Outsourcing medical billing has emerged as a prudent choice for numerous healthcare providers seeking to streamline their operations and maximize revenue. By outsourcing this critical function, healthcare professionals can delegate the complex task of billing and coding to experienced professionals who possess an in-depth understanding of the ever-evolving healthcare regulations and industry standards. This approach not only ensures accuracy and precision in the billing process but also enables healthcare providers to focus on delivering quality patient care without being burdened by administrative tasks. Moreover, outsourcing medical billing presents a cost-effective solution for healthcare organizations, relieving them of the need to invest in expensive billing software, technology upgrades, and hiring and training specialized staff. In this article, we will explore the various reasons why outsourcing medical billing has become an increasingly popular and advantageous choice for healthcare providers.

Reduced Costs

Outsourcing medical billing can lead to significant cost reductions for healthcare providers. By partnering with a professional medical billing service, you can eliminate the need for in-house billing staff, which means no salaries or benefits to cover. This reduction in personnel costs alone can result in substantial savings for your organization.

In addition to eliminating the need for a dedicated billing team, outsourcing also helps lower overhead expenses. With in-house billing, you may need to invest in office space, equipment, and software. By outsourcing, you can avoid these overhead costs and allocate your resources more efficiently.

Outsourcing medical billing also helps eliminate billing errors, which can be a costly and time-consuming issue. Professional billing services have the expertise and resources to accurately code and submit claims, minimizing the risk of rejected or denied claims. By avoiding these errors, you can save both time and money by reducing the need for rework and resubmission.

Furthermore, outsourcing medical billing can lead to reduced training costs. In-house billing staff requires ongoing training to stay updated on regulatory changes, coding guidelines, and technological advancements. By outsourcing, you can rely on the expertise of the billing service provider, freeing up your resources to focus on other training needs within your organization.

Increased Efficiency

Outsourcing medical billing brings specialized expertise to the table. Professional billing services are dedicated to the intricacies of medical billing and stay up to date with the latest industry changes. This expertise ensures that your claims are accurately coded, submitted promptly, and processed efficiently.

Streamlined workflows are another advantage of outsourcing. By partnering with a billing service, you can implement standardized and efficient billing processes. This streamlining reduces the chances of bottlenecks and delays in claims processing, allowing for faster reimbursement.

Faster claims processing is a direct result of outsourcing medical billing. Professional billing services have the resources and technology to expedite the claims submission and payment processes. With their expertise, they can navigate through the complexities of insurance requirements, reducing the time it takes to receive payment for services rendered.

Improved revenue cycle management is another benefit of outsourcing medical billing. Professional billing services focus on maximizing revenue collection and minimizing revenue leakage. By closely monitoring accounts receivable, they can identify and address any issues that could impact your cash flow. This proactive approach ensures that your revenue cycle is managed effectively, ultimately leading to increased financial stability for your organization.

This image is property of www.medicalbillersandcoders.com.

Access to Latest Technology

Outsourcing medical billing provides access to cutting-edge billing software and technology. Professional billing service providers invest in advanced billing software to streamline their operations and enhance efficiency. By leveraging this technology, they can optimize the billing process and improve accuracy and speed.

Electronic claims submission is a key feature of advanced billing software. By electronically submitting claims, billing services can expedite the claims process, reduce errors, and increase the likelihood of fast and accurate reimbursement. This technology eliminates the need for paper-based claims, saving time and resources for all parties involved.

Automated payment posting is another advantage of outsourcing medical billing. With automated payment posting, billing services can efficiently post payments, reconcile accounts, and identify any discrepancies. This automation reduces the chances of errors and speeds up the payment reconciliation process, leading to improved cash flow management.

Data analytics and reporting tools are an invaluable asset when it comes to outsourcing medical billing. Professional billing services can generate comprehensive reports and analyze key performance indicators (KPIs) to provide valuable insights into your revenue cycle. These actionable insights allow you to make informed decisions and identify areas for improvement.

Focus on Core Competencies

Outsourcing medical billing allows healthcare providers to focus on their core competencies, such as patient care and medical practices. By offloading the complex and time-consuming task of billing, you can allocate more resources and time to delivering high-quality healthcare services.

By partnering with a professional billing service, you gain more time for patient care. Rather than spending hours on billing-related tasks, your staff can focus on providing personalized care and attention to patients. This enhanced patient care can lead to improved patient satisfaction, ultimately driving better outcomes and loyalty.

Outsourcing medical billing can also enhance your medical practices. With more time and resources available, you can invest in continuing education and training for your staff. By staying updated on advancements in medical treatments and techniques, you can provide the highest level of care to your patients.

The improved patient satisfaction resulting from outsourcing medical billing can have a positive impact on your organization. Satisfied patients are more likely to recommend your services to others and can contribute to the growth of your patient base. By focusing on patient care, you can build a strong reputation and attract new patients.

Additionally, outsourcing medical billing can increase physician productivity. Without the hassle of billing-related tasks, physicians can spend more time on patient consultations and examinations. This increased productivity can lead to a higher volume of patients seen per day, ultimately boosting your revenue potential.

This image is property of medusarcm.com.

Enhanced Compliance

Ensuring compliance with industry regulations is crucial for healthcare providers. When you outsource medical billing, you gain access to experts who have comprehensive knowledge of regulations and coding guidelines. These professionals stay up to date with changes, minimizing the risk of compliance violations and penalties.

Accurate coding and documentation are essential for compliant medical billing. Professional billing services have the expertise to accurately assign the correct codes for services rendered and ensure proper documentation. By outsourcing, you can reduce the chances of coding errors and missed opportunities for reimbursement.

Outsourcing medical billing also helps reduce the risk of audits and penalties. Professional billing services follow industry best practices and have robust compliance measures in place. By partnering with a reputable billing service, you can significantly lower the risk of audits and associated financial and reputational consequences.

Privacy and security are critical in healthcare, and outsourcing medical billing can enhance both. Professional billing services have stringent privacy and security protocols in place to protect patient information. By outsourcing, you can ensure that your patients’ data is handled with the utmost care and compliance with privacy laws.

Scalability and Flexibility

Outsourcing medical billing offers scalability and flexibility for healthcare providers. Whether you are experiencing growth or downsizing, outsourcing allows you to adapt to changing needs without the constraints of an in-house billing team.

Easier growth or downsizing is possible when you outsource medical billing. If your organization is expanding, a professional billing service can quickly scale their operations to accommodate increased volumes. On the other hand, if you need to downsize, you can easily adjust the services provided by the billing service accordingly.

The ability to adapt to changing needs is an advantage of outsourcing. As healthcare regulations, insurance requirements, and technology evolve, outsourcing allows you to stay ahead of these changes. Professional billing services invest in ongoing training and keep up with the latest industry trends, ensuring that your billing processes are always up to date.

Outsourcing medical billing also offers customizable services. A reputable billing service provider can tailor their services to meet your specific needs and requirements. This flexibility allows you to choose the level of involvement and support that aligns with your organization’s goals and priorities.

Access to additional resources is another benefit of outsourcing. Professional billing services have a pool of experienced billing professionals, IT specialists, and customer support teams. By partnering with them, you can tap into this expertise and resources, enhancing the efficiency and effectiveness of your billing operations.

This image is property of statimllc.com.

Reliability and Consistency

Outsourcing medical billing provides reliability and consistency for your revenue cycle management. Professional billing services offer 24/7 support, ensuring that your billing inquiries and concerns are addressed promptly. This constant support minimizes interruptions and helps maintain a smooth revenue flow.

Reduced staff turnover is a significant advantage of outsourcing. High staff turnover can negatively impact the continuity and efficiency of your billing processes. By relying on a dedicated team of billing experts through outsourcing, you can avoid the challenges associated with recruiting, training, and retaining in-house billing staff.

Consistent revenue flow is a crucial aspect of financial stability for healthcare organizations. With outsourced medical billing, you can expect a steady and predictable revenue flow. Professional billing services have the expertise and resources to optimize your accounts receivable management, reducing delays and improving cash flow.

High accuracy rate is another key benefit of outsourcing medical billing. Professional billing services prioritize accuracy in coding, documentation, and claims submission. With their expertise and attention to detail, they minimize the chances of errors and increase your chances of receiving the correct reimbursement for services rendered.

Improved Cash Flow

Outsourcing medical billing can significantly improve your cash flow. Faster claims submission and payment are key advantages of partnering with professional billing services. They have the technology and expertise to expedite the claims process, reducing the average time it takes to get reimbursed.

Reduced claim denials and rejections are another benefit of outsourcing medical billing. Professional billing services ensure that claims are accurately coded and comply with insurance requirements. By minimizing billing errors, they increase the chances of claims being accepted and paid promptly.

Effective follow-up on unpaid claims is a crucial aspect of optimizing your cash flow. Outsourcing medical billing allows billing services to dedicate time and resources to follow up on unpaid claims. They have the expertise to identify and resolve any issues that may be delaying payment, ensuring that you receive the reimbursement you are owed.

Optimized accounts receivable management is a key focus of professional billing services. They closely monitor your accounts receivable, identify any bottlenecks or delinquent payments, and take appropriate actions to maximize collections. By outsourcing, you can rely on their expertise to streamline your revenue cycle and enhance your cash flow.

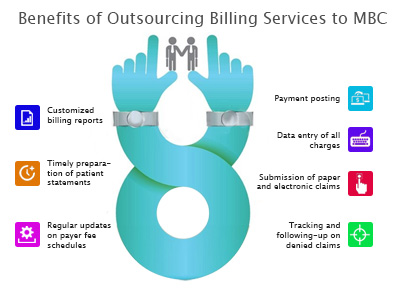

This image is property of practolytics.com.

Better Transparency

Outsourcing medical billing provides better transparency into your financial performance. With real-time data access, you can monitor your revenue cycle metrics and key performance indicators on demand. This visibility empowers you to make informed decisions and take timely action when needed.

Detailed financial reports are an invaluable tool for healthcare providers. By outsourcing medical billing, you can expect comprehensive financial reports that provide insights into your revenue cycle performance, billing trends, and areas for improvement. These reports enable you to assess your financial health and make strategic decisions accordingly.

Audit trails and documentation are crucial for compliance and accountability. Professional billing services maintain accurate and complete records of all billing transactions, making it easier for you to track and verify claims. These audit trails and documentation serve as evidence of compliance and can be invaluable in case of audits or reviews.

Clear communication channels are a priority when outsourcing medical billing. Professional billing services ensure transparent and open communication with their clients. This communication allows you to stay informed about the status of your claims, address any concerns promptly, and build a strong partnership based on trust and collaboration.

Risk Mitigation

Outsourcing medical billing helps mitigate legal and financial risks for healthcare providers. By partnering with a professional billing service, you gain access to expert knowledge of regulations and compliance requirements. This expertise minimizes the chances of compliance violations and associated legal and financial liabilities.

Minimizing financial risks is another advantage of outsourcing. Professional billing services have comprehensive knowledge of insurance requirements, reimbursement policies, and coding guidelines. By relying on their expertise, you can ensure accurate claims submission, reducing the risk of financial losses due to underbilling or improper coding.

Expert knowledge of regulations is a significant benefit of outsourcing medical billing. Reputable billing service providers stay up to date with regulatory changes, ensuring that your billing practices are compliant. This expertise minimizes the risk of penalties and sanctions resulting from non-compliance with industry regulations.

Prompt insurance verification is crucial for ensuring accurate billing and minimizing the risk of claim denials. With outsourcing, you can rely on billing services to verify patients’ insurance coverage and eligibility promptly. By confirming insurance details, you can increase the chances of claim acceptance and timely reimbursement.

In conclusion, outsourcing medical billing offers a wide range of benefits for healthcare providers. From cost reductions and increased efficiency to access to latest technology and risk mitigation, outsourcing can significantly improve your revenue cycle management. By partnering with a professional billing service, you can allocate your resources more effectively, focus on core competencies, and enhance patient care. Ultimately, outsourcing medical billing can lead to greater financial stability, improved cash flow, and better transparency into your organization’s financial performance.