In the ever-evolving landscape of healthcare costs, finding effective strategies to alleviate the burden of high medical bills has become an increasingly pressing concern for many individuals. With the relentless rise in healthcare expenses, one cannot help but wonder if there are any viable approaches to reducing the cost of a medical bill. Delving into this intricate dilemma, this article explores potential avenues that may offer some respite to those caught in the spiraling cycle of exorbitant medical expenses. From negotiating with healthcare providers to exploring alternative payment options, discover practical solutions that could potentially alleviate the financial strain associated with medical bills.

Negotiating with Healthcare Providers

As a patient, understanding your medical bill is an important first step in negotiating with healthcare providers. Medical bills can be complex and confusing, often filled with codes and abbreviations that may seem like a foreign language. By taking the time to review and comprehend your medical bill, you will be better equipped to ask for adjustments or negotiate payment arrangements.

One effective strategy when negotiating with healthcare providers is to ask for an itemized bill. An itemized bill provides a breakdown of each service and its associated cost, allowing you to identify any potential errors or inflated charges. Requesting an itemized bill shows the healthcare provider that you are serious about understanding the charges and can help open the door for negotiation.

When faced with a high medical bill, it is worth inquiring about discounts or financial assistance programs offered by the healthcare provider. Many providers offer financial assistance based on income or other qualifying criteria, which can significantly reduce the overall cost of your bill. By asking about these options, you demonstrate your willingness to work with the provider to find a mutually beneficial solution.

Discussing payment plans is another avenue to explore when negotiating with healthcare providers. Rather than paying the entire bill upfront, you can propose a monthly payment plan that fits within your budget. Healthcare providers understand the financial strain medical bills can cause, and many are willing to work with patients to create manageable payment arrangements.

For those who have the means to do so, offering a lump sum payment can sometimes result in a reduced bill. Healthcare providers may be more inclined to accept a lower sum upfront rather than waiting for smaller monthly payments over an extended period. This approach requires careful consideration of your financial situation and the potential savings that can be negotiated.

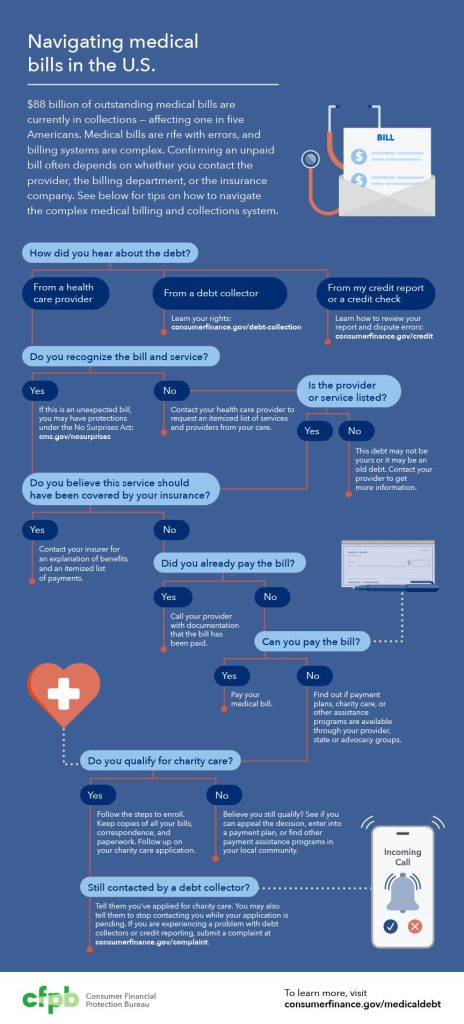

In cases where the medical bill is overwhelming and payment seems impossible, seeking charity care or financial aid may be the best option. Many hospitals and healthcare organizations have programs in place to assist individuals who are unable to pay their medical bills. These programs may provide partial or complete forgiveness of the bill based on financial need. It is crucial to research and inquire about these programs to determine if you qualify for assistance.

Utilizing Health Insurance

If you have health insurance coverage, it is crucial to confirm that your specific medical service or treatment is covered. Review your insurance policy or contact the insurance company directly to understand your coverage. Knowing which services are covered and the associated costs can help you plan your finances accordingly.

When reviewing your insurance coverage, be sure to check for out-of-network charges. Out-of-network providers may not be covered by your insurance plan, leading to higher out-of-pocket expenses. If you receive care from an out-of-network provider, it is worth contacting your insurance company to discuss possible coverage arrangements. In some cases, the insurance company may make exceptions, especially if the out-of-network care was a result of a referral or emergency situation.

In the event that your insurance company denies a claim, it is crucial to understand your right to appeal. Insurance companies can make mistakes, and it is not uncommon for valid claims to be denied initially. Review the denial letter carefully, follow the instructions provided, and gather any necessary documentation to support your appeal. By appealing denied claims, you have the opportunity to provide additional information or clarify any misunderstandings, potentially resulting in coverage for the services rendered.

Negotiating with the insurance company directly is another approach to consider. Sometimes, insurance companies may be willing to negotiate the amount they reimburse for a particular service or treatment. This is particularly relevant if you have received an out-of-network service or if the insurance company has not fully covered a claim. It may be helpful to gather evidence that supports your request for negotiation, such as pricing information from other providers or the average cost for the same service in your area.

For individuals who do not have health insurance or are facing high out-of-pocket costs, exploring healthcare cost-sharing programs can provide financial relief. These programs, often offered by religious organizations or nonprofit groups, involve pooling resources with other participants to cover medical expenses. Healthcare cost-sharing programs operate on the principle of shared financial responsibility and can be a viable alternative to traditional health insurance.

Seeking Alternative Treatment Options

In some cases, exploring alternative treatment options can help lower the cost of medical care. Telemedicine or virtual care, for example, allows patients to consult with healthcare professionals remotely. This innovative approach eliminates the need for in-person visits, reducing transportation costs and potentially lowering medical bills. Telemedicine is particularly beneficial for non-emergency situations or routine check-ups.

When it comes to prescription medications, considering generic or alternative options can lead to significant cost savings. Generic medications are bioequivalent to their brand-name counterparts but come at a fraction of the cost. Working with your healthcare provider to explore generic alternatives can help reduce your out-of-pocket expenses. Additionally, some medications may have alternative therapies or over-the-counter options that are equally effective, yet less costly.

For individuals seeking specialized or experimental treatments, looking for clinical trials or research studies can be a viable option. Clinical trials often provide access to cutting-edge treatments at reduced or no cost for participants. These trials are conducted under the strict supervision of medical professionals and can contribute to advancing medical knowledge while potentially benefiting the patient.

Seeking a second opinion is another way to explore alternative treatment options and potentially lower costs. Sometimes, different healthcare providers may have varying approaches or opinions on the most appropriate treatment plan. Obtaining a second opinion allows for a fresh perspective and can help ensure that the proposed treatment is necessary and aligned with your financial capabilities.

Navigating Medical Billing Errors

Medical billing errors can contribute to inflated medical bills. It is crucial to review your medical bill for any discrepancies and errors. Common errors include duplicate charges, incorrect billing codes, or charges for services not received. By carefully reviewing your bill, you can identify these errors and take the necessary steps to rectify them.

Documenting and reporting any discrepancies to the healthcare provider or insurance company is essential to resolving billing errors. Keep a detailed record of the errors, including dates, descriptions, and any supporting documentation such as receipts or appointment confirmations. Contact the billing department of the healthcare provider or the customer service department of your insurance company to report the errors and request corrections.

In case of disputes, engaging in dispute resolution processes is an option worth considering. This can involve mediation or arbitration to reach a resolution between the patient, healthcare provider, and/or insurance company. Dispute resolution processes aim to provide a fair and unbiased assessment of the situation, facilitating a resolution that is acceptable to all parties involved. Be sure to familiarize yourself with your rights and obligations in the dispute resolution process to ensure a fair outcome.

Seeking Financial Assistance

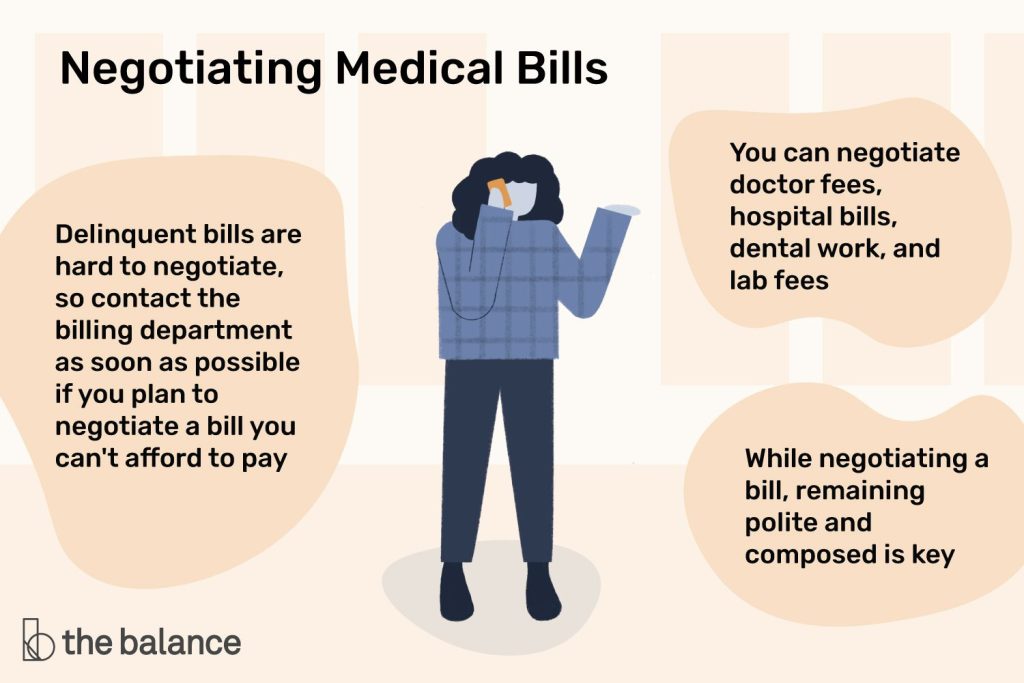

This image is property of www.thebalancemoney.com.

When facing significant medical bills, it is essential to explore various financial assistance options. Government programs, such as Medicaid or state-specific healthcare programs, can provide financial support for eligible individuals. Check your eligibility and apply for these programs to reduce the burden of medical expenses.

Nonprofit organizations and grants dedicated to providing financial assistance for medical bills can also be valuable resources. These organizations often have specific criteria for eligibility, so it is important to research and contact them directly to understand the application process. Some organizations may offer grants or financial assistance based on specific medical conditions, income levels, or demographic factors.

Religious or community organizations can also provide financial assistance for medical bills. These organizations often have funds or programs in place to support individuals in need. Contact local religious institutions or community centers to inquire about potential assistance programs and eligibility requirements.

Crowdfunding or medical fundraising can be a viable option for individuals with significant medical expenses. Online platforms provide opportunities to create fundraising campaigns and share them with friends, family, and the broader community. Utilize these platforms to share your story, outline your medical needs, and request financial support. Crowdfunding allows individuals to contribute a small amount, collectively making a significant impact in reducing medical bills.

Managing Medical Expenses

Managing medical expenses requires proactive financial planning. Creating a budget and prioritizing bills can help ensure that you allocate your financial resources appropriately. List all your expenses, including medical bills, and determine how much you can realistically afford to pay each month. By prioritizing your bills and allocating funds accordingly, you can manage your medical expenses more effectively.

Negotiating with collection agencies is another strategy to consider when managing medical expenses. If you have outstanding medical bills that have been sent to collections, it may be possible to negotiate a lower settlement amount. Collection agencies often purchase debt for a fraction of the original cost, making them open to negotiation. Contact the agency handling your debt and inquire about the possibility of settling for a reduced amount.

Understanding the implications of medical debt is crucial for individuals facing financial challenges. Medical debt can have a significant impact on credit scores and financial stability. It is important to familiarize yourself with the laws and regulations governing medical debt and the potential consequences of unpaid bills. Seeking assistance from financial advisors or credit counseling agencies can provide guidance on managing medical debt and avoiding negative consequences.

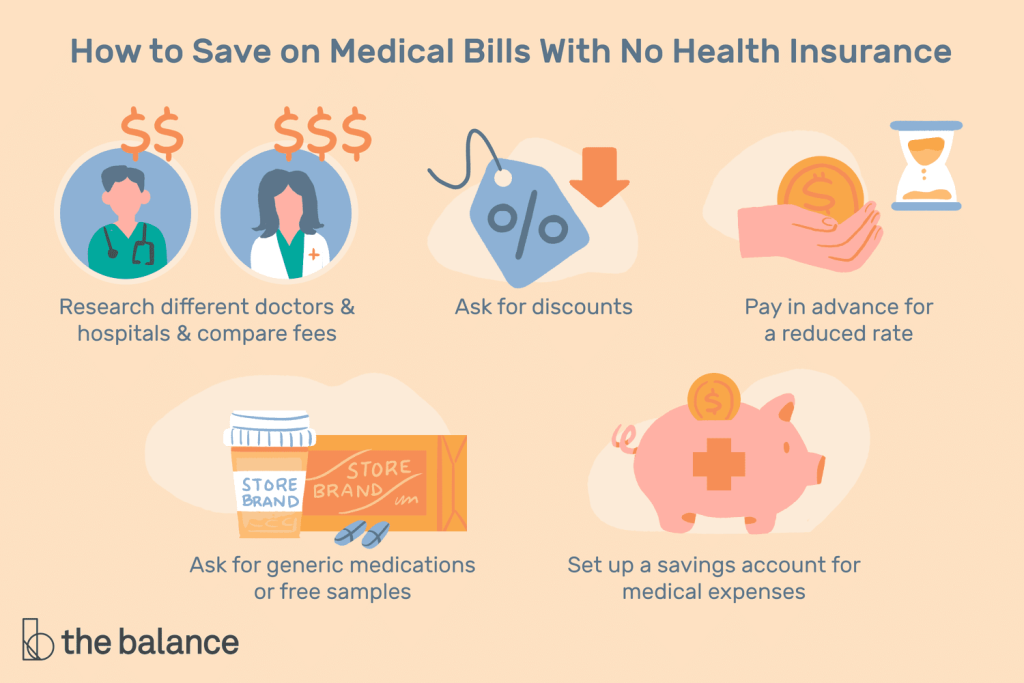

This image is property of i1.wp.com.

Being Proactive in Preventive Care

Taking proactive steps in preventive care can help prevent chronic conditions and reduce the need for expensive medical treatments. Maintaining a healthy lifestyle through regular exercise, a balanced diet, and stress management can contribute to overall well-being and minimize the risk of developing chronic conditions. By adopting these healthy habits, you can reduce the likelihood of encountering costly medical bills.

Utilizing preventive services covered by insurance is an effective way to stay ahead of potential health issues. Most insurance plans provide coverage for preventive screenings, vaccinations, and annual check-ups. Taking advantage of these services can help detect any health concerns early on, allowing for timely interventions and potentially reducing the need for extensive medical treatments in the future.

Participating in free or low-cost preventive health programs can also contribute to reducing medical expenses. Many communities offer programs focused on preventive health, such as health fairs, wellness workshops, and educational seminars. These programs aim to empower individuals to take control of their health and provide valuable resources at little to no cost. Stay informed about local initiatives and take advantage of these opportunities to optimize your health and minimize medical expenses.

Considering Medical Tourism

For individuals facing exorbitant medical costs, considering medical tourism may be a viable option. Medical tourism involves traveling to another country to receive medical care at a significantly lower cost than what is available domestically. It is important to thoroughly research and evaluate the healthcare facilities and practitioners in the destination country before making a decision. Consider factors such as reputation, accreditation, safety measures, and the potential challenges of traveling for medical care. Weighing the costs and benefits is crucial when considering medical tourism as an alternative to high medical bills.

This image is property of www.peoplekeep.com.

Advocating for Transparent Pricing

Supporting legislative efforts for price transparency in healthcare is a proactive approach to address the high cost of medical bills. Price transparency allows patients to understand the cost of healthcare services before undergoing procedures or treatments, enabling informed decision-making and the ability to compare prices. By advocating for price transparency, you contribute to a more equitable healthcare system that empowers patients to make financially sound choices.

Requesting cost estimates before undergoing medical procedures or treatments is another way to advocate for transparent pricing. Contact the healthcare provider or hospital in advance and ask for an estimated cost for the specific service or treatment. This information allows you to plan your finances and explore alternative options if the cost is beyond your means. Asking for cost estimates also creates awareness and encourages healthcare providers to be more transparent in their pricing practices.

Increasing Healthcare Literacy

Educating yourself about healthcare billing and insurance terms is essential for effectively navigating the healthcare system and advocating for yourself as a patient. Many medical terms and concepts can be confusing, but investing time in understanding them can save you from unnecessary expenses and misunderstandings. Use reliable online resources, educational materials, and seek guidance from patient advocates or healthcare professionals to increase your healthcare literacy.

Patient advocates or healthcare professionals can provide valuable insights and guidance when faced with complex medical bills or insurance-related issues. These individuals specialize in patient advocacy and are well-versed in healthcare policies and procedures. Engaging their services or seeking their advice can help you navigate the healthcare system more effectively and make informed decisions regarding your medical expenses.

In conclusion, there are various strategies and approaches to lower the cost of a medical bill. By understanding your medical bill, negotiating with healthcare providers, utilizing health insurance effectively, seeking alternative treatment options, navigating medical billing errors, seeking financial assistance, managing medical expenses, being proactive in preventive care, considering medical tourism, advocating for transparent pricing, and increasing healthcare literacy, you can take proactive steps towards reducing your medical expenses and ensuring more affordable healthcare.

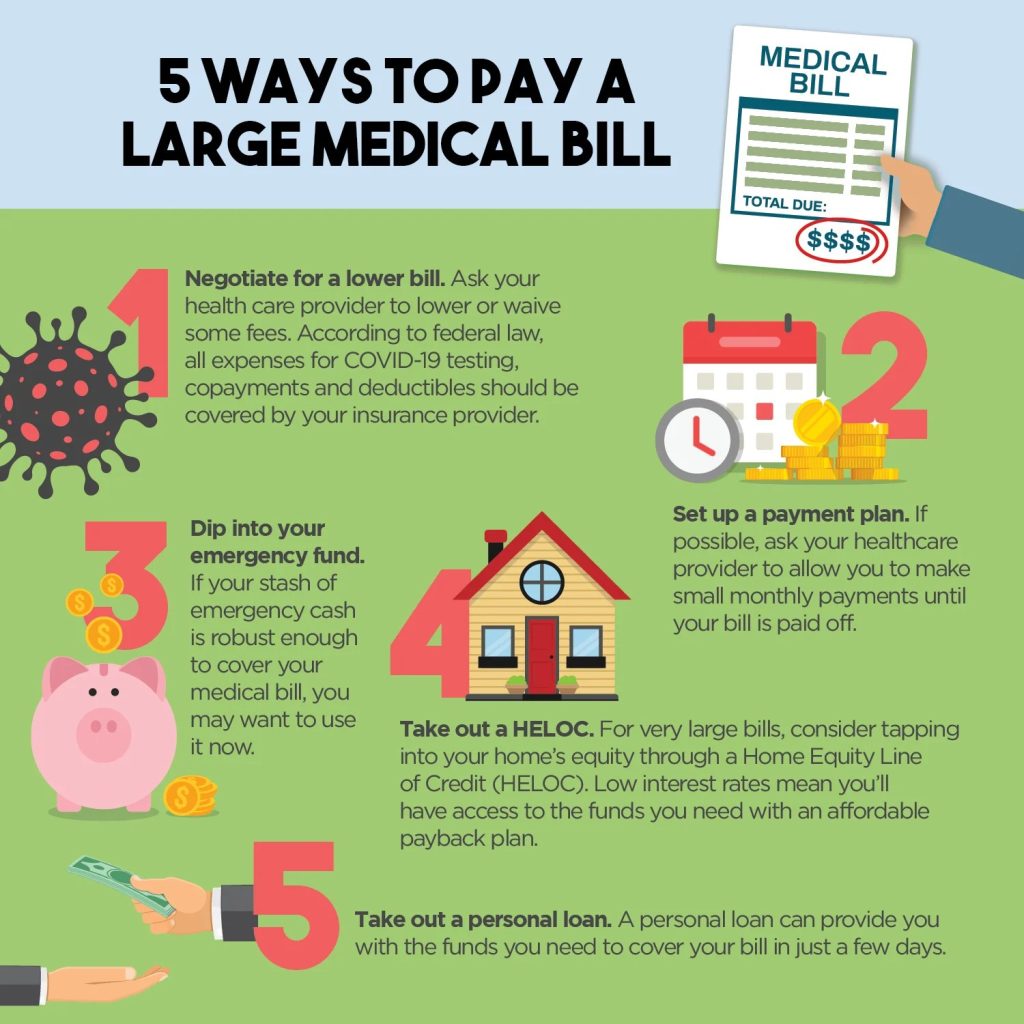

This image is property of files.consumerfinance.gov.