diagnosis or reason for the services rendered. Confirming these codes ensures accurate billing and supports the medical necessity of the services provided.

Capturing Charge Information Correctly

When creating charge records, it is crucial to capture the charge information correctly. This includes accurately documenting the description, quantity, and cost of each service provided. Furthermore, providers should ensure that any additional charges, such as medications or supplies, are appropriately included. Capturing charge information correctly guarantees that patients are billed appropriately and prevents any errors or discrepancies in the billing process.

Documenting Time-Based Services

For time-based services, healthcare providers must document the exact duration of the service accurately. This is particularly important for services such as anesthesia, therapy sessions, or complex procedures that have specific time-based billing rules. Properly documenting the duration of these services ensures accurate billing and supports the appropriate reimbursement for the time spent providing care.

Managing Follow-Up and Appeals

Identifying Denied Claims

Managing follow-up and appeals involves identifying denied claims promptly. Denied claims refer to claims that have been rejected or not reimbursed by insurance companies. Healthcare providers should have a robust system in place to track and identify these denials, ensuring timely follow-up and resolution of any issues.

Resolving Claim Issues and Rejections

Upon identifying denied claims, healthcare providers should promptly work towards resolving any issues or rejections. This may involve reviewing the claim details, confirming that all required information is provided, and addressing any inaccuracies or missing documentation. By addressing claim issues and rejections proactively, providers can avoid lengthy delays in reimbursement and minimize any financial impact on the patient.

Submitting Appeals when Necessary

In certain situations, healthcare providers may need to submit appeals for denied or underpaid claims. Appeals involve challenging the insurance company’s decision and providing additional information or supporting documentation to justify the validity of the claim. It is crucial to follow the insurance company’s specific appeals process and submit the necessary documentation within the required timeframe to maximize the chances of successful resolution.

Keeping Track of Billing Correspondence

To effectively manage follow-up and appeals, healthcare providers should maintain organized records of billing correspondence. This includes keeping track of all communication with insurance companies, including claim submissions, denials, appeal letters, and any supporting documents. By maintaining a comprehensive record, providers can easily reference previous correspondence, update relevant parties on the status of appeals, and keep an accurate audit trail of the billing process.