In the world of medical billing, understanding the fees charged by billing companies is crucial for healthcare providers seeking efficient financial management. This article provides a comprehensive overview of the percentage rates commonly charged by most medical billing companies. By exploring the factors that influence these rates and the services offered, healthcare professionals can make informed decisions regarding their billing needs.

Factors Affecting Medical Billing Company Charges

Scope of Services

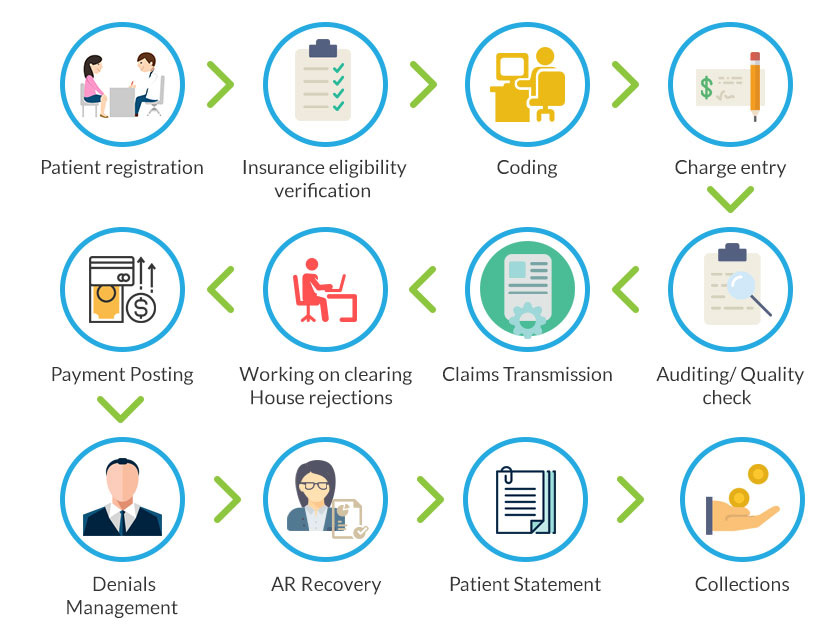

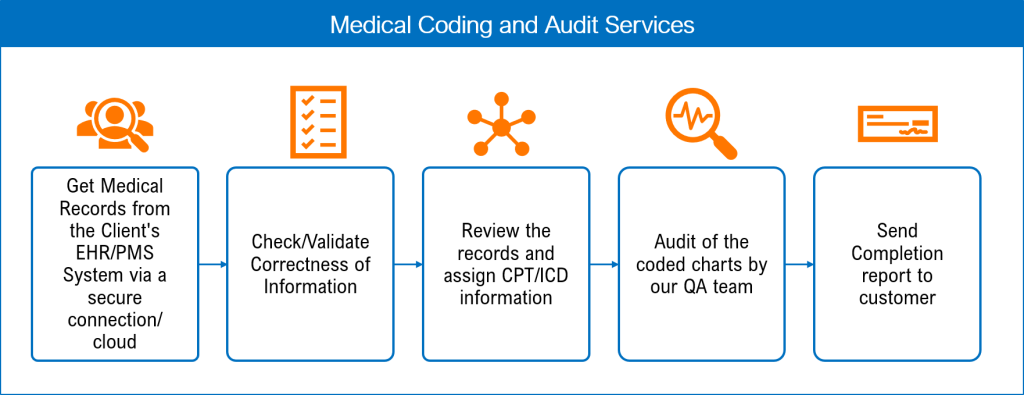

The scope of services provided by a medical billing company can greatly impact the charges. Different companies offer varying levels of support, from basic billing and coding services to comprehensive revenue cycle management. The more extensive the services provided, the higher the charges are likely to be. It’s important to carefully consider your practice’s needs and select a medical billing company that offers services aligned with those needs.

Size and Type of Medical Practice

The size and type of your medical practice can also influence the charges imposed by a medical billing company. Larger practices with a higher volume of claims will require more resources and effort to manage, leading to higher charges. Additionally, certain types of medical practices, such as specialized fields or those with complex billing requirements, may incur higher charges due to the additional expertise and resources required to handle their unique billing needs.

Geographic Location

The geographic location of your medical practice can impact the charges of a medical billing company. Cost of living and regional market dynamics can affect pricing structures. For example, medical billing companies operating in major metropolitan areas with higher operating costs may charge higher fees compared to those in smaller, less expensive regions. It’s essential to take into account the regional variations when evaluating the charges of different medical billing companies.

Experience and Expertise

The experience and expertise of a medical billing company can have a significant influence on their charges. Companies with a long track record of success and a highly skilled team of billing specialists may command higher fees due to their expertise and reputation. Their experience in working with various insurance companies and knowledge of complex billing regulations can greatly improve cash flow and minimize billing errors, making them worth the higher charges for many medical practices.

Specialized Services

Medical billing companies offering specialized services tailored to certain medical specialties may charge higher rates. These companies focus on understanding the unique billing requirements and complexities of specific fields, such as cardiology or orthopedics. Their expertise in handling specialized coding and billing processes can result in improved reimbursement rates and reduced claim denials. However, these specialized services often come at a premium, so it’s important to consider the value they bring to your practice before committing to higher charges.

Common Pricing Models

Choosing the right pricing model for medical billing services is crucial for healthcare practices to manage costs effectively and ensure efficient revenue cycle management. Medical billing companies offer various pricing models, each with its own advantages and considerations. In this overview, we’ll explore common pricing models used in medical billing, including percentage of collections, flat fee, per transaction, hourly rate, tiered pricing, and value-based pricing. Understanding these models can help medical practices make informed decisions when selecting billing services.

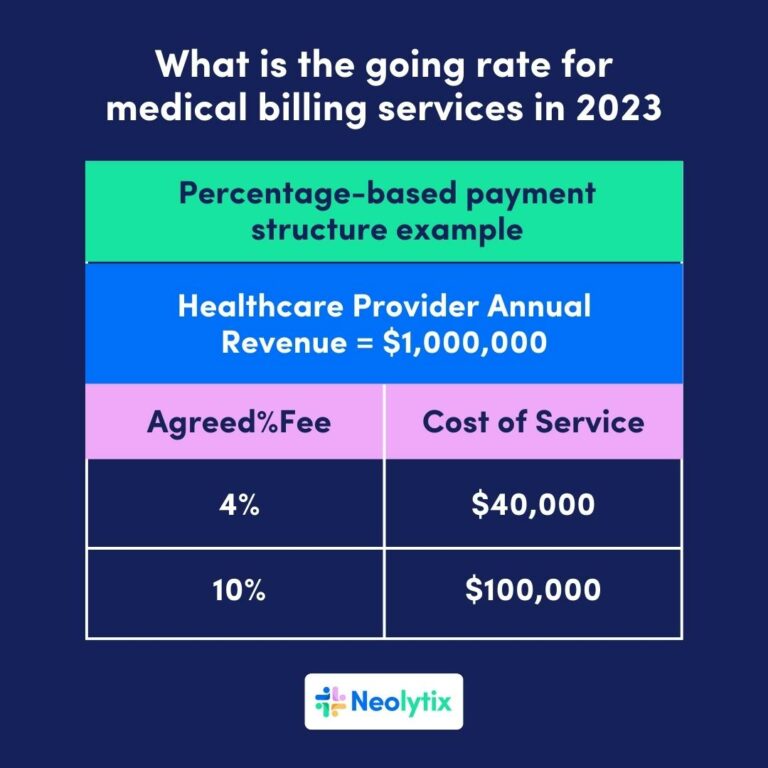

Percentage of Collections

One common pricing model used by medical billing companies is charging a percentage of the amount collected from insurance payments and patient payments. This model aligns the incentives of the billing company with the medical practice, as the billing company directly benefits from maximizing collections. The typical range for this model is around 4-10% of collections, but it can vary based on the specific terms and services included in the agreement.

Flat Fee

Another pricing model is charging a flat fee, which is a predetermined fixed amount paid on a monthly or quarterly basis. This model provides predictability and stability in billing costs, regardless of the practice’s revenue fluctuations. Flat fees vary based on the scope of services required and the size of the medical practice. It’s important to carefully consider the scope of services included in the flat fee to ensure it meets your practice’s needs.

Per Transaction

Some medical billing companies charge on a per-transaction basis, where each claim or transaction processed incurs a specific fee. This pricing model is commonly used for smaller practices or those with a low claim volume. It offers a more cost-effective option for practices with fewer transactions. However, it’s crucial to assess the total cost based on the anticipated claim volume to ensure it remains cost-effective and comparable to other pricing models.

Average Percentage Charged by Medical Billing Companies

When medical practices seek the services of medical billing companies, understanding the typical percentage charges is essential for effective financial planning. Factors influencing these charges include the complexity of billing requirements, claim values, claim volumes, reimbursement rates, and the billing company’s expertise. Careful evaluation of these factors is vital for practices to secure fair and competitive percentage charges with billing companies.

Range of Percentages

The average percentage charged by medical billing companies typically falls within the range of 4-10% of collections. However, it’s important to note that the actual percentage charged can vary based on numerous factors. For example, large practices with a higher volume of claims may negotiate lower percentages, while smaller practices may face higher percentage charges due to economies of scale.

Factors Influencing Percentage Charges

Several factors can influence the percentage charges imposed by medical billing companies. These factors include the complexity of the medical practice’s billing requirements, the average claim value, the volume of claims processed, the average reimbursement rates, and the billing company’s level of experience and expertise. Practices should carefully evaluate these factors to negotiate fair and competitive percentage charges with billing companies.

Additional Charges and Fees

In the realm of medical billing services, practices should be aware of potential additional charges and fees. Understanding these potential fees is crucial for effective financial planning and decision-making when partnering with medical billing companies.

Setup and Onboarding Fees

Many medical billing companies charge setup and onboarding fees to cover the initial costs associated with setting up their software systems, training their staff, and integrating with the practice’s existing systems. These fees can vary significantly depending on the complexity of the practice’s billing requirements and the level of customization needed.

Patient Eligibility Verification

Some medical billing companies charge additional fees for patient eligibility verification services. This involves checking patients’ insurance coverage, verifying their benefits and eligibility, and ensuring pre-authorization requirements are met. These services can help prevent claim denials and reduce the administrative burden on the medical practice, but they may come at an additional cost.

Denial Management

Handling claim denials requires additional time and effort from the billing company. As a result, some companies charge extra fees for denial management services, including investigating denials, filing appeals, and tracking the status of denied claims. While these services can improve collections and minimize revenue loss, it’s important to consider the associated costs when evaluating the overall charges of a medical billing company.

Claims Follow-Up

Medical billing companies may charge fees for claims follow-up services, which involve tracking the status of submitted claims, identifying delayed or denied claims, and taking appropriate actions to ensure timely payment. This proactive approach can help accelerate cash flow and reduce the aging of accounts receivable. Practices should assess the value and cost-effectiveness of these services when analyzing the charges of different billing companies.

Reporting and Analytics

Access to comprehensive reporting and analytics is crucial for monitoring the financial health of a medical practice. Some billing companies charge additional fees for advanced reporting capabilities, customized reports, and in-depth analytics. These services can provide valuable insights into revenue trends, reimbursement rates, and the overall efficiency of the billing process. However, practices should carefully consider whether the added costs are justified by the provided insights.

Software and Technology Fees

Medical billing companies often utilize specialized software and technology to streamline their operations and improve efficiency. They may pass on the costs associated with licensing, hosting, and maintaining these software systems to the medical practices they serve. It’s important for practices to understand and analyze these fees, ensuring they align with the value and functionality of the utilized software.

Hidden Costs to Watch Out For

Rejections and Rebilling

Medical billing errors and claim rejections can result in additional costs for a medical practice. When evaluating the charges of a billing company, it’s essential to consider the potential costs associated with rejections and rebilling. Practices should assess the billing company’s error rate, their ability to resolve rejected claims efficiently, and whether any additional charges apply for rejections.

Unpaid Claims

Unpaid or overdue claims can significantly impact a medical practice’s cash flow and revenue. Some medical billing companies charge additional fees for handling unpaid claims, including follow-up, collections, and appeals. Practices should carefully evaluate the billing company’s approach to unpaid claims and the associated costs to avoid unexpected charges or revenue loss.

Undercoding or Overcoding

Incorrect coding of medical procedures and services can lead to underbilling or overbilling, which can result in financial implications for a medical practice. While medical billing companies strive for accuracy, mistakes can happen. Practices should ascertain whether the billing company accepts liability for coding errors and covers associated costs such as resubmission fees or payer penalties.

Training and Support

Proper training and ongoing support are essential for a seamless and efficient billing process. Some medical billing companies may charge additional fees for initial training or onsite support. It’s crucial to assess the level and cost of training and support offered by billing companies, as inadequate training or limited support can lead to billing errors and additional costs down the line.

Third-Party Service Charges

Medical billing companies often collaborate with third-party vendors or service providers for certain functions, such as eligibility verification or electronic claim submission. While these partnerships can offer added value, some billing companies may add surcharges or fees for utilizing these third-party services. Practitioners should carefully review the terms and potential costs associated with third-party collaborations when evaluating billing company charges.

Negotiating Rates with Medical Billing Companies

Understanding the Market Rates

Before entering into negotiations with a medical billing company, it’s essential to have a clear understanding of the prevailing market rates and industry standards. Researching and comparing the rates charged by different billing companies can provide valuable insights into fair pricing structures. This information can be used as a benchmark during negotiations to ensure that the rates offered are competitive and reasonable.

Comparing and Evaluating Proposals

When evaluating proposals from different medical billing companies, it’s important to compare them side by side. Assess the scope of services included, the level of expertise, the proposed pricing model, and any additional fees or charges. Look for companies that align closely with your practice’s needs and provide transparent pricing structures. Evaluating multiple proposals allows for an informed decision that balances cost with quality.

Flexible Contract Terms

During negotiations, consider negotiating flexible contract terms with medical billing companies. This includes provisions for periodic rate reviews, options for scaling services up or down as needed, and the ability to modify or terminate the contract if the partnership doesn’t meet expectations. Flexibility can help ensure that the charges remain aligned with the evolving needs of your medical practice.

Value-Added Services

In addition to the core billing services, some medical billing companies offer value-added services that can enhance practice efficiency and revenue. These services may include comprehensive reporting, analytics, or practice management support. While they may come at an additional cost, practices should consider the potential benefits and weigh them against the associated charges to determine if they provide value for their specific needs.

Factors to Consider When Choosing a Medical Billing Company

Reputation and Experience

The reputation and experience of a medical billing company play a vital role in their ability to deliver quality services. Research the company’s track record, client testimonials, and industry reputation. Look for companies with a proven history of success, positive client feedback, and strong references in similar medical specialties.

Certifications and Compliance

Compliance with industry regulations, such as HIPAA (Health Insurance Portability and Accountability Act), is crucial when selecting a medical billing company. Verify that the company has the necessary certifications and adheres to strict data security and privacy protocols. Compliance ensures that sensitive patient information is handled securely and protects your practice from potential legal or financial consequences.

Technology and Integration

A modern and robust technology infrastructure is essential for efficient and accurate billing operations. Ensure that the medical billing company utilizes state-of-the-art software and maintains compliance with industry standards. Inquire about their integration capabilities with electronic health record (EHR) systems, practice management software, and other essential tools utilized by your medical practice.

Customer Support

Prompt and responsive customer support is crucial when partnering with a medical billing company. Inquire about the availability and accessibility of their support team, as well as the average response time for inquiries or issues. Strong customer support ensures effective communication and timely resolution of billing-related concerns.

Client References

Request client references from potential medical billing companies to gain insights into their working relationships with other medical practices. Speaking directly with current clients can provide valuable information about the quality of service, the transparency of billing charges, and the overall satisfaction with the company.

Tips for Managing Medical Billing Costs

Optimizing Revenue Cycle Management

Implementing effective revenue cycle management practices can help minimize billing costs and improve overall financial performance. Streamline workflows, optimize coding and documentation processes, and implement regular audits to identify and rectify billing errors promptly. By focusing on revenue cycle management, medical practices can reduce denied claims, accelerate payments, and decrease unnecessary administrative costs.

Internal Auditing and Monitoring

Perform regular internal audits to monitor the performance of the medical billing company and ensure adherence to agreed-upon terms and service level agreements. Review key metrics, such as claim submission rates, average reimbursement time, and denial rates. Conducting internal audits provides visibility into the billing process and helps identify any issues or areas for improvement.

Transparent Reporting and Metrics

Request regular and comprehensive reports from the medical billing company to monitor the financial health of your practice. Analyze key metrics, such as collection rates, accounts receivable aging, and denial rates. Transparent reporting and accessible metrics enable proactive management of billing costs and financial performance.

Keeping up with Industry Changes

The medical billing landscape is constantly evolving, with changes in regulations, compliance requirements, and payer rules. Stay informed about industry changes and ensure that the medical billing company remains up to date. This reduces the risk of billing errors or non-compliance, which can result in additional costs and revenue loss.

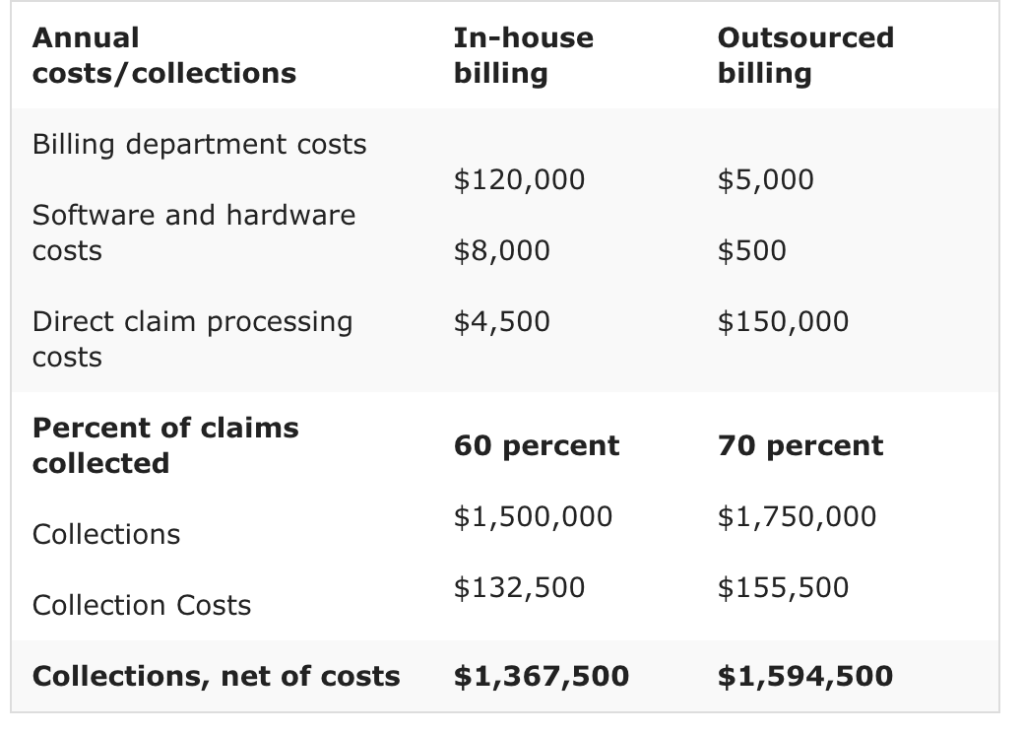

Outsourcing vs. In-House Billing

Cost Considerations

Outsourcing medical billing comes with its own set of charges, including the fees imposed by the billing company. However, it’s essential to evaluate the cost-effectiveness of outsourcing versus maintaining an in-house billing department. Consider factors such as staff salaries, benefits, training costs, and technology investments when assessing overall costs. Outsourcing can often provide cost savings, especially for smaller practices or those with limited billing requirements.

Resource Allocation

Operating an in-house billing department requires significant resources, both in terms of manpower and technology. Outsourcing allows medical practices to redirect resources to core patient care activities, rather than managing billing operations internally. By leveraging the expertise and resources of a medical billing company, practices can optimize resource allocation and focus their efforts on clinical services and patient satisfaction.

Expertise and Specialization

Medical billing companies specialize in handling complex billing and coding processes, ensuring accuracy and compliance. They have dedicated teams of billing specialists who stay updated with industry changes and best practices. In-house billing departments may struggle to match the level of expertise and specialization offered by medical billing companies. Outsourcing enables access to this expertise and can lead to improved revenue cycle management.

Efficiency and Scalability

Medical billing companies utilize advanced technologies and experienced staff to streamline operations and maximize efficiency. They invest in systems that can efficiently handle the billing needs of multiple clients, allowing for scalability. In-house billing departments may face challenges in achieving the same level of efficiency and scalability, particularly for growing practices. Outsourcing can provide the necessary infrastructure and flexibility for practices to expand without worrying about resource constraints.

Compliance and Risk Management

Compliance with ever-changing regulations and payer requirements is critical in medical billing. Medical billing companies are well-versed in these requirements and maintain strict compliance protocols. By outsourcing billing, practices can mitigate the risks associated with non-compliance, ensuring that their billing processes adhere to the latest regulations and minimizing the potential penalties or legal consequences.

Conclusion

When assessing the charges of medical billing companies, it’s essential to consider various factors such as the scope of services, the size and type of medical practice, the geographic location, the experience and expertise of the billing company, and any additional specialized services required. Comparison of common pricing models, evaluation of average percentage charges, and consideration of additional charges and hidden costs can help make informed decisions. Negotiating rates, considering key factors when choosing a medical billing company, and managing costs effectively are essential strategies. The choice between outsourcing and in-house billing should be based on cost considerations, resource allocation, expertise, efficiency, scalability, and compliance. By carefully evaluating all these factors and making informed decisions, medical practices can select the right medical billing company and optimize their revenue cycle management while minimizing costs.