In the dynamic field of healthcare, payment systems play a vital role in determining the financial operations and efficiency of healthcare organizations. With the ultimate goal of providing high-quality care to patients, it is essential to understand the various types of payment systems that exist within the healthcare industry. This article aims to shed light on the diverse range of payment systems in healthcare, exploring their features, advantages, and limitations. By gaining a comprehensive understanding of these payment systems, healthcare professionals can make informed decisions that promote financial stability and enable seamless transactions within the healthcare ecosystem.

Fee-for-Service (FFS)

In this exploration of Fee-for-Service, we will delve into how this system operates, its advantages, disadvantages, and its impact on healthcare delivery and costs. By the end, you’ll have a comprehensive understanding of the intricacies of this payment model and its implications in the healthcare industry.

Definition

Fee-for-Service (FFS) is a payment model in healthcare where providers are reimbursed based on the quantity of services they provide to patients. Under this system, each service or procedure is assigned a specific fee, and healthcare professionals are paid for each service rendered. FFS is the most traditional and widely used payment system in healthcare.

How it works

In a Fee-for-Service payment system, healthcare providers bill for each individual service or procedure performed. The charges are based on a fee schedule, which outlines the reimbursement rate for each service. Patients or their insurance companies are then billed for the services received, and providers are subsequently paid for each billable item.

Advantages

One of the key advantages of Fee-for-Service is that it offers flexibility and choice for patients, as they can seek care from a wide variety of providers. This system also incentivizes healthcare professionals to provide a high volume of services, as their income is directly tied to the number of procedures performed. Additionally, Fee-for-Service allows for detailed tracking of individual services, which can be useful for billing and reimbursement purposes.

Disadvantages

One major drawback of Fee-for-Service is its potential to drive up healthcare costs. Since providers are incentivized to deliver more services, unnecessary procedures or tests may be ordered, leading to overutilization of healthcare resources. Furthermore, this payment model does not directly link payment to the quality or outcome of care, which can result in fragmented and uncoordinated healthcare delivery.

Capitation

In this approach, healthcare providers receive a fixed payment per patient over a specified period, regardless of the actual services rendered. The essence of capitation lies in its upfront, per-patient fee, which is designed to cover the full spectrum of healthcare needs for the enrolled population.

Definition

Capitation is a payment system in healthcare where providers are paid a fixed amount per patient per unit of time, regardless of the services actually delivered. The payment is made in advance and is typically based on the estimated healthcare needs of the enrolled population.

How it works

Under the Capitation model, healthcare organizations receive a fixed monthly payment per patient, known as a capitation fee. This fee covers all necessary healthcare services for the enrolled population, regardless of whether they require minimal or extensive care. The providers are responsible for managing the patients’ healthcare needs within the allocated budget.

Advantages

Capitation encourages healthcare providers to focus on preventive care and population health management. Since the payment is fixed, providers have a financial incentive to keep their patients healthy and avoid unnecessary procedures or hospitalizations. This payment model also promotes coordination and collaboration among healthcare teams, as they share the responsibility of managing the health of the population.

Disadvantages

One potential disadvantage of Capitation is the possibility of underserving patients who require more intensive or specialized care. The fixed payment per patient may not adequately compensate providers for the costs associated with complex medical conditions. Additionally, there is a risk of underutilization of healthcare services, as providers may be driven to limit the delivery of care to control costs.

Bundled Payments

This payment model breaks away from the conventional Fee-for-Service system by consolidating all services associated with a particular medical condition or procedure into a single, fixed payment.

Definition

Bundled Payments, also known as episode-of-care payments, involve a fixed payment for a defined set of services related to a specific medical condition or procedure. Instead of paying for individual services, all the services involved in the care process are bundled together and reimbursed under a single payment.

How it works

In a Bundled Payment system, healthcare providers are given a fixed amount for all the services involved in a specific episode of care, such as a joint replacement surgery or maternity care. This payment covers all aspects of care, including hospitalization, physician services, post-discharge follow-up, and rehabilitation. Providers are then responsible for coordinating and managing the patient’s care within the agreed-upon budget.

Advantages

Bundled Payments promote care coordination and integration among different providers involved in the patient’s journey. This payment model incentivizes collaboration and communication, as providers need to work together to avoid unnecessary duplication of services and ensure smooth transitions of care. Bundled Payments also encourage efficiency and cost savings, as providers have financial incentives to deliver high-quality care at a lower cost.

Disadvantages

One potential challenge of Bundled Payments is the need for accurate and robust data collection and analysis. Providers must carefully track and monitor the cost and outcomes of each episode of care to determine the appropriate payment and identify areas for improvement. Implementation of this payment system may also require significant administrative and operational changes within healthcare organizations.

Accountable Care Organizations (ACOs)

Definition

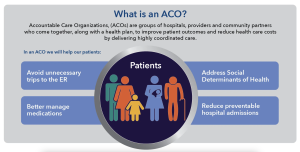

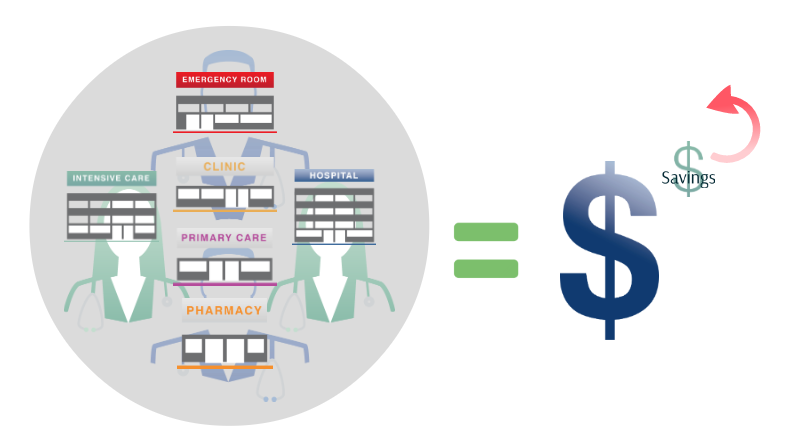

Accountable Care Organizations (ACOs) are networks of healthcare providers who voluntarily come together to deliver coordinated care to a defined population. ACOs are responsible for managing the health of their assigned population, with an emphasis on quality improvement and cost containment.

How it works

In an ACO, healthcare providers, including primary care physicians, specialists, hospitals, and other healthcare professionals, collaborate and share responsibility for the health outcomes of their enrolled patients. ACOs are typically accountable for managing the overall cost of care and meeting quality benchmarks. Additionally, ACOs may enter into shared savings arrangements, where they receive a portion of the cost savings achieved if quality targets are met.

Advantages

ACOs promote integrated and patient-centered care by fostering collaboration among different providers and settings. This model encourages the use of evidence-based practices and care coordination to improve patient outcomes. ACOs also have the potential to achieve cost savings by reducing unnecessary hospitalizations, emergency room visits, and duplicative services.

Disadvantages

One challenge of ACOs is the coordination and alignment of various healthcare providers and organizations. Developing effective communication channels and shared decision-making processes among ACO participants can be complex and time-consuming. Additionally, the success of ACOs in achieving cost savings and improving quality may depend on factors such as the health status of the population and the level of engagement from all participating providers.

Pay for Performance (P4P)

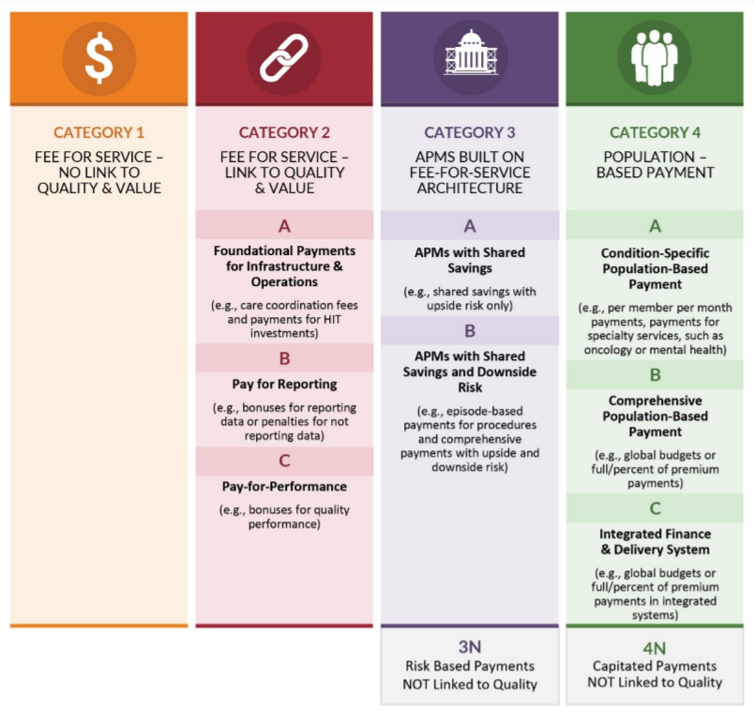

This image is property of www.brookings.edu.

Definition

Pay for Performance (P4P), also known as value-based purchasing, involves linking financial incentives to the achievement of specific quality and performance targets. In this payment model, providers receive additional reimbursement or bonuses based on their performance in delivering high-quality and efficient care.

How it works

Under the Pay for Performance system, providers are measured against predetermined quality metrics, such as patient outcomes, patient satisfaction, and adherence to clinical guidelines. Based on their performance, providers are eligible for financial rewards, additional reimbursements, or penalties. The goal is to incentivize providers to deliver evidence-based, patient-centered care and continuously improve their performance.

Advantages

Pay for Performance encourages providers to focus on quality improvement and patient outcomes. By linking financial incentives to performance, this payment system motivates providers to deliver effective, efficient, and patient-centered care. P4P also promotes the use of data and performance metrics, which can help identify areas for improvement and facilitate shared learning among healthcare providers.

Disadvantages

One potential challenge of Pay for Performance is the selection and measurement of appropriate performance indicators. Developing a fair and comprehensive set of metrics that accurately reflect the quality and value of care can be complex. There is also a risk of focusing on specific measures at the expense of broader aspects of care or inadvertently incentivizing providers to avoid patients with complex medical conditions.

Value-based Purchasing (VBP)

Definition

Value-based Purchasing (VBP) is a payment system that rewards healthcare providers based on the value and quality of care delivered rather than the volume of services provided. VBP aligns financial incentives with the achievement of defined quality measures and patient outcomes.

How it works

In a Value-based Purchasing model, healthcare providers are evaluated based on their performance in meeting specific quality and efficiency metrics. Providers who meet or exceed these benchmarks may receive higher reimbursements or financial incentives. Conversely, providers who fall below the established standards may face reductions in payments or penalties.

Advantages

Value-based Purchasing promotes the delivery of high-quality, cost-effective care. By rewarding providers for achieving positive outcomes and meeting quality standards, this payment model encourages the use of evidence-based practices and continuous quality improvement. VBP also creates incentives for providers to prioritize patient safety, patient experience, and the coordination of care.

Disadvantages

One challenge of Value-based Purchasing is accurately measuring and assessing the value and quality of care delivered. Developing appropriate metrics that capture the complexity and diversity of healthcare services can be a complex task. There is also a concern that VBP may inadvertently create disparities in care access, as providers may be incentivized to avoid patients who are more likely to have poor outcomes or require expensive interventions.

Episode-of-Care Payments

This image is property of www.healthcare-economist.com.

Definition

Episode-of-Care Payments, also known as bundled payments, involve a single payment for all services related to a specific medical condition or procedure. This payment model encompasses all aspects of care, from pre-operative assessments to post-operative follow-up.

How it works

Under the Episode-of-Care Payment system, healthcare providers receive a predetermined amount for all services and resources involved in a specific episode of care. This payment covers the services provided by different healthcare professionals, hospitalization, medications, imaging, and any necessary post-discharge care. Providers are responsible for managing the patient’s care within the allocated budget.

Advantages

Episode-of-Care Payments promote care coordination, efficiency, and cost containment. By bundling all services for a specific episode, this payment model encourages providers to work together and streamline their efforts. Providers are incentivized to eliminate unnecessary tests, reduce hospital admissions, and optimize the use of resources to deliver high-quality care at a lower cost.

Disadvantages

One potential disadvantage of Episode-of-Care Payments is the risk of undercompensating providers for complex or high-cost cases. The fixed payment for a specific episode may not adequately account for the individual needs or medical complexities of certain patients. Additionally, implementing this payment system requires careful assessment of the costs and resources involved in different episodes of care.

Global Budgets

Definition

Global Budgets involve setting a predetermined amount of funding for healthcare services within a defined period. This approach assigns a fixed budget to healthcare organizations or institutions, covering all necessary services provided to a specific population during a given timeframe.

How it works

Under the Global Budget system, healthcare organizations receive a predetermined lump sum of money for the provision of healthcare services over a particular period, such as a year. This budget includes all types of care, including primary care, hospitalizations, medications, and preventive services. Providers are responsible for managing the allocated budget and ensuring that the needs of the population are met within the available resources.

Advantages

Global Budgets promote financial predictability and the efficient allocation of resources. Healthcare organizations have the flexibility to allocate funds based on the needs of the population, rather than focusing on volume-based reimbursement. This approach encourages providers to emphasize preventive care, population health management, and the optimization of healthcare resources.

Disadvantages

One potential challenge of Global Budgets is the risk of underfunding or overspending. Determining an appropriate budget that adequately meets the needs of the population can be challenging. If the allocated budget is insufficient, healthcare organizations may struggle to deliver the necessary services to their patients. Conversely, if the budget is too generous, there may be little incentive for cost containment and resource optimization.

Shared Savings

Definition

Shared Savings is a payment model in healthcare where providers are eligible to receive a portion of the cost savings they generate by delivering high-quality and efficient care. This payment system encourages providers to reduce healthcare costs while maintaining or improving patient outcomes.

How it works

In the Shared Savings model, healthcare providers are responsible for managing the overall cost of care for a defined population. If they successfully reduce healthcare costs below a pre-established benchmark, they may be eligible to share in the achieved savings. The proportion of the savings shared with providers varies depending on the specific agreement and the level of cost reduction achieved.

Advantages

Shared Savings incentivizes providers to adopt cost-effective practices and innovative care delivery models. By sharing in the savings they generate, providers are motivated to deliver high-quality care at a lower cost, leading to improved patient outcomes and increased financial sustainability. This payment model also encourages care coordination and collaboration among different providers involved in the patient’s care.

Disadvantages

One potential challenge of Shared Savings is accurately measuring and attributing the cost savings achieved. Calculating the exact amount of savings generated by a specific provider or care team can be complex. Additionally, the savings-based payment model may not be suitable for all healthcare providers, especially those who primarily serve high-cost populations or patients with complex medical conditions.

Direct Contracting

Definition

Direct Contracting is a payment model where healthcare providers enter into contracts with payers, such as government agencies or insurance companies, to provide comprehensive care for a specific population. This payment system aims to align the financial incentives and objectives of payers and providers, fostering value-based care delivery.

How it works

In the Direct Contracting model, healthcare providers negotiate contracts with payers that outline the scope of covered services, the agreed-upon payment amounts, and quality benchmarks. Providers assume financial risk and are responsible for delivering the required services while managing costs and meeting performance goals. The payment structures can vary, including capitation, shared savings, or a combination of different reimbursement mechanisms.

Advantages

Direct Contracting promotes collaboration and alignment between payers and providers, fostering a focus on value-based care delivery. By directly contracting with healthcare organizations, payers can leverage the expertise and infrastructure of providers to enhance care coordination and improve outcomes. This payment model also allows for more flexibility in designing payment arrangements that suit the unique needs and capabilities of both parties.

Disadvantages

One potential challenge of Direct Contracting is the administrative complexity associated with negotiating and implementing contracts between payers and providers. Developing mutually agreeable terms, including payment structures and performance measures, can be time-consuming and resource-intensive. Additionally, the success of Direct Contracting may depend on effective communication, data sharing, and trust between all involved parties.

In conclusion, various payment systems exist in healthcare, each with its own advantages and disadvantages. Fee-for-Service provides flexibility but may drive up costs and create fragmented care. Capitation promotes preventive care but may lead to underserving complex patients. Bundled Payments encourage care coordination but require robust data collection. Accountable Care Organizations foster collaboration but require coordination among providers. Pay for Performance incentivizes quality care but requires appropriate performance measures. Value-based Purchasing promotes quality improvement but can create disparities. Episode-of-Care Payments encourage efficiency but risk undercompensating complex cases. Global Budgets provide predictability but require careful budgeting. Shared Savings reward cost reduction but accurate measurement is crucial. Direct Contracting aligns incentives but demands administrative effort. Each payment system offers unique opportunities and challenges, and the choice of the most appropriate system depends on the specific goals, capabilities, and context of the healthcare organization.