In the world of health insurance, it is not uncommon to find yourself faced with a perplexing situation where a health insurance company deducts a substantial 50% from a procedure. The intricacies and complexities of such deductions can leave policyholders perplexed and seeking answers. Understanding the reasons behind these deductions is crucial as it allows individuals to make informed decisions about their healthcare coverage and ultimately navigate the intricacies of the health insurance landscape with confidence. This article seeks to shed light on the factors that contribute to this seemingly drastic deduction and explore potential strategies to minimize its impact on policyholders.

Factors That Affect Deductions

The determination of deductions by a health insurance company is influenced by several factors. Understanding these factors and reviewing your insurance policy will help you anticipate and navigate the deductions associated with different medical procedures. It’s essential to be aware of your coverage to make informed healthcare decisions.

Type of Procedure

The type of procedure being performed is one of the key factors that can impact the deductions made by a health insurance company. Certain procedures may be deemed as more essential or medically necessary, resulting in lower deductions. On the other hand, procedures that are considered elective or cosmetic may have higher deductions. It is important to review your policy and understand how different procedures are categorized and the associated deductions.

Coverage Details

The specific coverage details of your health insurance policy will also play a significant role in determining the deductions that apply. Different policies may have varying levels of coverage for different procedures. Some policies may provide comprehensive coverage, while others may have restrictions or limitations. Understanding the coverage details of your policy is crucial in determining the deductions you may face for different medical procedures.

Provider Contracts

Health insurance companies often have contracts with healthcare providers. These contracts outline specific rates for different procedures, which can result in deductions. If a healthcare provider is contracted with your insurance company, they have agreed to a pre-negotiated rate for services rendered. As a result, the deductions charged by in-network providers may be lower compared to out-of-network providers who do not have these contractual agreements.

Negotiated Discounts

Contracted Rates

Contracted rates refer to the agreed-upon rates between health insurance companies and healthcare providers. These rates are negotiated in advance and can significantly impact the deductions you may face for a particular procedure. In-network providers, who have contracted rates with your insurance company, are typically able to offer services at these discounted rates. This can lead to substantial savings for policyholders in the form of reduced deductions.

In-Network Providers

Utilizing the services of in-network providers can have a significant impact on the deductions applied by your health insurance company. In-network providers have established relationships with your insurance company, which often results in lower negotiated rates. By choosing healthcare providers within your insurance network, you may benefit from reduced deductions for medical procedures.

Bulk Purchasing

Another factor that can affect deductions is the concept of bulk purchasing. Health insurance companies often negotiate discounted rates with healthcare providers based on the volume of services they anticipate their policyholders will utilize. By leveraging the collective buying power of their policyholders, insurance companies are able to secure preferential rates. These discounts can, in turn, lead to lower deductions for policyholders when they undergo specific medical procedures.

Co-Insurance and Co-Payments

Understanding Co-Insurance

Co-insurance is a cost-sharing requirement in which the policyholder is responsible for a percentage of the total cost of a medical procedure. This percentage is usually set by the insurance policy and can vary depending on the type of procedure. For example, your insurance policy may require you to pay 20% of the total cost of a procedure, while the insurance company covers the remaining 80%. This co-insurance amount can directly impact the deductions you are responsible for.

Co-Payment Requirements

Co-payments are fixed, predetermined fees that policyholders are required to pay for specific services. Unlike co-insurance, which is typically a percentage of the total cost, co-payments are flat fees that are consistent regardless of the cost of the procedure. Understanding the co-payment requirements of your insurance policy is important in determining the deductions you will be responsible for. Higher co-payment amounts can result in lower deductions for certain medical services.

Maximum Out-of-Pocket

The maximum out-of-pocket is the highest amount that a policyholder will be required to pay in a given policy year. Once this amount is reached, the insurance company typically covers 100% of the remaining eligible expenses. The maximum out-of-pocket limit includes deductibles, co-insurance, and co-payments. Understanding your policy’s maximum out-of-pocket limit is important as it can impact the overall deductions you will be responsible for throughout the year.

Deductibles

Annual Deductible

An annual deductible is the amount that the policyholder is required to pay out of pocket before the insurance company begins paying for covered services. This is usually a set amount that resets each policy year. The annual deductible can vary depending on the insurance policy and can impact the deductions applied to various medical procedures. Higher deductible amounts often result in higher deductions until the deductible is met.

Family Deductible

Some health insurance policies have a family deductible that applies when multiple individuals within a family are covered under the same policy. The family deductible is typically higher than an individual deductible. Once the total eligible expenses for the entire family reach the family deductible amount, the insurance company begins paying for covered services. Understanding the family deductible is essential in determining the deductions you will face for medical procedures.

Out-of-Network Deductible

Out-of-network deductibles refer to the deductibles that apply when policyholders receive services from healthcare providers who are not contracted with their insurance company. Out-of-network deductibles are typically higher than in-network deductibles, which means that policyholders may face larger deductions when utilizing out-of-network services. It is important to review your insurance policy and understand the impact of out-of-network deductibles on the deductions for medical procedures.

Claim Reimbursements

Claim reimbursements are the financial transactions between policyholders and insurance companies in healthcare. This guide explores how they’re calculated, influencing factors, and strategies for optimization. Whether you’re a policyholder or healthcare provider, it provides insights to navigate claim reimbursements effectively.

Usual, Customary, and Reasonable (UCR) Fees

Usual, Customary, and Reasonable (UCR) fees refer to the standard charges for specific medical services within a geographical area. Insurance companies often use UCR fees as a benchmark when determining the amount they will reimburse policyholders for medical expenses. If a healthcare provider’s charges exceed the UCR fees, the policyholder may face higher deductions. Understanding UCR fees can help policyholders better anticipate the deductions they may encounter.

Provider Charges vs. UCR Fees

Provider charges are the actual fees charged by a healthcare provider for a specific procedure or service. These charges can vary significantly between providers. When an insurance company determines reimbursements, they often compare the provider’s charges to the established UCR fees for that particular service. If the provider’s charges exceed the UCR fees, the policyholder may be responsible for the difference as a deduction.

Reimbursement Calculation

The reimbursement calculation is the process by which the insurance company determines how much they will reimburse a policyholder for a covered medical service. This calculation takes into account factors such as UCR fees, contracted rates, deductibles, and co-insurance. By understanding how the reimbursement calculation is done, policyholders can better predict the deductions they will face for different procedures.

Pre-Authorization and Utilization Review

Pre-authorization requirements are a critical aspect of navigating healthcare insurance. This guide delves into what pre-authorization entails, its role in ensuring appropriate medical procedures, and how it impacts coverage and deductions. Whether you’re a policyholder seeking clarity or a healthcare provider assisting patients, this information is essential for making informed decisions regarding medical services and deductions.

Pre-Authorization Requirements

Pre-authorization requirements refer to the process by which policyholders must seek approval from their insurance company before undergoing certain medical procedures. These requirements ensure that the procedure is medically necessary and meets the criteria set by the insurance policy. Failure to obtain pre-authorization for a procedure may result in higher deductions or even denial of coverage. Understanding pre-authorization requirements can help policyholders avoid unexpected deductions.

Utilization Review Process

Utilization review is a process utilized by insurance companies to evaluate the medical necessity and appropriateness of certain medical procedures. This process allows the insurance company to determine if a particular procedure is justified based on the policy terms and guidelines. If a procedure is deemed unnecessary or not in line with the policy’s guidelines, it may result in higher deductions or denial of coverage. Understanding the utilization review process can assist policyholders in navigating the deductions for different medical services.

Medical Necessity

Medical necessity is a term used to define procedures or services that are required to diagnose or treat a medical condition. Insurance companies often evaluate the medical necessity of a procedure to determine if it qualifies for coverage under the policy. If a procedure is not considered medically necessary, it may result in higher deductions for the policyholder. Understanding the concept of medical necessity is important in understanding deductions for various medical services.

Network Restrictions

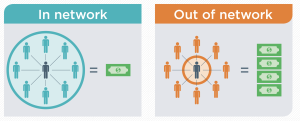

In-Network vs. Out-of-Network

Health insurance policies often distinguish between in-network and out-of-network providers. In-network providers have contracts with the insurance company and offer services at negotiated rates. Utilizing in-network providers typically results in lower deductions for policyholders. Out-of-network providers, on the other hand, do not have contractual agreements, which often leads to higher deductions. Understanding the distinction between in-network and out-of-network providers can help policyholders make informed decisions about their healthcare choices.

Referral Requirements

Some health insurance policies require policyholders to obtain a referral from their primary care physician before seeking specialized care. Referrals are typically needed when accessing services from specialists or receiving certain medical procedures. Failure to obtain the necessary referrals may result in higher deductions or even denial of coverage. Understanding your policy’s referral requirements is crucial in managing deductions for different medical services.

Limited Coverage

Health insurance policies may have certain limitations or restrictions on coverage for specific procedures or services. While some procedures may be covered in full, others may have limited coverage. These limitations can result in higher deductions for policyholders. Understanding the limited coverage provisions of your policy can help you anticipate the deductions you may face for certain medical services.

Explanation of Benefits (EOB)

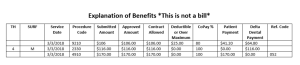

Understanding an EOB

An Explanation of Benefits (EOB) is a document that policyholders receive from their insurance company after a medical procedure has been processed. The EOB provides detailed information about the charges, deductions, and reimbursements associated with the procedure. It is important for policyholders to carefully review their EOB to understand the deductions applied and any remaining cost responsibilities.

Claim Summary

The claim summary section of the EOB provides an overview of the charges and reimbursements for the specific medical procedure. It outlines the total charges, the deductions applied, and the amount that the insurance company will reimburse. Reviewing the claim summary can help policyholders understand the deductions they are responsible for and the portion that will be covered by the insurance company.

Deductible and Co-Pay Calculation

The deductible and co-pay calculation section of the EOB provides detailed information on how the deductions are calculated for a specific procedure. It may include information on the deductible amount applied, the co-insurance percentage, and any co-payment requirements. Understanding the deductible and co-pay calculation can provide insight into the deductions policyholders will face for a particular medical service.

Appealing Decisions

Reviewing Denied Claims

Policyholders have the right to review and appeal denied claims. If a claim is denied or a deduction is applied for a medical service, policyholders can request a review of the decision. Reviewing denied claims allows policyholders to provide additional information or documentation to support their case. Understanding the process for reviewing denied claims can help policyholders navigate the appeals process and potentially have deductions reversed.

Grievance and Appeals Process

The grievance and appeals process refers to the formal procedure policyholders can follow to address disputes or disagreements with their insurance company. This process allows policyholders to contest deductions, denied claims, or any other issues they may have with their coverage. Understanding the steps involved in the grievance and appeals process can help policyholders advocate for themselves and seek resolution for deductions they believe to be unjust.

Independent External Review

In some cases, policyholders may have the option to seek an independent external review of a deduction or denied claim. This process involves having an unbiased third party review the case and determine whether the deduction or denial was appropriate. Independent external reviews can provide policyholders with an additional avenue to challenge deductions and seek a fair resolution.

Consumer Education

Understanding Policy Details

One of the most crucial factors in managing deductions is a thorough understanding of your health insurance policy. It is essential to review and familiarize yourself with the policy details, including coverage limitations, deductibles, co-insurance, co-payments, and any other relevant information. By understanding your policy, you can make informed decisions and anticipate the deductions you may face for different medical procedures.

Utilizing Preventive Services

Many health insurance policies provide coverage for preventive services at little to no cost to the policyholder. These services are aimed at detecting and preventing potential health issues before they become more serious. By utilizing preventive services, policyholders can potentially avoid higher deductions associated with more extensive medical procedures. Understanding what preventive services are covered under your policy and taking advantage of them can contribute to overall cost savings.

Annual Coverage Review

It is important to regularly review your health insurance coverage to ensure that it aligns with your needs and financial situation. Annual coverage reviews allow you to assess the deductibles, coverage details, and any changes that may have occurred in your policy. By conducting an annual coverage review, you can identify any potential gaps or areas for improvement in your coverage and make informed decisions about managing deductions for different medical services.

In conclusion, deductions made by health insurance companies for medical procedures are influenced by various factors. The type of procedure, coverage details, and provider contracts all play a role in determining the deductions. Negotiated discounts, co-insurance, and co-payment requirements, as well as deductibles, further impact the amount policyholders are responsible for. Understanding factors such as claim reimbursements, pre-authorization and utilization review processes, network restrictions, and the appeals process can empower policyholders to make informed decisions and effectively manage deductions. Consumer education, with an emphasis on understanding policy details, utilizing preventive services, and conducting annual coverage reviews, is crucial in navigating the complexities of health insurance deductions. By being aware of these factors and taking proactive steps, individuals can better manage their healthcare expenses.