In the realm of healthcare, a wide range of medical claims exists, serving as crucial tools for patients, healthcare providers, and insurance companies alike. These claims are essential in ensuring that medical services are accurately documented and reimbursed. From primary care visits to surgical procedures, each type of medical claim has its own distinct purpose and intricate process. Understanding the various types of medical claims is not only important for healthcare professionals but also for patients striving for a comprehensive understanding of their medical expenses and insurance coverage. In this article, we will explore the different types of medical claims and shed light on their significance in the complex landscape of healthcare.

Health Insurance Claims

Health insurance claims are an integral part of the healthcare system, allowing individuals to receive reimbursement for the medical services, medication, hospitalization, surgical procedures, and diagnostic tests they have received. Understanding the different types of health insurance claims can help you navigate the process more effectively and ensure that you receive the coverage you are entitled to.

Medical Services Claims

Medical services claims encompass a wide range of healthcare procedures and treatments. These claims include expenses related to physician visits, consultations, laboratory tests, radiology services, and other outpatient services. When submitting a medical services claim, it is important to provide detailed information about the healthcare provider, date of service, and a breakdown of the charges incurred.

Prescription Drug Claims

Prescription drug claims involve the reimbursement of expenses incurred for purchasing medications prescribed by healthcare professionals. Health insurance plans often have different tiers or formularies for prescription drugs, which determine the coverage and cost-sharing arrangement. When submitting a prescription drug claim, it is crucial to provide the name of the medication, dosage, quantity, and the prescribing healthcare provider’s information.

Hospitalization Claims

hospitalization claims cover the expenses associated with inpatient care, including room charges, surgical procedures, nursing care, medications administered in the hospital, and other related services. It is important to thoroughly review your health insurance policy regarding eligibility requirements, coverage limits, and any pre-authorization or pre-certification necessary for hospitalization claims.

Surgical Procedure Claims

Surgical procedure claims pertain to the costs incurred for surgical interventions, such as the surgeon’s fees, anesthesia, operating room charges, and post-operative care. It is essential to gather all relevant documentation, including surgical reports, itemized bills, and any pre-authorization or pre-certification forms, to support your claim for reimbursement.

Diagnostic Test Claims

diagnostic test claims involve reimbursement for the expenses associated with various diagnostic procedures, such as X-rays, MRIs, CT scans, blood tests, and biopsies. Supporting documentation, such as requisition forms, test results, and itemized bills, should be provided when submitting diagnostic test claims.

Workers’ Compensation Claims

Workers’ compensation claims are specific to individuals who have experienced work-related injuries or illnesses. These claims are designed to provide financial assistance and support to employees who have suffered occupational injuries, illnesses, or accidents. Understanding the different types of workers’ compensation claims can help ensure that you receive appropriate compensation for your work-related condition.

Occupational Injury Claims

Occupational injury claims cover injuries sustained while performing work-related tasks or activities. These can include fractures, sprains, strains, burns, cuts, and other physical injuries. It is important to report the injury promptly to your employer, seek appropriate medical treatment, and provide all necessary documentation to support your claim.

Occupational Illness Claims

Occupational illness claims involve illnesses or diseases that are directly related to or caused by exposure to hazardous conditions, substances, or activities in the workplace. These illnesses can range from respiratory conditions, such as asthma and lung disease, to chronic conditions resulting from prolonged exposure to toxic substances. It is crucial to obtain medical documentation linking the illness to your specific work environment when submitting an occupational illness claim.

Workplace Accident Claims

Workplace accident claims are specific to accidents that occur in the work environment, such as slip and falls, machinery accidents, or incidents involving falling objects. These claims may cover expenses related to medical treatment, rehabilitation, lost wages, and disability benefits. Providing detailed documentation of the accident, including witness statements and any applicable incident reports, is essential when filing a workplace accident claim.

Auto Accident Claims

Auto accident claims involve seeking compensation for injuries or damages resulting from motor vehicle accidents. Whether you are a driver, passenger, or pedestrian involved in an auto accident, understanding the different types of auto accident claims can help you navigate the claims process effectively.

Personal Injury Claims

Personal injury claims encompass injuries sustained by individuals involved in motor vehicle accidents. These claims may cover medical expenses, pain and suffering, lost wages, and other damages resulting from the accident. It is essential to gather evidence, such as the accident report, medical records, and witness statements, to support your personal injury claim.

Property Damage Claims

Property damage claims involve seeking reimbursement for damages to your vehicle or other property caused by the accident. These claims cover the costs of repairs or replacement, as well as any related expenses, such as towing or storage fees. Providing photographs of the damage, repair estimates, and any supporting documentation can help facilitate the property damage claims process.

Medical Expenses Claims

Medical expenses claims involve seeking reimbursement for the costs of medical treatment and services resulting from auto accident injuries. These claims cover expenses such as hospital visits, medication, rehabilitation, physical therapy, and other necessary healthcare services. Collecting all relevant medical records, bills, and receipts is crucial when filing a medical expenses claim.

Lost Wages Claims

Lost wages claims pertain to seeking compensation for the income lost due to injuries sustained in an auto accident. These claims cover the wages missed during the recovery period and, in some cases, may extend to future lost earning capacity. It is important to provide documentation, such as pay stubs, tax returns, and a letter from your employer, to support your lost wages claim.

Disability Insurance Claims

Disability insurance claims involve seeking financial assistance and support when an individual is unable to work due to a disability. Understanding the different types of disability insurance claims can help you navigate the claims process and ensure that you receive the benefits you are entitled to.

Short-Term Disability Claims

Short-term disability claims involve seeking benefits for a temporary disability that prevents you from working. These claims typically cover a specific period, such as several weeks to a few months, and provide a percentage of your regular income. Typically, short-term disability claims require medical documentation supporting the disability and its impact on your ability to work.

Long-Term Disability Claims

Long-term disability claims pertain to seeking benefits for a disability that is expected to last for an extended period, usually over six months or more. These claims provide financial support when an individual is unable to perform their job due to the disability. Long-term disability claims often require extensive medical documentation, including physicians’ reports, test results, and evidence of ongoing treatment.

Total Disability Claims

Total disability claims involve seeking benefits when an individual is completely unable to perform any occupation or work due to a disability. These claims typically require rigorous medical documentation and evidence demonstrating the inability to engage in any gainful employment. It is important to thoroughly review your disability insurance policy to understand the criteria for total disability claims.

Partial Disability Claims

Partial disability claims encompass situations where an individual can still perform some work or occupation, but the disability limits their earning capacity. These claims often involve assessing the individual’s residual functional capacity and the impact of the disability on their ability to work. Providing medical documentation and vocational assessments can help support a partial disability claim.

Medical Malpractice Claims

Medical malpractice claims arise when a healthcare professional’s negligence or omission results in harm or injury to a patient. Understanding the different types of medical malpractice claims can help you pursue appropriate legal action and seek compensation for the damages suffered.

Wrong Diagnosis Claims

Wrong diagnosis claims involve situations where a healthcare professional provides an incorrect or delayed diagnosis, leading to harm or injury to the patient. These claims generally require expert testimony to establish the standard of care and prove that the wrong diagnosis caused harm. Medical records, diagnostic tests, and opinions from other healthcare professionals may be crucial when pursuing a wrong diagnosis claim.

Surgical Errors Claims

Surgical errors claims pertain to situations where errors occur during surgical procedures, resulting in harm or injury to the patient. These errors can include wrong-site surgeries, anesthesia errors, instrument or foreign object retention, or other surgical complications. Collecting surgical reports, medical records, and expert opinions is essential when pursuing a surgical errors claim.

Medication Errors Claims

Medication errors claims involve situations where errors occur in prescribing, dispensing, or administering medications, leading to harm or injury to the patient. These claims may cover medication interactions, dosage errors, allergic reactions, or the administration of the wrong medication. It is important to gather all relevant medical records, pharmacy records, and expert opinions when pursuing a medication errors claim.

Birth Injury Claims

Birth injury claims arise when healthcare professionals’ negligence or errors during childbirth lead to harm or injury to the mother or baby. These claims can involve complications during labor, improper use of medical devices, failure to monitor the baby’s well-being, or other birth-related injuries. Collecting detailed medical records, expert opinions, and opinions from specialists can be crucial when pursuing a birth injury claim.

Medicare Claims

Medicare claims pertain to seeking reimbursement for healthcare services covered under the Medicare insurance program. Understanding the different types of Medicare claims can help beneficiaries navigate the complex process and ensure that their expenses are appropriately covered.

Part A Claims

Part A claims involve seeking reimbursement for inpatient hospital services, skilled nursing facility care, hospice care, and some home health services. Medicare Part A claims require submitting the appropriate forms, including itemized bills, physician orders, and other necessary documentation.

Part B Claims

Part B claims encompass reimbursement for outpatient, medical, and durable medical equipment services, including physician visits, laboratory tests, X-rays, and preventive screenings. Beneficiaries need to provide detailed information, including the healthcare provider’s information, service dates, and a breakdown of charges when submitting Part B claims.

Part D Claims

Part D claims involve seeking reimbursement for prescription medications covered under Medicare Part D plans. These claims typically require providing detailed information about the medication, including the name, dosage, quantity, and prescribing physician’s information. It is important to review your Part D plan’s formulary and understand any coverage limitations or cost-sharing arrangements.

Medicaid Claims

Medicaid claims involve seeking reimbursement for healthcare services covered under the Medicaid program, which provides assistance to low-income individuals and families. Understanding the different types of Medicaid claims can help beneficiaries access necessary healthcare services and ensure appropriate coverage.

Inpatient Service Claims

Inpatient service claims cover the expenses associated with hospitalization and other inpatient healthcare services. These claims require submitting detailed documentation, including hospital records, itemized bills, and any necessary authorizations from the Medicaid program.

Outpatient Service Claims

Outpatient service claims involve seeking reimbursement for healthcare services provided outside of a hospital setting, such as physician visits, laboratory tests, and outpatient surgery. Beneficiaries need to provide documentation, such as detailed bills, diagnostic reports, and any referrals or authorizations required by the Medicaid program.

Managed Care Claims

Managed care claims pertain to individuals enrolled in Medicaid managed care plans, where healthcare services are provided through a contracted network of healthcare providers. These claims typically require filing appropriate forms and providing necessary documentation, such as bills, receipts, and any documentation required by the managed care organization.

Veterans Affairs (VA) Claims

Veterans Affairs (VA) claims involve seeking benefits and compensation for injuries or disabilities incurred while serving in the military. Understanding the different types of VA claims can help veterans access the support they are entitled to and navigate the VA claims process.

Service-Connected Claims

Service-connected claims involve seeking benefits for disabilities or injuries directly resulting from military service. These claims require providing evidence linking the disability to the individual’s military service, such as service records, medical evidence, and expert opinions.

Non-Service-Connected Claims

Non-service-connected claims involve seeking benefits for disabilities or injuries that are not directly related to military service. These claims typically involve disabilities acquired after military service or other qualifying circumstances, such as service-connected disabilities impacting an individual’s ability to work.

Disability Pension Claims

Disability pension claims involve seeking financial assistance for veterans who are disabled and have limited income and resources. These claims require demonstrating the veteran’s disability, income limitations, and other eligibility criteria to qualify for a disability pension through the VA.

Eligibility Claims

Eligibility claims encompass situations where veterans seek benefits based on their eligibility for VA programs and services. These claims involve providing necessary documentation, such as discharge papers (DD Form 214), proof of service-connected disabilities, income verification, and other eligibility requirements specific to the VA program or service.

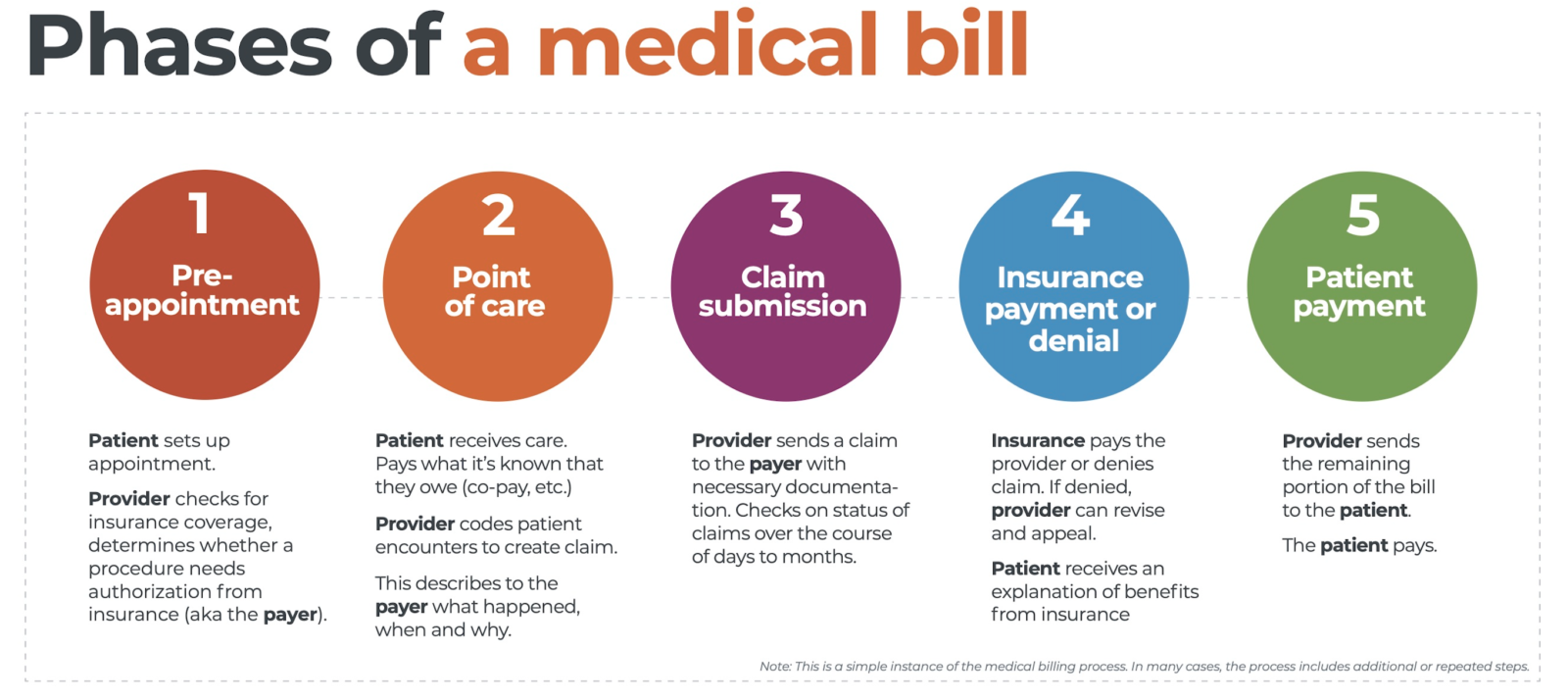

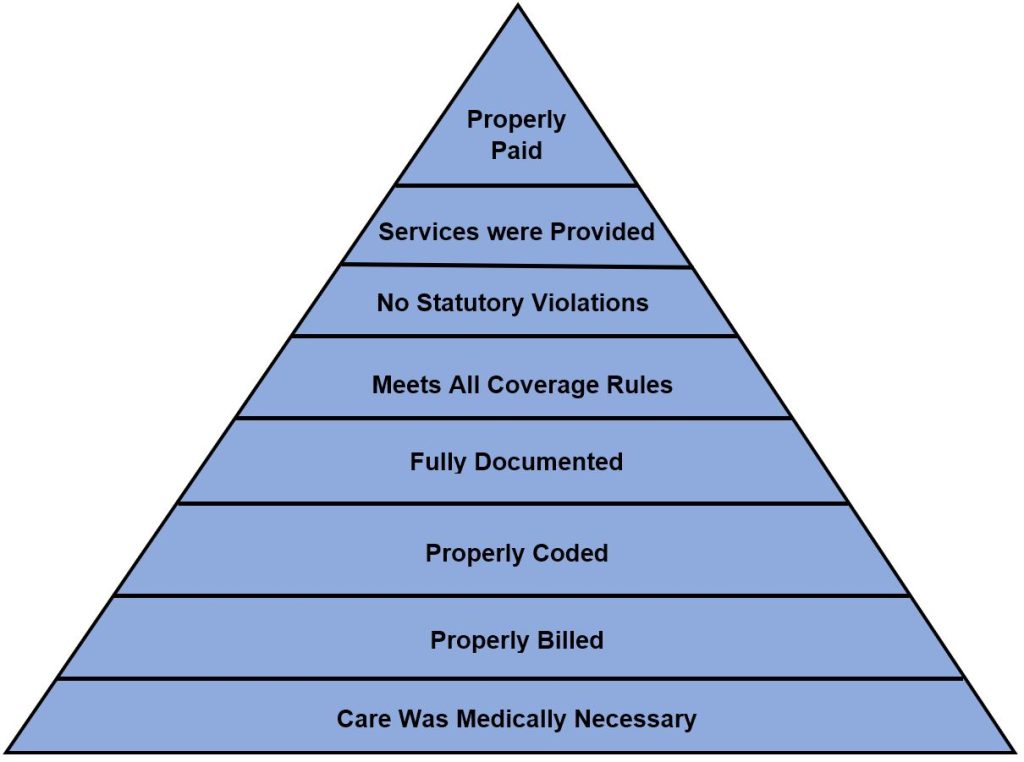

This image is property of i0.wp.com.

Personal Injury Protection (PIP) Claims

Personal Injury Protection (PIP) claims are specific to individuals involved in auto accidents in states with no-fault insurance systems. PIP coverage provides benefits for medical expenses, lost wages, and other related expenses, regardless of who is at fault in the accident. Understanding the different types of PIP claims can help individuals access the available benefits.

Medical Treatment Claims

Medical treatment claims involve seeking reimbursement for medical expenses resulting from an auto accident covered under PIP insurance. These claims typically require providing medical records, bills, and other documentation to verify the necessity and cost of the medical treatment received.

Rehabilitation Claims

Rehabilitation claims pertain to seeking reimbursement for expenses related to physical therapy, occupational therapy, or other rehabilitation services required due to injuries sustained in an auto accident. These claims may require providing treatment plans, invoices, and other documentation to support the need for rehabilitation services.

Lost Income Claims

Lost income claims involve seeking compensation for wages or income lost due to the inability to work following an auto accident covered under PIP insurance. These claims typically require providing evidence of lost wages, such as payroll records, tax returns, and a letter from your employer, to support the claim for lost income.

Funeral Expenses Claims

Funeral expenses claims are specific to situations where a person dies as a result of injuries sustained in an auto accident covered by PIP insurance. These claims provide reimbursement for funeral and burial costs, as well as related expenses such as transportation and handling. Providing itemized funeral bills and other documentation is crucial when filing a funeral expenses claim.

Dental Insurance Claims

Dental insurance claims involve seeking reimbursement for dental services and treatments covered under dental insurance policies. Understanding the different types of dental insurance claims can help individuals access necessary dental care and ensure appropriate coverage.

Preventive Care Claims

Preventive care claims encompass routine dental exams, cleanings, x-rays, and other preventive treatments. These claims typically require providing detailed documentation, such as dental records, service dates, and a breakdown of charges, to support the reimbursement for preventive dental services.

Basic Restorative Claims

Basic restorative claims involve seeking reimbursement for dental procedures aimed at restoring the function and structure of teeth, such as fillings and simple extractions. When filing a basic restorative claim, it is important to provide the dental provider’s information, procedure codes, and a breakdown of charges.

Major Restorative Claims

Major restorative claims pertain to more extensive dental procedures, such as crowns, bridges, dentures, and dental implants. These claims typically require providing treatment plans, diagnostic records, and a breakdown of charges to support the reimbursement for major restorative dental services.

Orthodontics Claims

Orthodontics claims involve seeking reimbursement for orthodontic treatments and braces to correct misaligned or maloccluded teeth. These claims may require pre-authorization or pre-certification and need to be supported by treatment plans, progress reports, and a breakdown of charges to ensure appropriate coverage for orthodontic services.