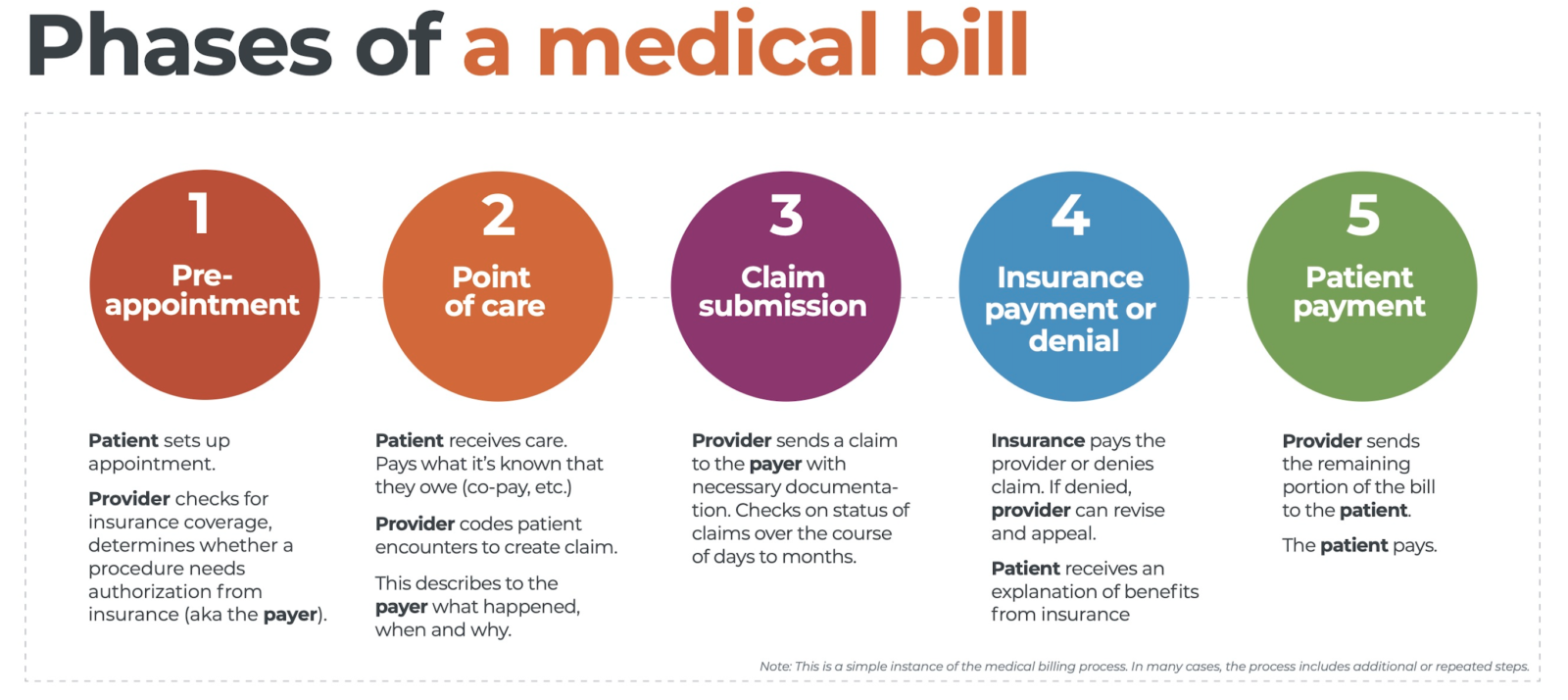

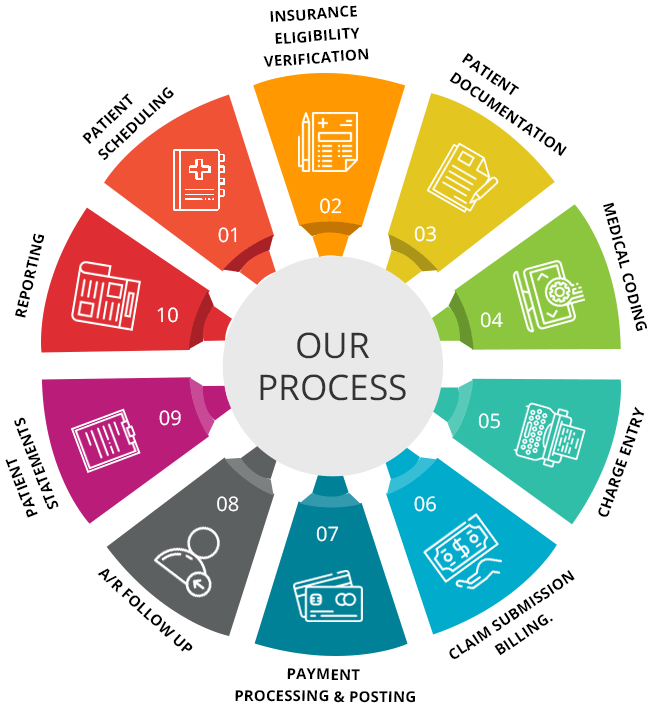

The Medical Billing Cycle is a complex process that involves numerous steps to ensure accurate and efficient billing and reimbursement for healthcare services. Understanding the number of steps involved in this cycle is crucial for healthcare providers, billing professionals, and insurance companies alike. In this article, we will explore the intricacies of the medical billing cycle, discussing the various stages involved and shedding light on the key steps that contribute to its efficiency and effectiveness. The medical billing cycle is a complex process that involves several steps to ensure accurate and timely payment for medical services. Each step in the cycle plays a crucial role in ensuring that healthcare providers receive appropriate reimbursement for the care they provide. In this article, we will explore the various steps in the medical billing cycle, from patient registration to collections, to provide a comprehensive understanding of this essential process in the healthcare industry.

Patient Registration

The first step in the medical billing cycle is patient registration. This involves gathering demographic information from the patient, such as their name, address, contact details, and insurance information. Accurate and up-to-date patient information is vital for ensuring proper claims processing and payment. During the registration process, healthcare providers also record the patient’s insurance details, including their insurance carrier, policy number, and group number. This information is crucial for verifying coverage and benefits later in the billing cycle.

Insurance Verification

Once the patient’s insurance details have been recorded, the next step is to verify their insurance coverage. This involves contacting the patient’s insurance provider to confirm the patient’s coverage and benefits. Insurance verification is essential to ensure that the patient is eligible for the services being provided and

to avoid claim denials or underpayment. During the verification process, healthcare providers also check the patient’s eligibility to ensure that they are covered for the specific services being rendered.

Charge Entry

After verifying the patient’s insurance, healthcare providers move on to the charge entry phase. This step involves entering the medical codes and assigning appropriate modifiers to accurately reflect the services provided to the patient. Medical codes, such as Current Procedural Terminology (CPT) codes and International Classification of Diseases (ICD) codes, are used to describe the diagnoses and treatments given to the patient. Assigning the correct codes ensures that claims are processed correctly and that the healthcare provider is reimbursed appropriately for their services.

Claims Submission

Once the charges have been entered and coded accurately, the next step is to generate a claim form and submit it to the patient’s insurance company. The claim form includes all the necessary information about the patient, the services provided, and the charges incurred. Along with the claim form, healthcare providers may also need to attach any necessary documentation, such as medical records or supporting documentation for certain procedures. Submitting claims promptly and accurately is crucial to avoid delays in reimbursement and ensure timely payment for services rendered.

Claims Processing

After the insurance company receives the claims, they go through a claims processing phase. During this stage, the insurance company reviews the claims for accuracy and adherence to their policies and guidelines. They also verify the eligibility of the services provided and determine if the claims meet the specific criteria for payment. Claims processing may involve various checks and audits to ensure that the claims are valid and appropriate. This step is vital for the insurance company to evaluate the claims and make decisions on payment and reimbursement.

Adjudication and Payment

Once claims have been processed, they move on to the adjudication and payment phase. During this step, the insurance company evaluates the claims for payment and adjustments based on their contractual agreements with healthcare providers. The claims are reviewed for payment accuracy, including any deductible, co-pay, or coinsurance that the patient may be responsible for. The insurance company applies their fee schedules and reimbursement rates to calculate the payment amount for each claim. After determining the patient’s responsibility, the insurance company issues payment to the healthcare provider.

Denials and Appeals

Occasionally, claims may be denied by the insurance company due to various reasons, such as lack of medical necessity or incomplete documentation. When a claim is denied, the healthcare provider must identify the reason for the denial and take appropriate action. This may involve filing appeals with the insurance company, providing additional documentation or justification for the services provided. The denial and appeals process can be time-consuming and requires diligent follow-up to ensure proper reimbursement for the services rendered.

Remittance Processing

Once the insurance company issues payment, the healthcare provider receives an Explanation of Benefits (EOB) or electronic remittance advice. This document outlines the details of the payment, including the amount paid, any adjustments or denials, and the patient’s responsibility. The healthcare provider matches the payments and denials with the claims submitted and posts the payments and adjustments to the patient’s accounts. Accuracy in remittance processing is crucial to ensure that the patient’s account is updated correctly and any outstanding balances are handled appropriately.

Patient Statements

After remittance processing, the healthcare provider generates itemized patient statements. These statements provide a detailed breakdown of the charges, payments, and adjustments applied to the patient’s account. The healthcare provider must verify the accuracy of the charges before sending the statements to the patients. Patient statements serve as a communication tool between the healthcare provider and the patient, informing them about the services provided, the amounts charged, and any remaining balances. Clear and accurate patient statements are essential for maintaining transparency and patient satisfaction.

Collections

The final step in the medical billing cycle is collections. If a patient has an unpaid balance after insurance payments and adjustments have been applied, the healthcare provider follows up on the unpaid patient balances. This may involve contacting the patient to remind them of their outstanding balance, explaining payment options, and negotiating payment arrangements. In some cases, if the patient fails to make payment or arrange a suitable payment plan, the healthcare provider may opt to send the accounts to collections. The collections process involves working with a collections agency to recover the unpaid balances on behalf of the healthcare provider.

In conclusion, the medical billing cycle consists of several steps that ensure accurate and timely payment for medical services. From patient registration to collections, each step in the cycle is vital for proper claims processing, reimbursement, and revenue cycle management. By understanding the various steps involved in the medical billing cycle, healthcare providers can optimize their revenue and ensure a smooth financial process for their practice.