In the complex world of healthcare and insurance, navigating medical bills can be daunting and overwhelming. If you’ve ever been faced with an exorbitant medical bill, you understand the frustration and anxiety it can cause. However, fret not, for there is a surefire method to reduce those overwhelming healthcare costs. By strategically negotiating with your healthcare provider, coordinating with your insurance company, and diligently examining your medical bill for errors or discrepancies, you can take control of your healthcare expenses and significantly lower your financial burden. This article aims to guide you through the process, equipping you with the necessary knowledge and tools to successfully reduce your medical bill.

Negotiating with the Healthcare Provider

Understanding Your Medical Bill

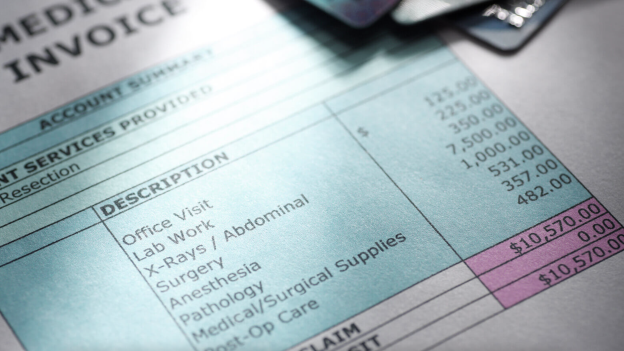

When it comes to negotiating with your healthcare provider, it is crucial to have a solid understanding of your medical bill. Take the time to carefully review each line item and familiarize yourself with the charges. Look out for any discrepancies or errors that may have led to overcharges. Understanding your bill will give you a strong foundation when it comes to negotiating and advocating for yourself.

Identifying Errors or Overcharges

One of the first steps in negotiating with your healthcare provider is identifying any errors or overcharges on your medical bill. This can be a time-consuming process, but it is well worth the effort. Look for duplicate charges, services not rendered, or charges for items that should have been included in the overall cost. Keep detailed notes and documentation of any discrepancies you find.

Gathering Relevant Documentation

Before entering into negotiations with your healthcare provider, gather all relevant documentation related to your medical bill. This includes any insurance explanation of benefits (EOBs), itemized bills, medical records, and receipts. Having this documentation on hand will strengthen your case and provide evidence to support your claims during the negotiation process.

Preparing to Negotiate

Preparation is key when it comes to negotiating with your healthcare provider. Take the time to research the standard costs of the medical services you received, both locally and nationally. This will give you a benchmark to compare your charges against, ensuring you have a clear understanding of what a fair price should be. Additionally, consider creating a detailed outline or script to guide your negotiation conversation and help you stay on track.

Communicating with the Healthcare Provider

Effective communication is essential when negotiating with your healthcare provider. Clearly state your concerns and the specific issues you have identified on your medical bill. Remain calm, professional, and assertive throughout the conversation. Ask for explanations of any charges that are unclear to you and provide evidence to support your claims. It is important to maintain open lines of communication during the negotiation process to reach a mutually beneficial resolution.

Utilizing Insurance Benefits

Understanding Your Insurance Coverage

To effectively navigate the negotiation process, it is crucial to have a thorough understanding of your insurance coverage. Familiarize yourself with your policy’s benefits, deductibles, co-pays, and out-of-pocket maximums. This will help you determine if any charges on your medical bill should have been covered by your insurance and provide a basis for negotiation with your healthcare provider.

Appealing Denied Claims

If your insurance provider denies coverage for a particular service or treatment, it is important to familiarize yourself with the appeals process. Review the denial letter carefully and gather any supporting documentation or medical records that may strengthen your case. Follow the steps outlined by your insurance provider to appeal the decision and provide a clear and compelling argument for why the claim should be reconsidered.

Requesting Preauthorization

To avoid potential disputes over coverage later on, it is wise to request preauthorization for any services or treatments that are not considered routine or preventive. This step will ensure that your insurance provider reviews the treatment plan and approves coverage before you proceed with the medical services. By obtaining preauthorization, you can minimize the risk of being responsible for excessive out-of-pocket expenses and increase your negotiating power if any issues arise.

Using In-Network Providers

One way to fully utilize your insurance benefits and potentially reduce medical costs is by seeking care from in-network providers. In-network providers have pre-negotiated rates with your insurance company, resulting in lower overall costs for you. When scheduling appointments or seeking medical services, confirm that the providers and facilities you choose are within your insurance network. This simple step can save you potentially significant amounts of money.

Negotiating Out-of-Network Charges

In some cases, you may need to seek care from an out-of-network provider. If this happens, you may find yourself facing higher out-of-pocket expenses. However, it is still possible to negotiate these charges. Start by researching the fair and customary charges for the specific service or treatment in your geographical area. Armed with this information, approach your healthcare provider and insurance company to discuss the possibility of reducing the charges or reaching a compromise.

Seeking Financial Assistance and Discounts

Navigating the financial challenges of medical bills can be overwhelming, but there are various avenues to explore for assistance. From government programs like Medicaid to non-profit organizations and hospital charity care, understanding your options is crucial. This guide provides insights into potential sources of financial relief and offers practical steps to take when seeking assistance with medical bills. Whether you’re an individual in need or a healthcare provider assisting patients, these strategies can help alleviate the burden of medical expenses and ensure access to necessary care.

Applying for Medicaid or Other Government Programs

If you find yourself struggling to afford your medical bills, it may be worth exploring if you qualify for Medicaid or other government programs. Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families. Eligibility requirements vary by state, so take the time to research the criteria and gather the necessary documentation to support your application. These programs can help alleviate the financial burden of medical bills and provide ongoing coverage for future healthcare needs.

Researching Non-Profit Organizations

Many non-profit organizations offer assistance with medical bills and related expenses. These organizations often provide grants, financial aid programs, or subsidies to individuals and families in need. Research and reach out to non-profit organizations that specialize in healthcare-related financial assistance. Be sure to review their eligibility requirements and application process carefully to increase your chances of receiving assistance.

Inquiring about Hospital Charity Care

Some hospitals offer charity care programs designed to provide financial assistance to qualifying patients. These programs are typically based on a sliding scale, taking into account your income and ability to pay. Reach out to the hospital’s financial assistance department to inquire about their charity care program and gather the necessary paperwork to apply. This can help reduce or eliminate the financial burden associated with your medical bills.

Utilizing Prescription Assistance Programs

Prescription medications can often contribute to the overall cost of medical bills. To mitigate this expense, explore prescription assistance programs offered by pharmaceutical companies or non-profit organizations. These programs provide eligible individuals with access to discounted or free medications. Research the eligibility requirements and application process for these programs to determine if you qualify.

Seeking Discounts or Payment Plans

In many cases, healthcare providers are willing to offer discounts or set up payment plans for patients facing financial difficulties. When negotiating your medical bill, inquire about the availability of discounts or payment arrangements. Clearly communicate your financial situation and bring supporting documentation if necessary. By working together with your healthcare provider, you may be able to find a mutually agreeable solution that eases the financial burden.

Exploring Alternative Payment Options

Using Medical Credit Cards

Medical credit cards are designed specifically for healthcare expenses and can offer an alternative payment option. They often offer promotional periods with zero or low-interest rates, allowing you to spread out payments over time without accruing excessive interest charges. Before opting for a medical credit card, carefully review the terms and conditions, including the interest rates and repayment terms. Ensure that this payment option aligns with your financial situation and goals.

Negotiating a Lump-Sum Payment

If you have the means to make a lump-sum payment, consider negotiating with your healthcare provider for a reduced amount. Healthcare providers may be willing to accept a lower payment in exchange for receiving payment in full upfront. This can save you money in the long run and potentially help expedite the resolution of your medical bill.

Requesting a Personal Loan

If you are unable to pay your medical bill in full and need additional financial assistance, consider applying for a personal loan. Personal loans can provide the funds needed to cover medical expenses, and they often have lower interest rates compared to credit cards. Shop around for the best loan terms and rates, and ensure that you borrow responsibly and within your means. This option can provide immediate relief while allowing you to negotiate with your healthcare provider for potential discounts.

Considering Medical Tourism

For individuals facing high medical costs, medical tourism is an option worth considering, especially for non-emergency procedures. Medical tourism involves traveling to another country to receive medical treatment at a lower cost. Research reputable healthcare facilities abroad and verify their quality standards to ensure a safe experience. Factor in all costs associated with travel, accommodation, and aftercare when assessing the potential savings. Medical tourism can significantly reduce medical expenses, but careful planning and consideration are essential.

Seeking Assistance from Family or Friends

If you find yourself in a difficult financial situation due to medical bills, consider reaching out to family or friends for assistance. Share your situation honestly and transparently, and explore the possibility of receiving a loan or financial support from your loved ones. Establish clear repayment terms and formalize the agreement to protect both parties involved. While it may be challenging to ask for help, the support of family and friends can help alleviate the burden of medical bills.

Securing Legal or Professional Help

Consulting a Medical Billing Advocate

If you find navigating the negotiation process overwhelming or lack the time and expertise to do so effectively, consider consulting a medical billing advocate. These professionals specialize in advocating for patients, reviewing medical bills, and negotiating with healthcare providers on your behalf. A medical billing advocate can provide valuable guidance, support, and expertise to help you achieve a fair and reasonable resolution to your medical bill.

Hiring a Medical Billing Advisor

Similar to a medical billing advocate, a medical billing advisor can assist you in navigating the complexities of the healthcare system and negotiating medical bills. These professionals typically work on a fee-for-service basis and can provide personalized guidance tailored to your specific situation. By leveraging their expertise and industry knowledge, a medical billing advisor can increase your chances of successfully negotiating a reduced medical bill.

Seeking Legal Assistance

In some cases, it may be necessary to seek legal assistance when dealing with medical bills. If you believe your rights have been violated or have encountered significant issues during the negotiation process, consult with a qualified healthcare attorney. They can assess your case, provide legal advice, and guide you through the appropriate course of action. Be sure to gather all relevant documentation and information to present to your attorney, as this will help them evaluate the merits of your case.

Filing a Complaint

If you have exhausted all other options and feel that you have been treated unfairly by your healthcare provider, consider filing a complaint. Start by contacting the appropriate regulatory agency in your state, such as the State Insurance Commissioner’s office or the local health department. Provide a detailed account of your concerns and the issues you have encountered. Agencies may investigate your complaint and work towards a resolution, potentially resulting in a reduction or elimination of your medical bill.

Understanding Patient Rights and Laws

Educate yourself on patient rights and laws that govern the healthcare industry to better advocate for yourself. Familiarize yourself with the Affordable Care Act and any state-specific laws that protect patients from unfair billing practices. Understanding your rights will empower you to assertively negotiate with your healthcare provider and seek the appropriate legal recourse if necessary.

Appealing to Government Agencies

When facing challenges with medical bills, it’s important to explore various avenues for assistance and resolution. Government agencies and organizations are valuable resources in addressing billing disputes and unfair practices. This guide outlines steps to take when appealing to government agencies, such as contacting the State Insurance Commissioner, filing complaints with the Better Business Bureau and the Consumer Financial Protection Bureau, seeking assistance from local health departments, and applying for state health services. By leveraging these resources, individuals can work toward a fair resolution and relief from the financial burden of medical bills.

Contacting the State Insurance Commissioner

If you feel that your insurance provider has acted unfairly or in violation of state regulations, reach out to the State Insurance Commissioner’s office in your state. They can provide guidance and assistance in resolving insurance-related disputes. Be prepared to provide documentation and information regarding your medical bill and the issues you have encountered. The State Insurance Commissioner’s office can investigate your complaint and, if necessary, intervene on your behalf.

Filing a Complaint with the Better Business Bureau

The Better Business Bureau (BBB) provides a platform for consumers to file complaints against businesses, including healthcare providers and insurance companies. If you have been unable to resolve your issues through direct negotiation, consider filing a complaint with the BBB. Provide a detailed account of your concerns and attach any supporting documentation. The BBB will review your complaint and attempt to mediate a resolution between you and the healthcare provider or insurance company involved.

Reaching Out to the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) is a federal agency that focuses on protecting consumer interests in the financial sector. They handle complaints related to financial products and services, including medical bills. If you believe that you have been subject to unfair billing practices or experience difficulties resolving your medical bill, consider filing a complaint with the CFPB. Provide a detailed account of your case, and the CFPB will investigate and work towards a resolution.

Seeking Assistance from Local Health Departments

Local health departments can provide valuable resources and assistance when dealing with medical bills. They may have programs or initiatives in place to help individuals facing financial difficulties due to healthcare expenses. Reach out to your local health department to inquire about any available resources, financial assistance programs, or recommendations they may have to navigate the negotiation process. Their expertise and support can make a significant difference in your efforts to reduce your medical bills.

Applying for State Health Services

Many states offer health services or programs designed to assist individuals facing financial hardship. These programs may provide financial assistance, coverage for specific medical conditions, or resources to help navigate the healthcare system. Research and apply for state health services that align with your needs and financial situation. These programs can help bridge the gap in coverage and reduce the impact of medical bills on your overall financial well-being.

Understanding Medical Debt and Collections

Managing Medical Debt

Managing medical debt requires careful financial planning and organization. Create a budget that prioritizes medical expenses and establish a realistic repayment plan. Communicate with your healthcare provider or collection agency to discuss repayment options, such as installment plans or negotiated settlements. Make timely payments to avoid further damage to your credit score and financial stability. Seek financial counseling if needed to develop a comprehensive plan for managing your medical debt responsibly.

Navigating the Collections Process

If your medical bill has been sent to collections, it is important to understand the collections process. Collection agencies have specific rules and guidelines they must follow when attempting to collect a debt. Familiarize yourself with your rights as a consumer under the Fair Debt Collection Practices Act (FDCPA) and any state-specific regulations. Respond promptly to communication from the collection agency and consider negotiating a settlement or payment plan to resolve the debt.

Negotiating Settlements

When dealing with medical debt that has been sent to collections, it is often possible to negotiate a settlement. Start by understanding your financial capabilities and determining a reasonable settlement amount that you can afford. Approach the collection agency with a settlement offer and be prepared to provide supporting documentation of your financial hardship. Negotiate with the agency to reach an agreement that satisfies both parties and leads to a reduced and manageable payment.

Applying for Hardship Programs

Some healthcare providers or collection agencies offer hardship programs specifically designed to assist individuals facing financial difficulties. These programs may provide reduced repayment options or forgiveness of certain debts. Reach out to your healthcare provider or collection agency to inquire about any available hardship programs. Provide documentation of your financial hardship and present a compelling case for consideration. Participating in a hardship program can provide significant relief and alleviate the stress associated with medical debt.

Protecting Your Credit Score

Medical debt can negatively impact your credit score if left unresolved. To protect your credit score, take proactive steps to address your medical bills promptly. Make on-time payments, negotiate with your healthcare provider or collection agency, and consider enrolling in a credit counseling program if needed. Regularly monitor your credit reports to ensure accurate reporting and dispute any errors or inaccuracies. By taking these actions, you can mitigate the impact of medical debt on your overall creditworthiness.

Avoiding Future Medical Bill Issues

Reviewing Your Insurance Policy

To avoid future medical bill issues, thoroughly review your insurance policy. Understand your coverage and any limitations or exclusions. Stay informed on any changes or updates to your policy and know your rights and responsibilities as an insured individual. Regularly communicate with your insurance provider to address any questions or concerns and ensure that you are fully aware of your policy’s terms and benefits.

Choosing In-Network Providers

A key strategy for avoiding future medical bill issues is to select in-network providers whenever possible. In-network providers have established contracts with your insurance company and have agreed upon pre-negotiated rates. By choosing in-network providers, you can help ensure that the services you receive are covered by your insurance and minimize the risk of unexpected out-of-pocket expenses. Before scheduling appointments or procedures, confirm that the providers and facilities are in-network.

Understanding Medical Codes and Procedures

To advocate for yourself effectively and avoid billing issues, familiarize yourself with medical codes and procedures. These codes are used to identify specific services or treatments provided to patients. Understanding the codes will help you verify the accuracy of your medical bills and ensure that you are being charged correctly. If you have questions about specific codes or procedures, reach out to your healthcare provider for clarification.

Asking for Detailed Estimates

Before receiving any non-emergency medical treatment or service, ask for a detailed estimate of the costs involved. This estimate should include all anticipated charges, such as physician fees, facility fees, and any ancillary services. Review the estimate carefully and compare it to the coverage provided by your insurance to anticipate your out-of-pocket expenses. This proactive approach allows you to budget accordingly and avoid any surprises when the medical bill arrives.

Maintaining Personal Medical Records

Maintaining personal medical records is essential for effective healthcare management and billing. Keep a record of all medical appointments, procedures, test results, and treatments. Include any related documentation, such as itemized bills, EOBs, and insurance correspondence. By having these records readily available, you can easily reference them when addressing billing issues, communicating with healthcare providers, or seeking second opinions.

Educating Yourself on Medical Billing

Understanding Common Billing Terminology

Educating yourself on common billing terminology is crucial when navigating the complex world of medical billing. Familiarize yourself with terms such as deductible, co-pay, co-insurance, out-of-pocket maximum, and explanation of benefits (EOB). Having a solid understanding of these terms will enable you to decipher your medical bills, communicate effectively with your insurance provider, and advocate for yourself during the negotiation process.

Researching Billing and Coding Practices

Delve into the world of billing and coding practices to gain deeper insights into how medical bills are generated. Research the current coding practices, modifiers, and billing guidelines relevant to your medical services. This knowledge will help you identify potential discrepancies or errors in your medical bills and engage in more informed negotiations with your healthcare provider.

Staying Informed about Healthcare Policies

Stay informed about healthcare policies and changes in the industry to stay ahead of potential billing issues. Research new regulations, laws, or policies that impact healthcare billing, insurance coverage, and patient rights. Subscribe to reliable sources of information, such as reputable healthcare advocacy websites, industry newsletters, or government websites. By staying informed, you can anticipate potential challenges and navigate the healthcare system more effectively.

Attending Financial Literacy Workshops

Attend financial literacy workshops tailored to healthcare-related topics. These workshops often cover a wide range of financial aspects, including medical bills, insurance, and budgeting for healthcare expenses. Financial literacy workshops provide valuable insights and practical tips for managing medical bills and avoiding financial hardships. Seek out local community organizations, hospitals, or non-profit organizations that offer financial literacy workshops and take advantage of these educational opportunities.

Subscribing to Healthcare Advocacy Websites

Stay up to date on the latest healthcare advocacy news and resources by subscribing to dedicated websites. Healthcare advocacy websites often provide valuable information, tips, and tools to help consumers navigate the complexities of medical billing. They may also offer assistance with negotiating medical bills, understanding insurance coverage, or finding financial resources. Subscribe to reputable healthcare advocacy websites to access reliable information and resources to support your medical billing journey.

Maintaining Communication and Documentation

Keeping Accurate Records of Communications

Maintaining accurate records of all communications related to your medical bills is essential. Keep copies of any emails, letters, or phone call logs exchanged with your healthcare provider, insurance company, collection agency, or any other relevant party. These records will serve as evidence of your efforts to resolve billing issues and can provide crucial information should complications arise in the future. Accurate records will help you present a comprehensive case when negotiating or seeking assistance.

Managing Important Documents and Bills

Organize your important documents and bills to stay on top of your medical billing. Create a system that allows you to easily locate and access your medical records, EOBs, itemized bills, and any other relevant paperwork. Consider scanning important documents and storing them digitally as backups. Maintain a calendar or reminder system to ensure that you promptly address payment deadlines and follow-up on negotiations or appeals.

Following-Up on Negotiation Progress

Persistence is key when negotiating your medical bills. Follow up regularly with your healthcare provider to assess the progress of your negotiations. Maintain open lines of communication and provide any additional information or documentation that may be requested. This proactive approach demonstrates your commitment to resolving the billing issues and increases the likelihood of reaching a satisfactory outcome.

Tracking Payment History

Track and document your payment history to ensure accuracy and identify any potential discrepancies. Keep a record of all payments made towards your medical bills, including the dates, amounts, and method of payment. Regularly compare your records to billing statements or receipts to ensure that all payments are properly credited. Promptly address any payment discrepancies with your healthcare provider or billing department to avoid potential complications.

Verifying Agreements in Writing

Whenever you reach an agreement or resolution regarding your medical bill, it is crucial to obtain written confirmation. Request written verification of any negotiated discounts, payment arrangements, or settlement agreements. These written agreements will serve as legally binding documents and protect your rights in case any disputes arise in the future. Retain these written verifications with your other important documents for easy reference.